The Fed’s QE3 announcement is welcome by a lot of people on the Street, but not many retirees on Main Street.

Michael Tarsala

There are three reasons to think that the Fed’s latest fiscal stimulus announcement could have a big economic and markets impact.

Many people age 22 don't care about money: They expect to inherit it. For most, that's a very poor assumption.

The research group credited with correctly predicting recessions going back 20 years and for never issuing a false alarm may have it wrong this time.

The new Apple iPhone should boost the overall U.S. economy. What's more amazing, though, is the company's increasing sway on stock markets.

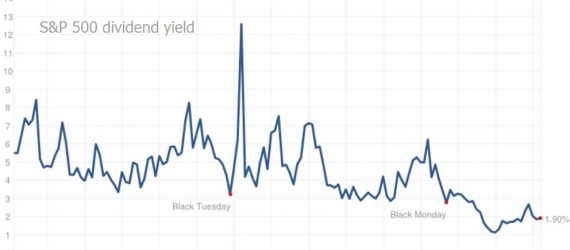

A conservative withdrawal rate from retirement savings is one of the most important steps in the whole planning process. Here's a tip on how to calculate it.

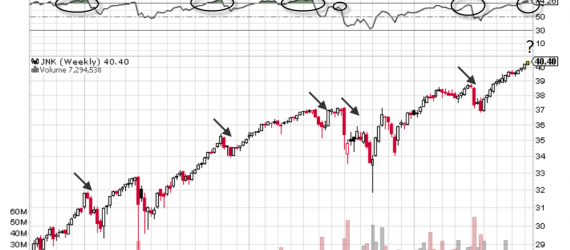

The downtrend in junk bond yield spreads is a positive for the ongoing U.S. stock rally, although it’s worth keeping an eye on one possible warning sign.

Goldman's Jim O'Neill is right: The BRICs have performed so badly that they could eventually be a turnaround play. Here's the one key chart to watch for cues.

Citigroup strategist Tobias Levkovich sees the S&P 500 rising another 12 percent to 1,615 next year.

The S&P 500 does not look expensive based on the forward valuation that many investors are used to seeing, but it’s getting close based on the “new normal”.