by Michael Tarsala

No matter your level of financial knowledge, making the switch from saving money to spending it retirement can be a tough adjustment.

I am in the process of helping my mom make the transition from scrimping and saving into semi-retirement. Soon she will be tapping part of her savings for the first time.

It’s no longer simply about picking the right stocks or the right adviser. It’s a research exercise in making sure there’s enough liquidity to cover expenses, a safe withdrawal rate from savings, a predictable income stream going forward, a minimal tax hit, and doing all that’s possible to make sure the nest egg lasts until it’s no longer needed.

There’s a lot to think about even before you start weighing the mix of stocks, bonds, annuities and other investment products.

Doing something as simple as choosing the right withdrawal rate from savings can be harder than it might seem. Gone are the days of the 4% rule — the assumption that no matter when you retire, taking out 4% a year subsequently adjusted for inflation is considered safe.

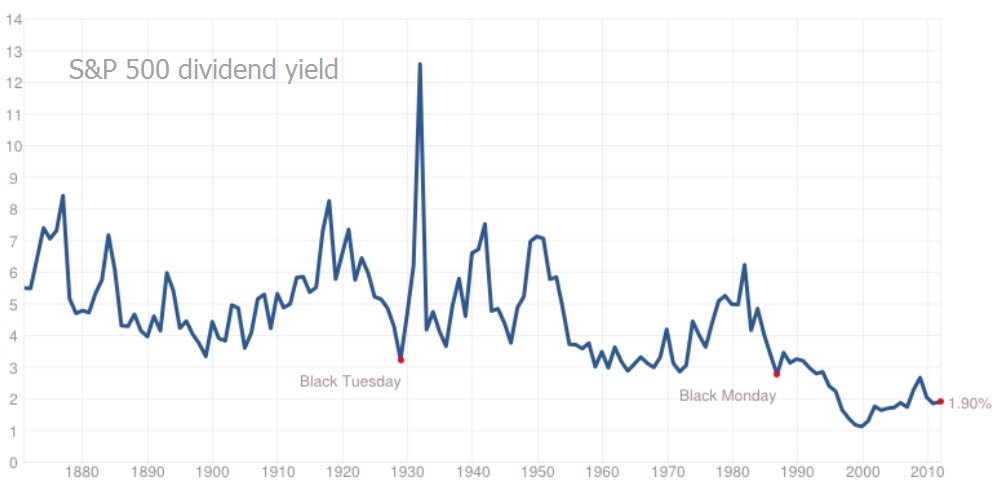

That old maxim may be too simplistic. Research by Wade Pfau, Ph.D., who specializes in retirement planning strategies, suggests that the 4% assumption cannot be considered safe in periods when 10-year PE ratios are historically high and dividend yields are historically low.

Source: multpl.com

Such is the case right now. Today’s 10-year PE ratio, as calculated by Prof. Robert Shiller at Yale, is 21.4, higher than the long-term average of 16.5. Meanwhile, the current S&P 500 dividend yield is around 2%, less than half the historical average of 4.4%.

For me, the withdrawal rate is a number that you simply have to get right at the start. It’s possible — and in some cases likely — that you could run out of money before you die if you overestimate the rate by just 1% of the highest acceptable level.

So as part of my research on mom’s behalf, I entered the following figures into the retirement planning calculator at Passionsaving.com: The current 10 year PE of 21.4, an assumed TIPS return of 1%, a 60% stock allocation and a 20% balance left after 30-years. I’m not making sure there’s some left at the end, by the way – my mom is young, could easily live past 91. I just want to make sure she has all that she needs.

Under those assumptions, the “safe” annual withdrawal rate is 3.56%. It’s a bit lower than I expected and not what I wanted to hear at all, given that it drops her income by more than 10% versus the standard 4% withdrawal rate.

Still, I think it was really important to have what I see as a good number to work with for the rest of the retirement planning exercise.

If you are of retirement age or will be soon, check out our Covestor blog for ideas and thoughts about retirement that come directly from our investment managers.