By: Kevin Flanagan, Head of Fixed Income Strategy

Key Takeaways

- The recent U.S. Treasury rally has reversed sharply, as stronger-than-expected labor data and a potential inflation setback have altered market expectations for Fed rate cuts.

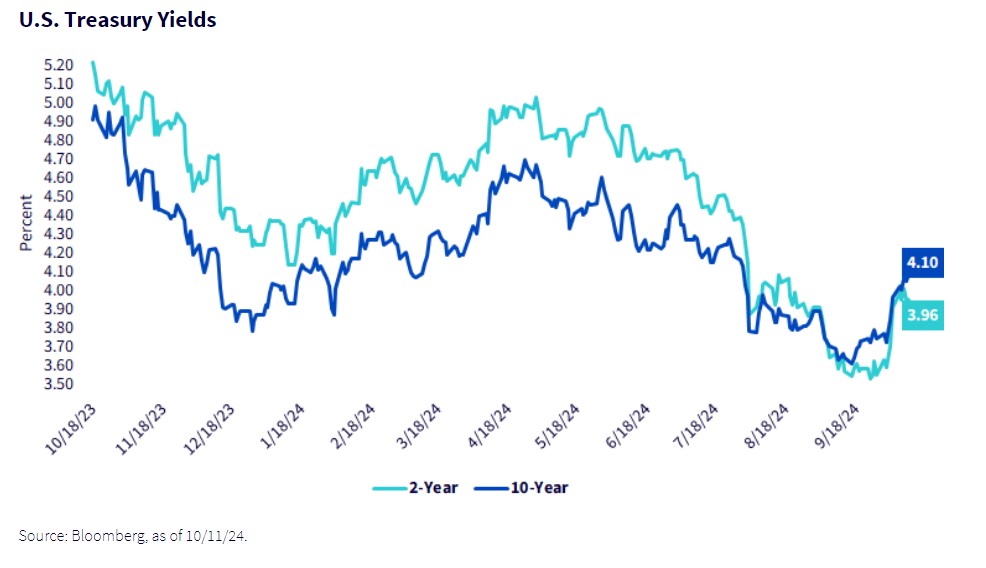

- Fed Funds Futures have dialed back expectations from eight rate cuts to five or six by Q4 2025, leading to a rebound in UST yields, with the 2- and 10-Year Treasury yields rising back to and, in the case of the latter, above 4%.

- With upcoming economic data likely skewed by hurricane disruptions, the current figures may represent the last clear snapshot of underlying trends before the bond market faces additional uncertainty.

A recurring theme I’ve been emphasizing during the two “big” rallies in the U.S. Treasury (UST) market within the last year has been that, at some point, the visible decline in yields will need to be validated. Investors saw this phenomenon play out earlier this year when UST yields reversed course and retraced a good portion of the Q4 decline. Here we are now, almost a year later, and investors have been witnessing another episode of a UST rally that hasn’t received the necessary validation.

Actually, it has been quite remarkable to see the complete “180” the money and bond markets have experienced just within the last few weeks. Think about where economic and Fed rate cut expectations were right after the September Federal Open Market Committee (FOMC) meeting and where they are currently. Right around that mid-September timeframe, the narrative was that the labor market was “cooling” more than expected while disinflation was firmly intact, with the Fed’s 50-basis-point (bp) rate cut only the beginning.

To provide some perspective, implied probabilities for Fed Funds Futures were pricing in a total of eight rate cuts (assuming 25-bp intervals) worth a cumulative total of an eye-opening 200 bps by Q4 2025. For those keeping track, that would have brought the Fed Funds target range down to around 2.90%. Needless to say, UST yields followed suit, with the 2-Year yield plunging -144 bps from its late May high watermark down to just barely above 3.50% as recently as September 24. The 10-Year got into the action as well, with the yield here falling around -100 bps to roughly 3.60% on September 17.

That was then, but what about now? Well, the recently released jobs report revealed that while labor market activity may be cooling, it was not nearly as “cool” as what the markets were thinking a few weeks earlier. In addition, the September CPI data revealed that the improving inflation picture may have hit a possible roadblock. This landscape is materially different from when Powell & Co. met less than a month ago.

Against this backdrop, Fed rate cut expectations have been dialed back to where only about five or six decreases are expected by Q4 of next year. In fact, a modest probability has now been given for no rate cut at the upcoming November FOMC meeting, where pre-jobs report, odds between a 25-bp or 50-bp cut were going back and forth.

Needless to say, UST yields have retraced anywhere from just under 30% of the aforementioned decline for the 2-Year note to a more substantial move of almost 50% for the 10-Year maturity. For those keeping track, these are upward moves of roughly +45 bps and +50 bps, respectively, bringing absolute levels back to the 4% threshold, if not higher, in the case of the 10-Year note.

Conclusion

Due to the unfortunate events from Hurricanes Helene and Milton, the rest of October will be the last few weeks of relatively “clean” sets of data for a while. In fact, last week’s jobless claims did reveal the first signs of these adverse effects already. As a result, the data released up until now may take on heightened importance for the bond market and the Fed because it could be the last time, for a few months, that we’ll get a true sense of underlying economic/labor market and inflation trends.

Originally posted on October 16, 2024 on WisdomTree blog

PHOTO CREDIT: https://www.shutterstock.com/g/lightspring

VIA SHUTTERSTOCK

DISCLOSURES:

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.