by Michael Tarsala, CMT

Utility stocks are gaining ground. And if markets play out somewhat like they did last year, that could offer clues for when to get more cautious with investments.

Mind you, there are still a lot of reasons for optimism. The Dow is near levels not seen since 2007. The market is not overbought at present. And stock yields are near record highs versus bond yields.

Keep this on the radar, though:

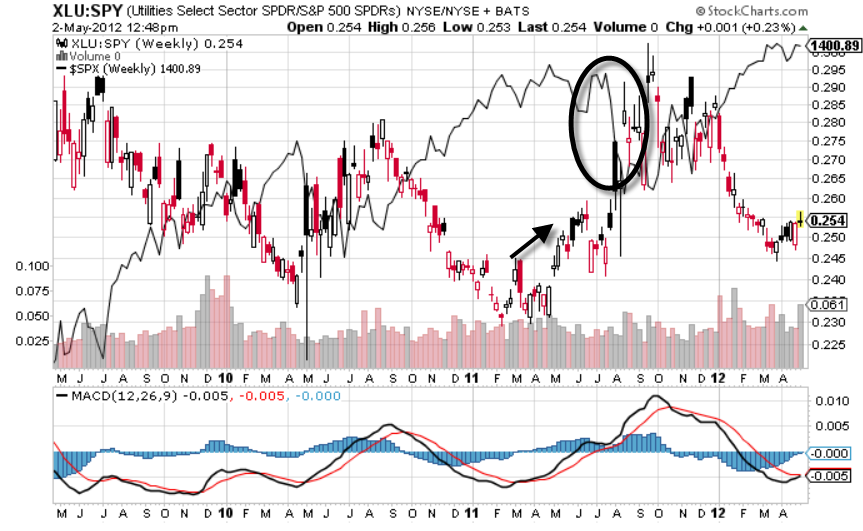

Source: Stockcharts.com

The candle chart above is the Utilities Select Sector SPDR (XLU), relative to the S&P 500 SPDR (SPY). It shows that utilities badly underperformed the S&P 500 for much of this year.

Yet it also shows that the spread relationship of those two SPDRs has been turning a bit higher in recent weeks. And the MACD signal at the very bottom of the chart makes a technical argument that the spread could move higher still.

Here’s why that’s something for all investors to watch:

- Should utilities continue their outperformance, it’s a reflection of cautious behavior. Many investors see utilities as a yield alternative, and will park investments there when they perceive mild to moderate market troubles. Utilities offer a way to stay invested, collect a yield that’s far higher than a U.S. Treasury, and avoid exposure to cyclical stocks.

- It also may provide an early warning signal. Last year, the XLU/SPY ratio began to turn higher in early May, ahead of some sideways chop and then a July selloff (the S&P by itself is the black line in the chart above).

- Improving relative strength from utilites may also be an opportunity to play offense, as well as just defense. It may be a reason for you to check out a dividend-focused model from Covestor that invests in utilities and other high-dividend sectors.