By: Matthew J Bartolini, CFA, CAIA, Head of SPDR Americas Research

- Financial sector ETF secondary market trading volumes surged to over $13 billion at the onset of the recent banking crisis, five times greater than the normal daily average

- Primary market activity increased at a slower pace, showing how ETFs provide additive liquidity

- Financial sector ETF options daily volumes skyrocketed to over 1.7 million contracts from the average 150,000

The stress and uncertainty of the recent banking crisis has reinforced four ETF truths:

- Investors gravitate to ETFs during times of stress as valuable price discovery tools.

- ETFs provide additive liquidity beyond what’s available in the primary market.

- ETF trading doesn’t have an outsized impact on trading of underlying securities.

- Use cases for ETFs now range from traditional to complex.

ETFs Provided Additive Liquidity

ETFs create additional liquidity because they are traded in the secondary market between willing buyers and sellers at a fair market price that doesn’t always necessitate touching the underlying portfolio.

In most cases, the secondary market demand for shares is met by the current supply of shares, without a market marker or authorized participant (AP) having to create more shares to meet that demand.

The additive liquidity can be measured by comparing secondary market trading volumes to primary market transactions. Given that primary market transactions (i.e., fund flows) can be positive and negative, we need to evaluate the absolute value.

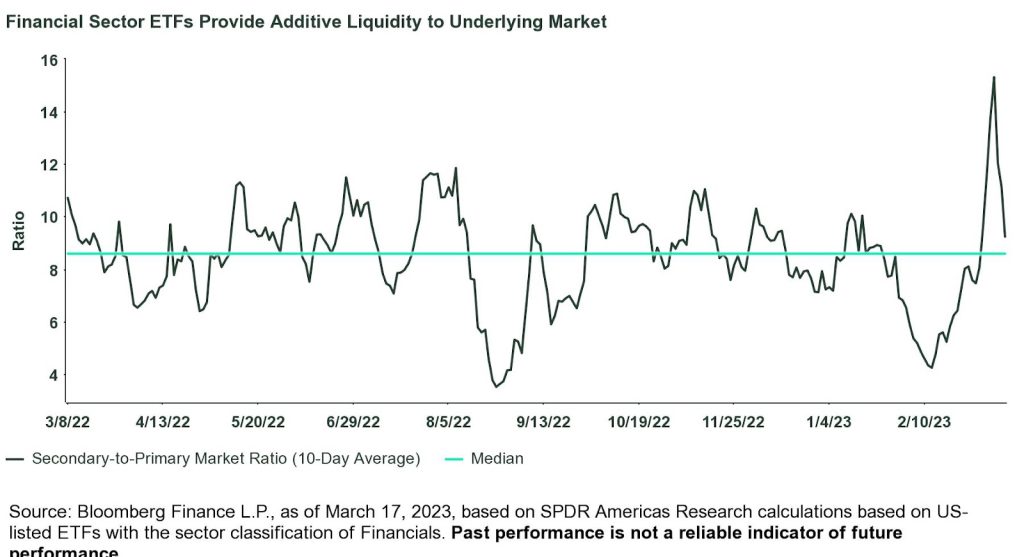

Typically, this ratio for all ETFs is 8:1, meaning that for every $8 traded on the secondary only $1 hits the primary market (the fund).1 For financial sector ETFs, the prior March one-year average ratio was 8.5. And from March 8-16, that ratio increased to over 15, as shown below.

This spike in secondary trading relative to primary activity signals that investors were able to effectively “meet on exchange” and transact, even as the underlying securities were facing extreme uncertainty. This demonstrates how secondary ETF trading provides additive liquidity for investors.

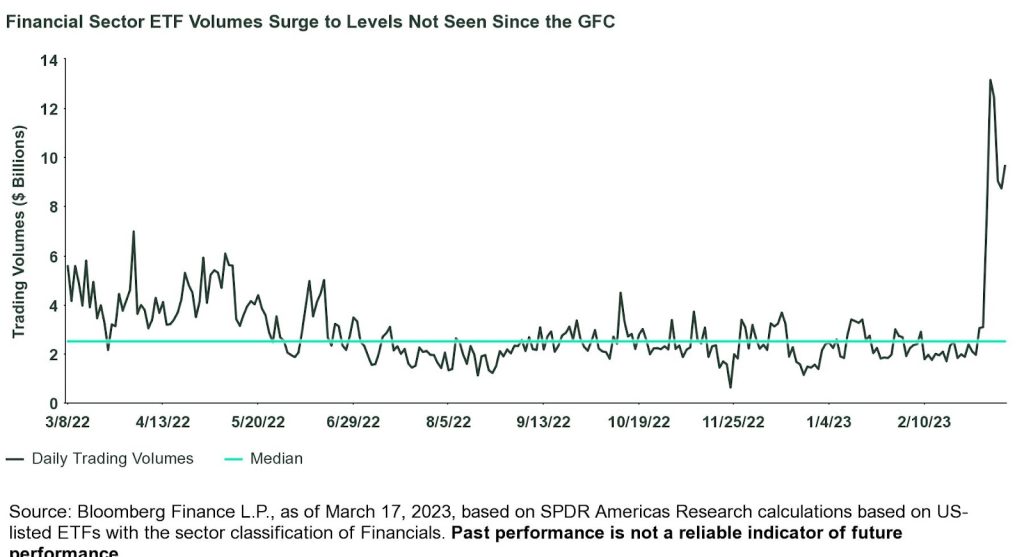

Notably, this additive liquidity does not result from low fund flows. In fact, trading volumes from March 8-16 were significantly above average, soaring beyond $13 billion on March 13, as shown below. The only other time trading volumes were this elevated was during the Great Financial Crisis (GFC), when volumes spiked to over $30 billion.2

From a flows perspective, the total net flows (not the absolute figure below) increased, but not on a one-for-one basis to the volumes. In fact, net flows during this time period were actually positive, as investors actively sought targeted financial exposure. The SPDR S&P Regional Banking ETF (KRE), actually posted a record single-day inflow of more than $1 billion on March 13.3

Investors of all types gravitated to the centralized exchange trading and transparency of the ETF structure, which created deeper pools of liquidity for uncertain markets and a much-needed buffer for the underlying securities.

These positive flows reflect how investors used ETFs as tactical instruments to quickly access a diversified basket of banking stocks in a single trade.

ETFs Had a Low Impact on Underlying Markets

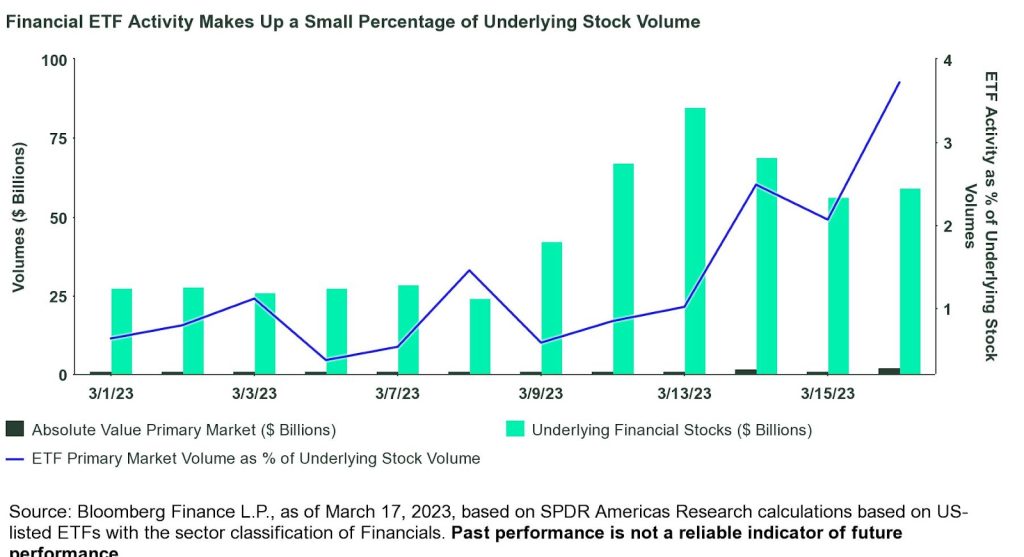

Even though primary market activity was elevated, the amount of buying and selling stocks to facilitate ETFs’ creation and redemptions as a percentage of the underlying stocks’ trading volume was low.

For example, the total trading volume on stocks within the financial sector of the Russell 3000 Index was $403 billion from March 8-16.4 Total absolute fund flows into financial sector ETFs (funds that primarily own the stocks in the financial sector) was just $7 billion.

As a result, the total percentage of trading in financial sector stocks likely to be specific financial sector ETF-related actions in the primary market was 1.7% from March 14-16. And as shown below, this percentage never broke above 4%, even on the day when total absolute flows were over $1 billion.

While the percentage did increase, it’s not all that dissimilar from the figure prior to the banking crisis. Overall, this low percentage on multiple days suggests ETFs were not pushing prices around. That is, how could 4% of trading volume lead to double-digit declines in stock prices? Not to mention, the primary market activity from ETFs was net inflows. In other words, ETF activity led to buyers of the falling bank shares as ETF investors sought to capitalize on this dislocation.

ETF Use Cases Are Wide Ranging

The rise in ETF volumes and trading efficiency is the result of many different investors utilizing the structure independently.

Some investors use ETFs as strategic asset allocation tools, covering broad-based exposures to build diversified long-term portfolios. Meanwhile, given how some ETFs (like sector funds) provide targeted exposure to a specific market or theme, tactical use cases are likely more prevalent.

Within those tactical use cases are derivative exposures tied to ETFs. Because ETFs trade on an exchange and are effectively equity securities, options can be listed on the ETF — increasing the flexibility and implementation use cases of ETFs.

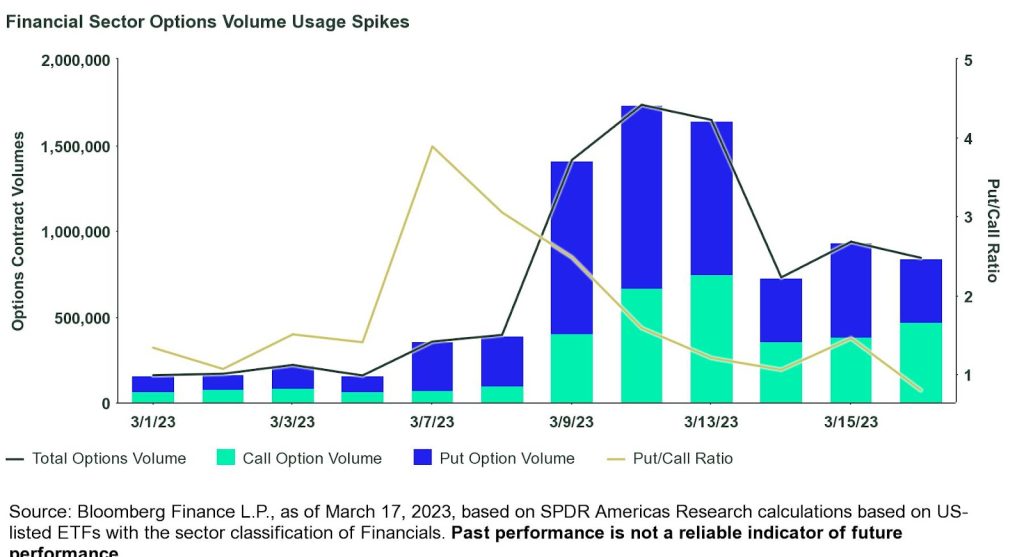

These listed derivatives afford the buyers of these contracts the right, but not the obligation, to buy or sell the ETF at a specified price and with a specified expiration date. And in this latest banking crisis, ETF options tied to financial sector ETFs surged.

On three of the days over the past week, over one million contracts tied to financial sector ETFs were traded, well above the volume witnessed previously. And the majority of the volumes were on the call side as shown below — highlighting how the put/call ratio was declining all week and actually fell below one, as call volume outstripped puts, on March 16.

The heavy call side action indicates investors were not positioning to hedge any downside risk (i.e., using puts) within the financial sector, but rather positioning for a bounce-back rally.

Overall, the record options usage reflects sophisticated implementation use cases within the ETF industry, as investors utilized the derivative ecosystem surrounding ETFs to tactically reposition portfolios beyond just buying or selling the ETF itself. Yet, this uptick in options trading did play a part in the increase in related ETF trading, often from options dealers/market makers seeking to hedge their risk exposure.

ETFs Provide Value During Yet Another Crisis

ETFs have long offered investors value as liquidity and price discovery tools during crises. And this latest banking crisis serves as a reminder of why investors gravitate toward ETFs in times of market stress.

Greater use of ETFs — whether long, short, or derivative-related — rarely has an outsized impact on the underlying market. For example, even during the onset of the COVID pandemic, ETF primary market activity was just 3% to 4% of US underlying equity volumes.5 We expect the same to remain true with volumes in financial sector ETFs during this banking crisis.

Originally Posted March 20th, 2023 SSGA

PHOTO CREDIT: https://www.shutterstock.com/g/SWKStock

Via SHUTTERSTOCK

Footnotes

1 Bloomberg Finance L.P., as of March 17, 2023, based on the median secondary-to-primary market ratio of all US-listed ETFs from 2018 to 2023.

2 Bloomberg Finance L.P., as of March 17, 2023, based on US-listed ETFs with the sector classification of Financials.

3 Bloomberg Finance L.P., as of March 17, 2023.

4 Bloomberg Finance L.P., as of March 17, 2023, based on SPDR Americas Research calculations.

5 Bloomberg Finance L.P., as of March 17, 2023, based on SPDR Americas Research calculations.

Glossary

Russell 3000 Index

The Russell 3000 Index is composed of 3000 large US companies, as determined by market capitalization. This portfolio of securities represents approximately 98% of the investable US equity market.

Options Contract

Offers the buyer the opportunity to buy or sell — depending on the type of contract they hold — the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they decide against it. Each option contract will have a specific expiration date by which the holder must exercise their option. The stated price on an option is known as the strike price.

Disclosure

The views expressed in this material are the views of the SPDR Research and Strategy team through the period ended March 17, 2023, and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

Unless otherwise noted, all data and statistical information were obtained from Bloomberg Finance, L.P. and SSGA as of March 17, 2023. Data in tables have been rounded to whole numbers, except for percentages, which have been rounded to the nearest tenth of a percent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Investing involves risk including the risk of loss of principal.

Derivative investments may involve risks such as potential illiquidity of the markets and additional risk of loss of principal.

This communication is not intended to promote or recommend the use of options or options trading strategies and should not be relied upon as such. Options investing entail a high degree of risk and may not be appropriate for all investors.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Because of their narrow focus, sector investing tends to be more volatile than investments that diversify across many sectors and companies.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.