By: Jose Torres, Interactive Brokers’ Senior Economist

After a few volatile years occurring after the beginning of the COVID-19 Pandemic, oil prices have retreated modestly with a weaker energy demand outlook partially offsetting concerns about tight supplies. Relief from high prices, however, will continue to be driven primarily by weaker demand rather than by rising global production. In this commentary, we’ll explore recent changes in energy prices and explain why prices are unlikely to decline substantially in the near term.

Energy Sector Faces Many Challenges

Americans struggling with fears about the COVID-19 pandemic, stay at home orders and economic lockdowns had a small consolation in the spring of 2020: A dramatic but short-lived decline in energy prices. As prices eventually climbed, however, concerns grew that energy costs would contribute to persistent inflation. Today, the energy outlook has many variables, such as investors seeking higher rates of return on capital rather than production increases, ESG concerns, supply chain challenges and geopolitical instability, including the Russian invasion of Ukraine and Chinese lockdowns. A strong dollar, higher interest rates and expectations of a global economic slowdown are also impacting daily price fluctuations. Those factors, in aggregate, suggest that an eventual decline in energy prices will result primarily from demand destruction rather than increased production.

Pandemic Drives Price Volatility

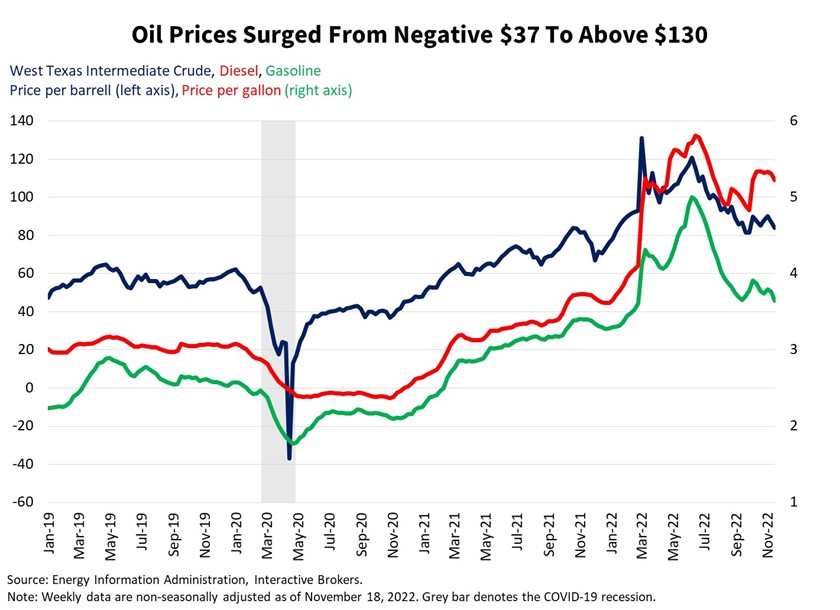

As economies across the globe screeched to sudden halts due to efforts to slow the spread of COVID-19, energy demand and prices dropped precipitously. In the U.S., the average price of regular gasoline hit a low of approximately $1.77 as oil companies ran out of oil storage capacity and were forced to pay other companies to take the commodity. Consumers’ gains, of course, were the oil industry’s pain, with the five integrated supermajor companies losing a combined $76 billion in 2020, and with the exception of alternative energy, the overall industry shed an estimated 27% of its workforce. The energy sector has since recovered 64% of pandemic-related job losses, while as of August of this year, other sectors, in aggregate, had fully recovered pandemic job losses.

As economies reopened, growing demand quickly consumed the glut while U.S. energy companies, after experiencing steep losses associated with oil oversupply, refrained from significantly expanding production. The resulting tight supply caused prices to climb substantially. Price pressures escalated further this past February when Russia invaded Ukraine, sparking global sanctions against the Kremlin, including freezing foreign held assets, a U.S. ban on importing energy from the country and a planned future ban by the European Union on purchasing Russian energy products. These sanctions pushed prices of regular gasoline to approximately $5 a gallon this past summer. More recently, a plan by the G7 nations to impose a price cap on Russian oil by December 5 has emerged, leading to risks of unfavorable reactions from the Kremlin. The Kremlin has threatened to cut oil exports to nations that abide by the price cap.

A Temporary Price Reprieve

The U.S. took actions to combat high oil prices even before the Russian invasion by announcing in November 2021 plans to tap the Strategic Petroleum Reserves. Since, the U.S. reduced the reserves from 601 million barrels to 445 million. It appeared to work, at least temporarily, with the Treasury Department estimating it lowered gasoline prices by as much as 31 cents per gallon. Additionally, member countries of the International Energy Agency (IEA) agreed to release 230 million barrels of oil from their own reserves. China’s zero COVID-19 policy and accompanying economic lockdowns also curtailed oil price gains by reducing energy demand with the IEA estimating that the country’s oil consumption will drop 2.7% this year, it’s first drop since 1990. These factors caused oil prices to decline from approximately $131 a barrel in the spring to only $77 a barrel in September while prices for regular gasoline declined from $5 a gallon to $3.69 a gallon.

OPEC Responds

Consumers weren’t the only ones to notice the price decline—In October, the Organization of the Petroleum Exporting Countries (OPEC) and its partner countries announced they would cut production by 2 million barrels a day (mb/d), causing oil prices to hit approximately $92 a barrel and gasoline prices to reach $3.72 a gallon in November. Since then, prices have retreated to $81 and even touched $75 on misleading rumors of OPEC planning to increase production.

Not Just Gasoline

Many of the same industry dynamics have also driven up diesel prices, creating inflationary pressures associated with logistics across the economy. Diesel has also been more sensitive to shortages in refinery capacity, which has led to elevated profitability among refinery companies. Its price has climbed from a pandemic low of $2.38 a gallon to $5.31 a gallon as of November 14. Diesel has also been impacted by the sanctions against Russia, which prior to the invasion was providing the U.S. with 700,000 barrels of diesel and other petroleum products a day.

A Tough Road Ahead

Weakening global gross domestic product growth combined with a strong U.S. dollar and a shortage of energy supplies in Europe is expected to reduce global oil demand growth from 2.1 mb/d barrels a day this year to 1.6 mb/d in 2023, according to estimates from the IEA. Despite OPEC cuts and the EU/U.S. sanctions, global production is expected to increase to 99.9 mb/d this year and 100.7 mb/d next year. Demand on the other hand is expected to be 99.4 mb/d this year and 101.2 mb/d next year.

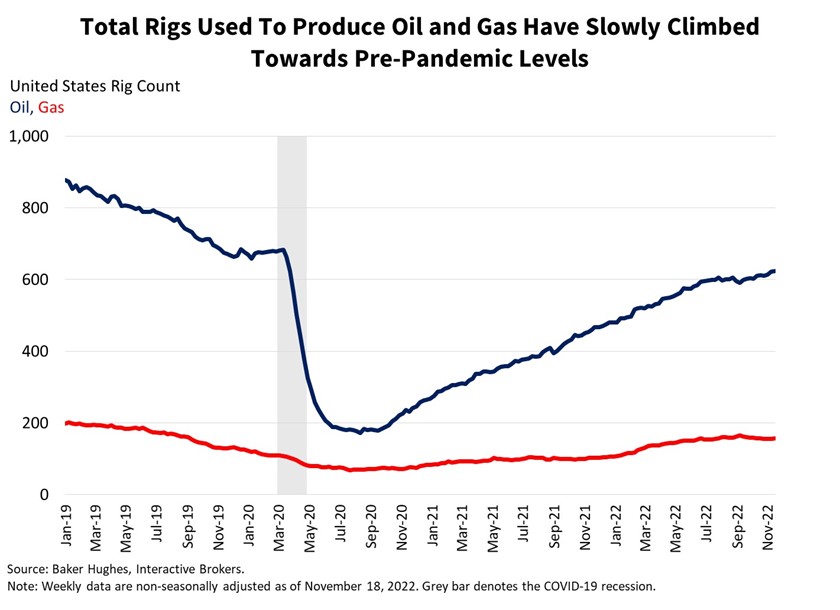

With the OPEC announced cuts and the Russia sanctions, the potential for the U.S. to increase its oil production is gaining increased attention. On a favorable note, the U.S. Energy Information Administration estimates that U.S. crude oil production this year will average 11.7 mb/d and increase to 12.4 mb/d next year, surpassing a record high set in 2019. In addition, rigs used to produce oil and gas have slowly climbed toward pre-pandemic levels. These impressive production gains are likely to provide marginal relief on the price front. Despite the outlook for growing oil production, higher prices could manifest if Chinese lockdowns soften and Russian exports restrictions are increased.

The following hurdles, however, are likely to prevent U.S. energy production from exceeding expectations:

- The negative prices and steep losses among energy companies during the COVID-19 pandemic have sparked shareholder activism that is forcing the industry to focus on returning capital to investors, not growth via production. In a recent Dallas Federal Reserve bank survey, 60% of energy executives said investor pressure to maintain capital discipline was preventing them from increasing production. Cash from operations at oil companies is at more than a five-year high while capital expenditures have increased only modestly following low 2020 levels.

- Publicly traded companies have redirected cash flow to paying down debt, conducting share repurchases and increasing dividends. In particular, share buybacks are occurring at record levels.

- Industry executives are also concerned that a potential recession with slowing demand for energy commodities could result in another oil glut that would be made worse if production has increased.

- In a related matter, supply chain issues, rising costs for equipment and wage pressures have created a disincentive for energy executives to boost production even with the current high prices for petroleum products.

- Shareholder ESG proxy voting also has caused companies to commit capital to clean energy rather than drilling. In the same Dallas Fed survey, 11% of executives cited ESG pressure from shareholders as a factor influencing them to limit production. This appears to be moderating. At Exxon Mobil and Chevron May shareholder meetings, for example, nearly two-thirds of investors voted against proposals that asked the oil giants to align their emission goals with the Paris climate change agreement. Nevertheless, examples of companies embracing ESG with sizeable shifts in capital outlays exist. BP has pledged to be carbon neutral by 2050 and recently acquired a 40.5% stake in the Asian Renewable Energy Hub that will entail more than 1.5 million acres (6,500 square kilometers) in Australia and tap solar and wind energy while producing hydrogen fuels.

Demand Destruction Could Provide Relief

Declining demand is likely to continue to bring relief on the energy front as the global economy appears to be heading for a substantial economic slowdown against the backdrop of tightening monetary policy and persistent inflation. The Conference Board is forecasting global real GDP growth of 2.1% in 2023, down 1.2 percentage points from the estimated 2022 rate. The IMF is slightly more optimistic with a 2023 estimate of 2.7% compared to its projected 3.2% rate for this year. The risk of GDP growth being weaker than anticipated, in my view, is more significant than the potential for GDP growth to be surprisingly strong. Inflation, while easing somewhat, has been stubbornly persistent across services while corporate decisions to onshore production to improve reliability which will increase operating costs, including those associated with regulation. These factors are likely to require the U.S. Federal Reserve (the Fed) to maintain its hawkish policies rather than pivot to a dovish stance that would fail in subduing inflationary pressures. Other countries are also struggling with inflation despite having already tightened monetary policy substantially, and like the Fed, are likely to continue tightening.

While recessions are painful, the resulting reduction in energy demand could provide some relief from the negativity of recent price increases.

This post first appeared on November 22nd, 2022 on the IBKR Traders’ Insight blog

PHOTO CREDIT: https://www.shutterstock.com/g/unio

Via SHUTTERSTOCK

DISCLOSURE: INTERACTIVE BROKERS

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers LLC, its affiliates, or its employees.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

In accordance with EU regulation: The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

DISCLOSURE: FUTURES TRADING

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.