By: Gerald Sparrow President & Founder, Sparrow Capital Management, Inc.

Stubborn doesn’t seem like a strong enough word, but that’s how Fed officials are describing inflation.

Inflation’s “stubbornness” has been on full display in recent weeks: First, the Producer Price Index (PPI) showed that costs remain high for producers of goods and services. Then in September’s more widely followed Consumer Price Index (CPI) high prices continued to persevere.

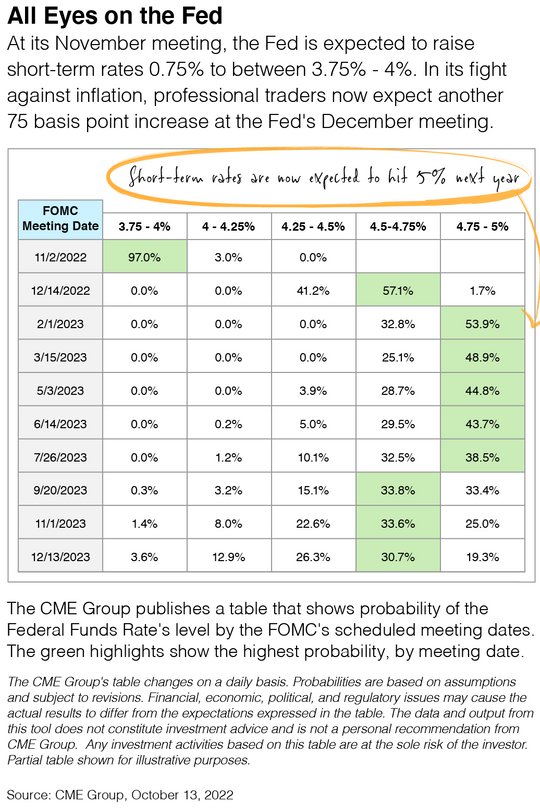

To address inflation, the Fed’s primary tool is short-term interest rates. As it pushes rates higher, the Fed aims to slow the economy by raising borrowing costs. As economic activity cools, the Fed expects to see the CPI and PPI trend lower.

In the table below, you can see what professional traders anticipate will happen with interest rates over the next year. They expect the Fed will have to raise short-term rates to nearly 5% in 2023 to lower inflation.

We know this year has had its ups and downs. Just when it appears to have turned a corner, something else happens, and the financial markets are under pressure again.

You may have heard the old saying: “Don’t worry about the horse, just load the wagon.” Now is an excellent time to stay focused on what you can control, like your “wagon,” and we’ll keep an eye on the “horses” in the meantime.

PHOTO CREDIT: https://www.shutterstock.com/g/rozbyshaka

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

![Chasing Madoff [movie trailer]](/content/default.jpg)