By Philip Lawlor, managing director, global markets research, FTSE Russell

As a turbulent 2018 draws to a close, we think markets face a very different investment landscape than what has prevailed for most of the post-crisis era.

We believe this stage in the cycle calls for a clear-eyed assessment of the potential risks that could upend long-held assumptions and catch markets off guard.

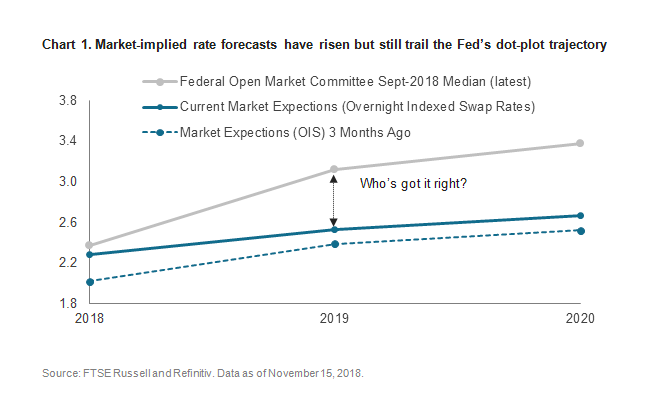

A case in point: Is there too much complacency about the future trajectory of US interest rates?

Investor Skepticism

In our opinion, the persistent gulf between market-driven rate forecasts and those of Federal Reserve rate setters suggests that investors remain skeptical that the central bank will stick to its proposed tightening path, as laid out in its dot-plot projections (Chart 1).

Such skepticism has served investors well over the past decade, as similarly sudden spikes in response to nascent signs of inflation were quickly followed by equally swift contractions as inflationary pressures abated.

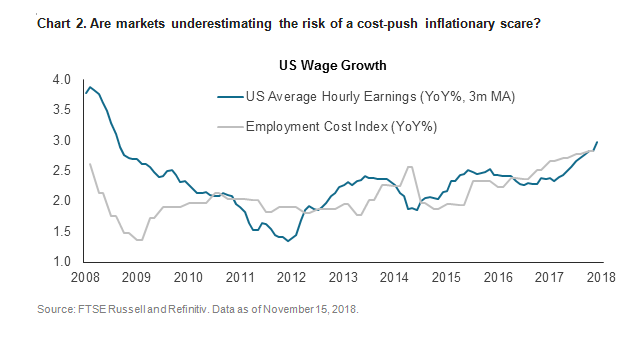

However, in our opinion, there is clearly a risk that the tightening US labor market (buoyed by the boost to aggregate demand from Trump’s tax cuts) has now reached an inflection point.

US wage growth has posted sequential increases over the past few months and now looks to be breaking to the upside.

Wage Growth

As we see it, a big question facing investors is what probability they would assign to US wage growth moving to a level that would trigger a different Fed and market reaction?

As the chart below suggests, wage growth would not have to climb much higher from current levels for the narrative around cost-push inflation to change.

Is the market relying too heavily on the persistence of a Goldilocks economic outcome and, thus, ascribing too low of a probability to this tail-event risk?

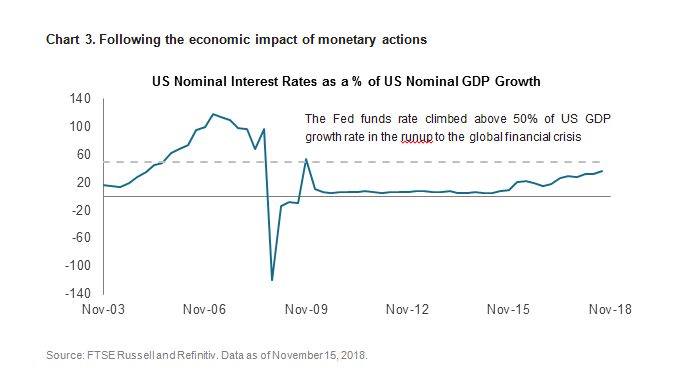

Tipping point

History tells us that there is a tipping point at which monetary policy morphs from being seen as gently “tapping” on the brakes (still accommodative) to being viewed as restrictive, with each successive hike seen as “slamming” on the brakes (Chart 3).

That point has typically come when nominal interest rates exceed 50% of nominal GDP growth.

The chart below shows the spread between nominal GDP and US Fed funds rates, an extrapolation of which would indicate that this tipping point is not far away.

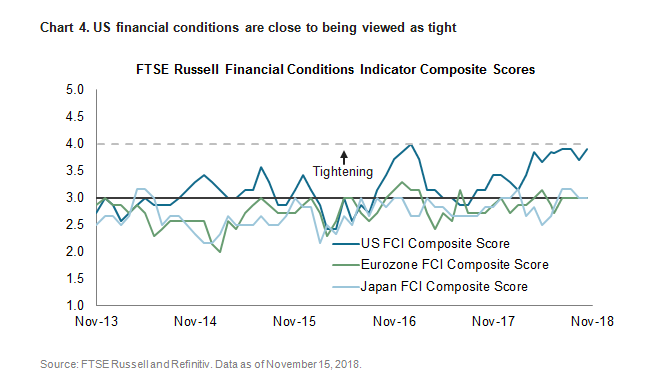

Monetary Tightening

Our proprietary, multi-metric Financial Conditions Indicators (which consider moves in currencies, bonds, interest rates and other variables) has seen the US composite score rise to a level just below 4 over the past year (Chart 4).

A move from 3 to 4 is deemed as tightening, while a move above 4 would be deemed as tight and regarded as a potential headwind for equity returns.

This contrasts starkly with the still accommodative scores for the Eurozone and Japan.

Photo Credit: Phil Dolby via Flickr Creative Commons

This article first appeared on the FTSE Russell blog on November 20, 2018.

© 2018 London Stock Exchange Group plc (LSEG Group). All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Any representation of historical data accessible through FTSE Russell Indexes is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained in this document or accessible through FTSE Russell Indexes, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Certain of the information contained in this article is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The author and its employer believe that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.