By: David Beniaminov, CFA; Jon Maier; Michelle Cluver, CFA

Macroeconomic shifts have stirred global markets this year, and the U.S. is no exception. Tighter monetary policy in response to higher inflation and Russia’s war in Ukraine have triggered a flight to safety, boosting the U.S. dollar and devaluing risk assets. We expect macro headwinds will continue to pressure U.S. corporate earnings in the coming months, which warrants a lower exposure to global factors, particularly those stemming from a strong dollar and Europe.

A Strong Dollar Could Weigh on Corporate Earnings

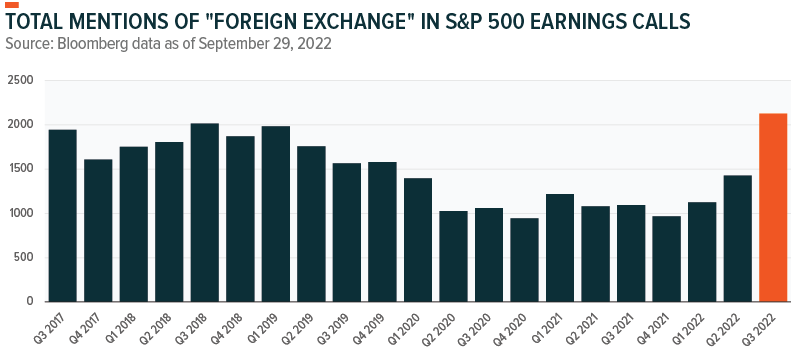

The dollar’s 20% rally over the past year (as of September 28, 2022) means that foreign earnings of U.S. domiciled firms are worth less when translated back into dollars. While it is reasonable to assume that currency hedging will mitigate some of the losses from currency translation, there will be some negative impact on multiples as a result. Mentions of foreign exchange among S&P 500 companies ticked higher during the third quarter of this year, which was greater than 2018 when the dollar rallied nearly 12%, according to data from Bloomberg.

Companies that generate a substantial part of their revenue from outside of the U.S. could experience additional earnings compression, albeit with a lag. Roughly 40% of S&P 500 revenues are generated outside of the U.S., and about 58% of Information Technology company sales were sourced from abroad.1 Many S&P 500 companies have warned about the negative impacts of a strong dollar. For example, during the second quarter earnings season, some U.S. multinational firms forecasted lower profit growth because of the strong dollar, and the rise in currency volatility could disrupt some hedging programs.2

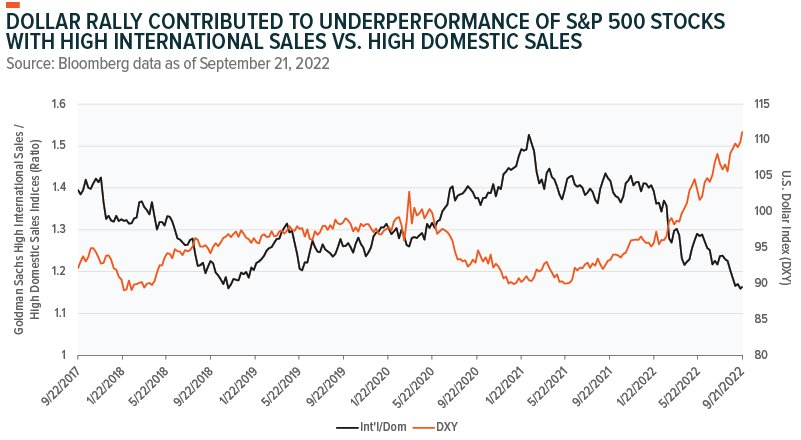

We expect earnings expectations to decline as multinational firms realize foreign exchange headwinds that accelerated over the past year. So far, markets have started to price in negative impacts of a strong dollar. Goldman Sachs index of S&P 500 stocks with the greatest share of non-US revenues has significantly underperformed S&P 500 stocks with high domestic revenues over the past year. And problems in Europe could exacerbate the eventual earnings hit from abroad.

Sector Revenue Exposure to International Economies

The energy crisis in Europe could intensify as winter sets in. The August year over year energy component of Consumer Price Index (CPI) in the Eurozone has risen 38.6%, while the July 2022 year over year energy component of Producer Price Index (PPI) in the Eurozone has risen 97.2%.3 This has a profound impact on the economy and growth potential of the region as soaring energy prices have also forced some energy-intensive companies to begin shutting down production. Steel, aluminum, fertilizer, and power plants have closed because the cost-benefit of such high energy prices makes them no longer profitable.4

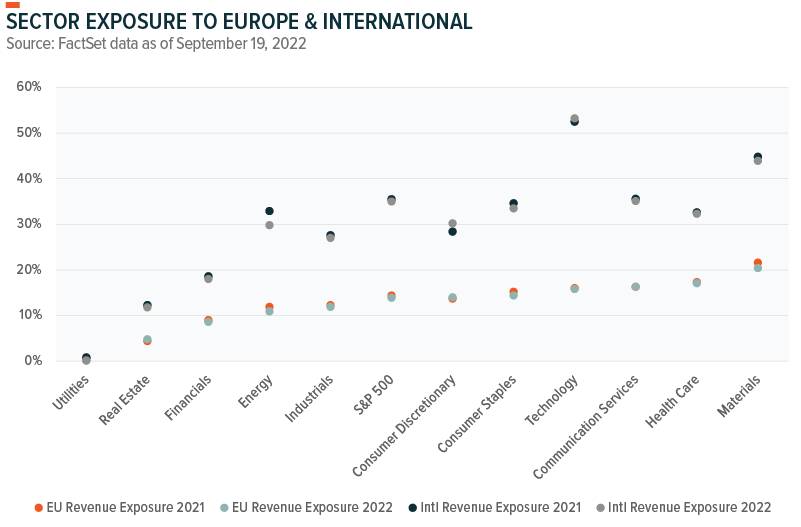

Problems in Europe extend beyond borders though and also impact U.S. companies. Utilizing FactSet’s GeoRev function, which displays revenue exposures by geographic region, the S&P 500 has about a 14% revenue exposure to Europe. On a sector level, exposures range from 0% to about 20%. The sector with the greatest exposure is Materials, followed by Health Care while on the low-end Utilities has almost no exposure owing to its home bias, and Real Estate about 5%.

Investors can avoid undue international risk by focusing on the sectors with little to no European revenue exposure like Utilities. If that is unavoidable, then focusing on lower concentration to European revenue exposure like Consumer Staples and Health Care could be warranted. These sectors are also the same defensive sectors that could likely outperform in a recessionary environment.

Relative Upside for Domestic-Focused, Defensive Sectors

This brings us back to currency risk as the transition from late cycle to recession will have a negative impact on earnings, especially within cyclical sectors. For example, Industrials, Materials, and Consumer Discretionary are negatively correlated with the dollar index, while defensive sectors such as Consumer Staples, Health Care, and Utilities exhibit a positive correlation with the dollar index. This aligns with the S&P 500’s -0.43 correlation with the dollar over the past five years, which means a strong dollar is typically associated with a declining equity market.

Our sector views table below provides more detail on sector positioning and the current tailwinds and headwinds for each sector.

Originally Posted October 3rd, 2022, GlobalX Blog

PHOTO CREDIT: https://www.shutterstock.com/g/Piscine

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

Investors cannot invest directly into an index. Consumer price index (CPI) measures the average change in prices that consumers pay for a defined basket of goods and services. The Dollar Index measures the value of the United States Dollar relative to a basket of foreign currencies. The Producer Price Index (PPI) measures the average change in the selling prices received by domestic producers for their output. The S&P 500 Total Return Index includes 500 leading U.S. companies and captures approximately 80% coverage of available market capitalization.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

FOOTNOTES

1. FactSet, Earnings Insight, September 10, 2022

2. Barron’s Inflation is Yesterday’s News. A Strong Dollar is Next Big Threat for U.S. Multinationals, July 20, 2022

3. Eurostat, Industrial Producer Prices up by 4.0% in the euro area and 3.7% in the EU, September 2, 2022

4. BNE, Energy Crisis: Europe’s Industry Shutting Down, September 20, 2022

5. BofA, When Alternatives Go Mainstream RIC Report, August 9, 2022.

6. CNBC, ‘Once-in-a-generation’ Prescription Drug Pricing Reform Could be Coming, July 29, 2022