By: Rohan Reddy, Global X

Editor’s Note: Hover over terms in sea green for a pop-out glossary definition. Full glossary also included at the end with terms listed in the order that they appear.

The Global X Income Outlook for Q1 2022 can be viewed here. This report seeks to provide macro-level data and insights across several income-oriented asset classes and strategies.

We spoke last quarter about the hawkish pivot by the Federal Reserve (Fed), and the likelihood of stickier inflationary pressures. These trends continued to materialize in 2022 as market expectations for aggressive monetary policy tightening took hold, and headline inflation data printed at extremely high levels by developed market standards. For investors, we believe there are some key themes and solutions to pay close attention to in the income investing markets.

Key Takeaways:

- The potential for numerous rate hikes by the Fed and other central banks, as well as aggressive balance sheet unwinding seems increasingly likely for the remainder of the year.

- Low duration instruments, like variable rate preferreds, may be an alternative for fixed income investors looking to reduce interest rate risk but still pursue income objectives.

- Energy assets with strong fundamentals, like master limited partnerships (MLPs) and energy infrastructure equities, look appealing in a rising oil price environment.

- Options based strategies, such as covered calls, could be attractive with elevated volatility and the defensive posturing in the equity markets.

Hawkish Central Bank Policies Make Further Rate and Credit Spread Rises More Likely

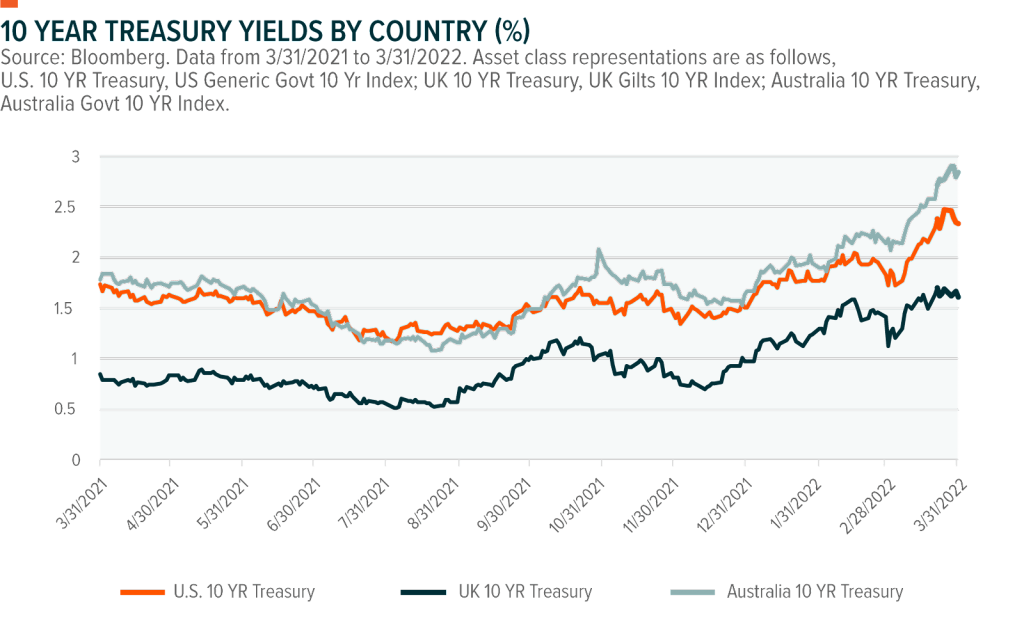

Persistent inflation in the United States and limited monetary policy response put the Fed in a precarious position to start the year. The Fed was forced to play catch up after leaving loose monetary policies in place, despite inflationary pressures spreading across the global economy. However, the Fed reacted sharply in Q1, raising rates for the first time in three years. The Fed wasn’t alone, though. The Bank of England and Bank of Canada, among others, raised rates, opening the door to broader global hawkish monetary policy this year.

Additionally, we believe it’s unlikely this pace of rate hikes and tapering will slow down. The European Central Bank (ECB), historically very dovish compared to other developed central banks, said they could end their bond buying program in Q3.1 The futures market is currently projecting a move to zero interest rate levels from negative 50 basis points (bps) by year end.2 The U.S. and U.K. central banks are forecasted to be even more aggressive, with 125 bps in hikes by the United Kingdom and 200 bps in hikes by the United States forecasted in the futures market.3 Clearly, these would be the most aggressive policy actions in that short of a timespan that we’ve seen this cycle.

We think the Fed, as an example, is being forced to play catch up as inflation levels in the United States reached 8.5% in the month of March. The last time headline inflation reached these levels in the United States was in the 1980s. The bond market is already moving in lockstep with inflation, so hawkish policy was priced into sovereign bond yields.

Credit spread widening is also more likely in light of central bank rate hikes and further monetary policy tightening. There was a spike in credit spreads in Q1 as the equity markets sold off and the rate hiking path began. The rise in geopolitical tensions could also make financing conditions more challenging for high yield issuers.

Variable Rate Preferreds as a Fixed Income Alternative

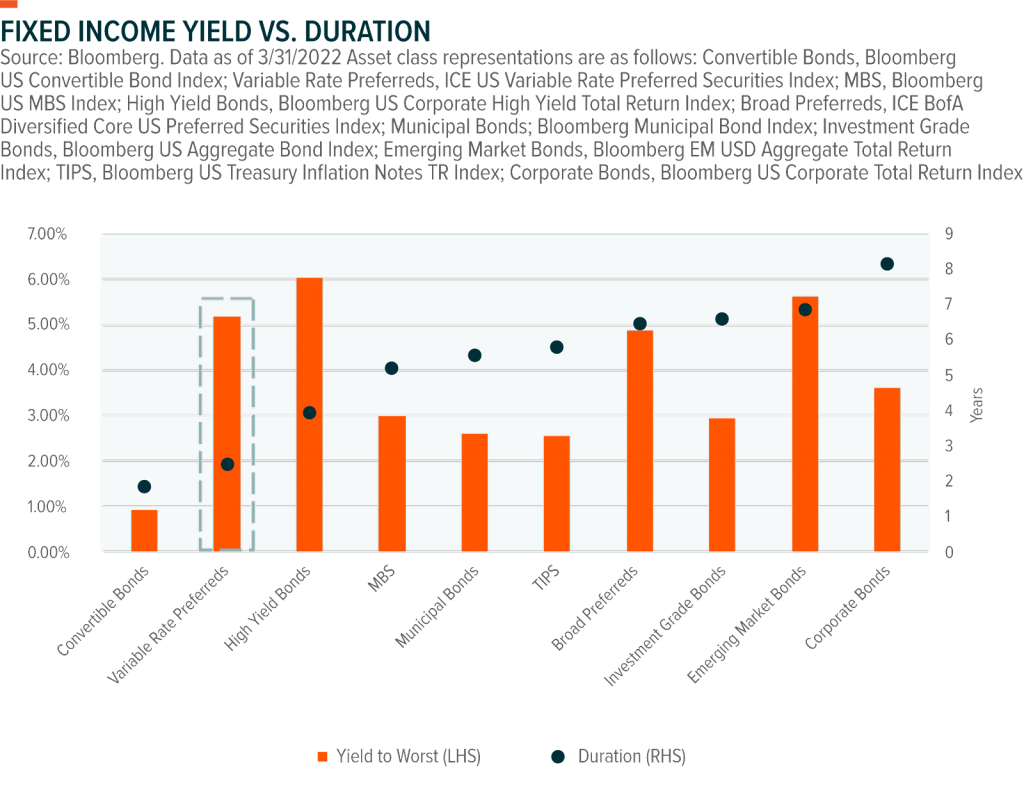

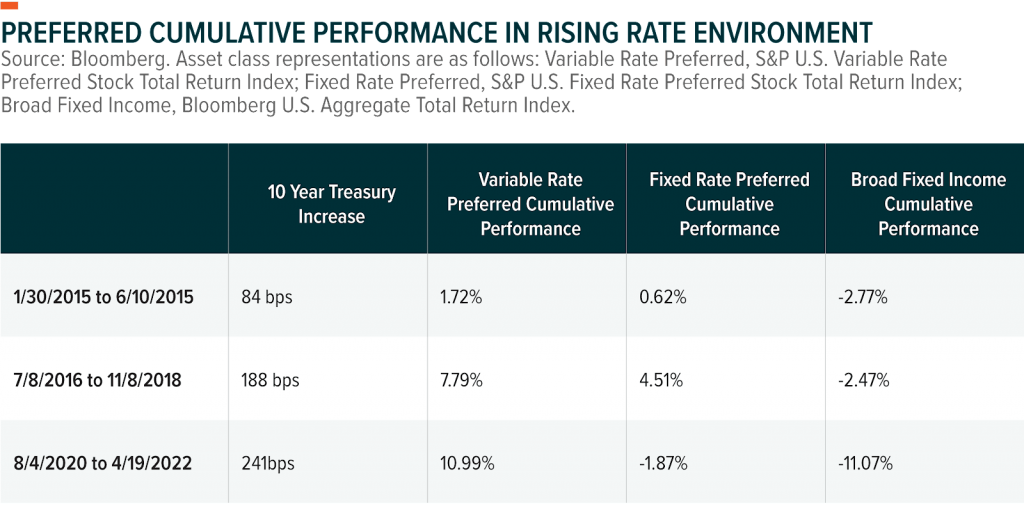

For fixed income investors, aggressive monetary policy shifts raise two risks: rate hikes, which are already permeating into the market, and potential credit spread widening for corporate credit. For income investors, in our view, the key in this environment is balancing interest rate risk with the need for yield.

Real (inflation-adjusted) yields turned negative in the midst of the pandemic, putting income investors in a challenging situation. The recent rise in sovereign bond yields is mitigating some of this risk, but real yields are still barely on the brink of turning positive. Persistent inflationary pressures, such as supply chain issues and labor shortages, are causing headline inflation to keep moving higher, with March’s figures coming in at 8.5%. This increases the need for real income levels to keep pace.

Variable rate preferreds historically hold up well in rising rate environments with their lower duration characteristics. The outperformance of variable rate preferreds also occurred when compared to broader fixed income as well.

Master Limited Partnerships as an Income Play on Commodities

In our view, commodity investments have been one of the shining spots in the market this year, as global supply shortages and inflationary pressures drove raw material prices higher. For income investors, though, the non-yielding nature of commodities futures makes that route less appealing to generate cash flow. We believe he equity of companies in commodities businesses are more attractive given the return of capital potential through dividends or share buybacks.

Master Limited Partnerships (MLPs) are one avenue for income investors to potentially both generate income and benefit from the commodity trade of oil. These pipeline businesses could be well positioned for a rise in U.S. energy production, and this year’s spike in oil and gas prices has also boosted natural resource assets, such as MLPs. The tax advantaged nature of the distributions and yield spreads compared to other asset classes could make MLPs a compelling option for income investors.

Elevated Volatility Makes Covered Call Strategies Attractive in a Rising Rate Environment

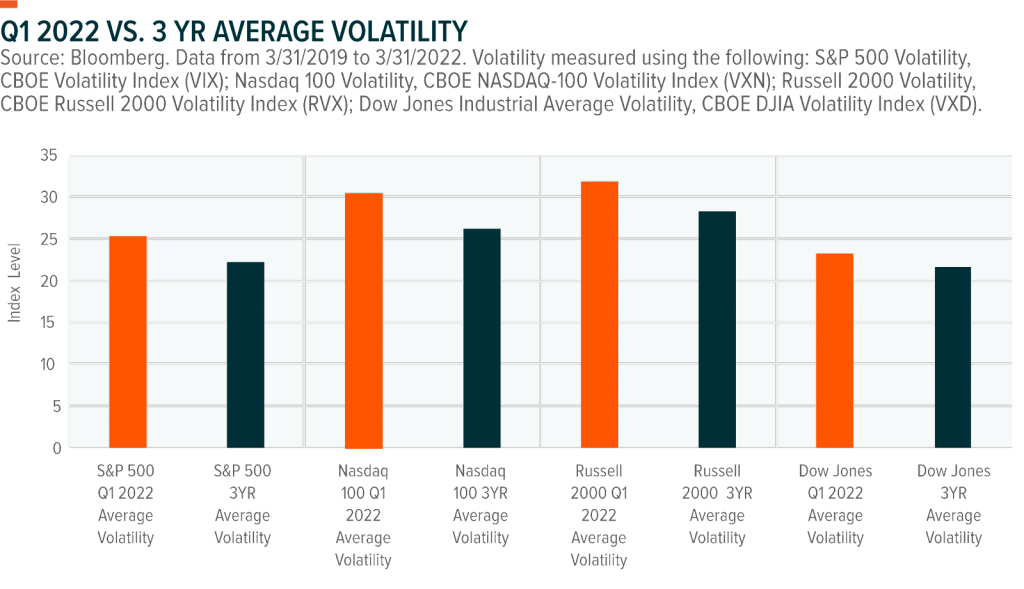

Central bank tightening did not just lead to a spike in yields and credit implications. Increased volatility began flowing into the equity markets as investors began re-pricing valuation multiples and growth equities began selling off in favor of value.

Volatility increases were notable across major indices, after the equity market selloff earlier in Q1. For income investors, in our view, covered call strategies on major indices like the Nasdaq 100 or S&P 500 could be a way to generate income outside of traditional dividend paying stocks and fixed income.

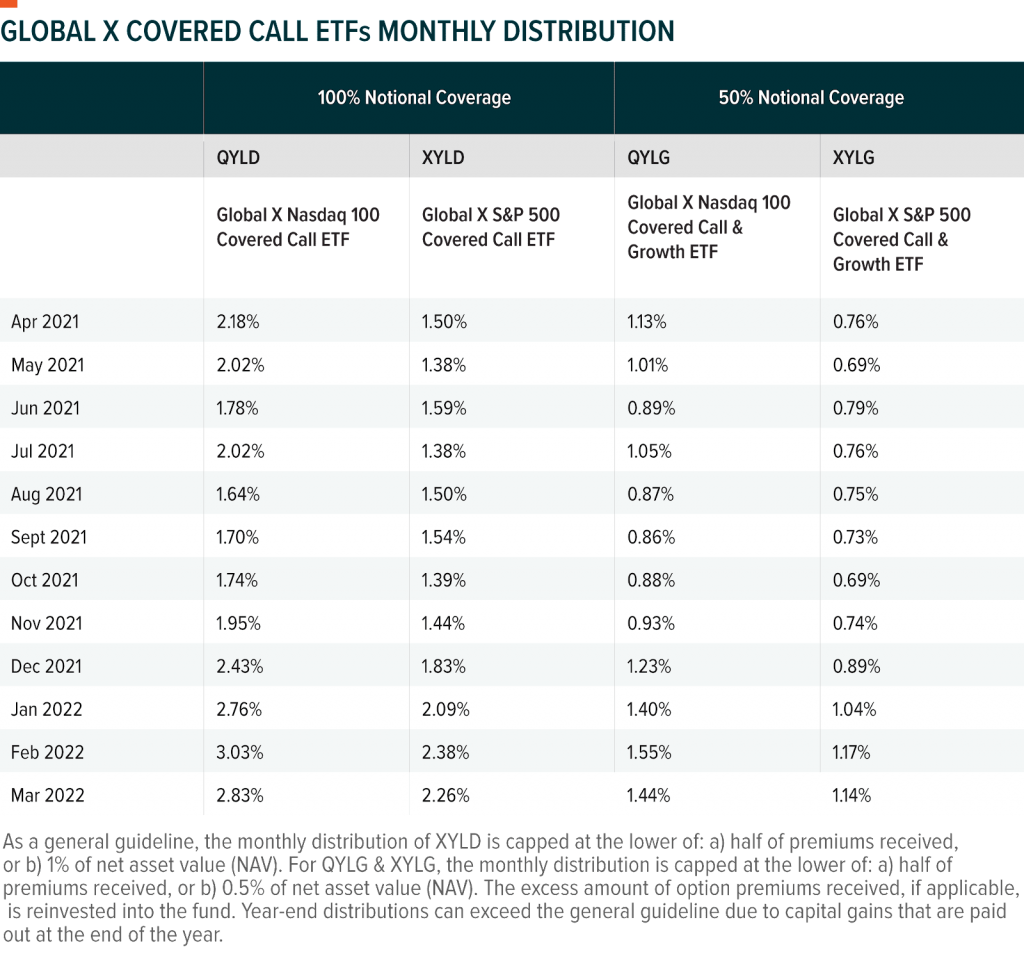

The potential for earnings growth may lead investors to desire some level of equity upside potential, while also collecting a potential income stream. With 6.5% earnings growth for Q2 expected in the S&P 500, and 11.1% for Q3, some income investors may want to maintain equity exposure.4 Below, we can see a comparison of the options premiums generated from writing covered calls both at-the-money with 100% notional coverage and also using 50% notional coverage to retain upside potential. For further information on options premiums for the Global X covered call strategies, including on the Russell 2000 and Dow Jones Industrial Average , please click the report in this link.

Disclosure to graph: Past performance is not indicative of future results. All investments have the potential for loss.

Conclusion

The ramp up in Treasury yields and other sovereign bonds globally means income investors need to be on the lookout for the impact on their income portfolios. Broader fixed income assets are likely to face pressure amid aggressive tightening policies by central banks, and growth equity assets may be volatile for the foreseeable future with rising rates. Variable rate preferreds offer a balanced approach to duration risk and income levels from the preferreds. Sectors able to withstand inflation pushed through the supply chain could bode well in this environment compared to other segments of the market. Energy related assets, like MLPs, and options strategies, such as covered calls, that are able to monetize volatility could be solutions in this rising rate environment.

Related ETFs:

MLPA: The Global X MLP ETF invests in some of the largest, most liquid midstream Master Limited Partnerships (MLPs).

MLPX: The Global X MLP & Energy Infrastructure ETF is a tax-efficient vehicle for gaining access to MLPs and similar entities, such as the General Partners of MLPs and energy infrastructure corporations.

PFFV: The Global X Variable Rate Preferred ETF invests in a broad basket of U.S. variable rate preferred stocks, providing benchmark-like exposure to the asset class

QYLD: The Global X Nasdaq 100 Covered Call ETF follows a “buy-write” (also called a covered call) investment strategy in which the Fund buys a basket of stocks, and also writes (or sells) call options that correspond to the basket of stocks. The Fund uses this strategy in an attempt to enhance its portfolio’s risk-adjusted returns, reduce its volatility, and generate monthly income from the premiums received from writing the call options.

XYLD: The Global X S&P 500 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on the same index.

RYLD: The Global X Russell 2000 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys exposure to the stocks in the Russell 2000 Index and “writes” or “sells” corresponding call options on the same index.

DJIA: The Global X Dow 30 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Dow Jones Industrial Average (also known as the Dow 30 Index) and “writes” or “sells” corresponding call options on the same index.

Footnotes

- European Central Bank. (2022, April 14). Monetary policy decisions.

- Saphir, A. (2022, April 18). Fed’s Bullard wants to get rates up to 3.5% by year end.

- Inman, P. (2022, April 9). High prices and low growth should nip UK and eurozone interest rate rises in the bud. The Guardian.

- FactSet Research Systems. (n.d.). FactSet earnings insight. Factiva. Accessed on April 19, 2022.

Glossary

Duration: Measure of bond’s price sensitivity to changes in interest rates.

VIX: The Chicago Board Options Exchange SPX Volatility Index commonly referred to as VIX, reflects a market estimate of future volatility of the S&P 500 index options, based on the weighted average of the implied volatilities.

VXN: The Chicago Board Options Exchange NDX Volatility Index commonly referred to as VXN, reflects a market estimate of future volatility of the Nasdaq 100 index options, based on the weighted average of the implied volatilities.

RVX: The Chicago Board Options Exchange RUT Volatility Index commonly referred to as RVX, reflects a market estimate of future volatility of the Russell 2000 index options, based on the weighted average of the implied volatilities.

VXD: The Chicago Board Options Exchange DJIA Volatility Index commonly referred to as VXD, reflects a market estimate of future volatility of the Dow Jones Industrial Average index options, based on the weighted average of the implied volatilities.

Nasdaq 100 Index: The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

S&P 500 Total Return Index: The index includes 500 leading U.S. companies and captures approximately 80% coverage of available market capitalization.

Russell 2000 Index: A small-cap stock market index that includes 2,000 smaller companies that focus on the U.S. market.

Dow Jones Industrial Average Index: The Dow Jones Industrial Average Index (DJI) is one of the most popular stock market indexes in the US, and often used as a barometer of US market health in tandem with S&P 500.

This post first appeared on May 5th, 2022 on the GlobalX blog

PHOTO CREDIT: https://www.shutterstock.com/g/NATNN

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Investors cannot invest directly in an index.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Global X believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions