By Catherine Yoshimoto, Director, Product Management

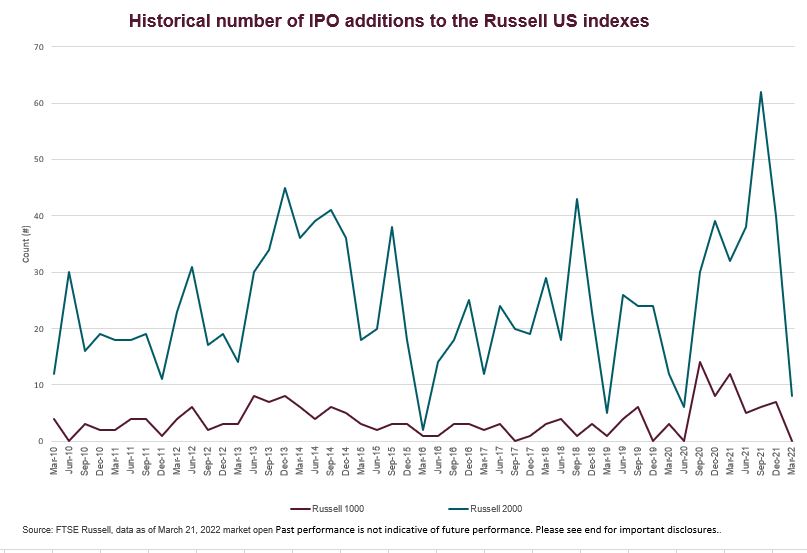

After a record year in 2021, Russell US Index IPO additions are off to a lackluster start in 2022. FTSE Russell adds eligible IPOs to our Russell US Indexes on a quarterly basis, and this quarter we had no IPO additions to the Russell 1000 Index while the Russell 2000 Index IPO additions were a mere fraction of the 1Q2021 number. This can perhaps in part be attributed to companies putting their public offering plans on hold in the face of heightened market volatility.

2021: A banner year for IPO additions

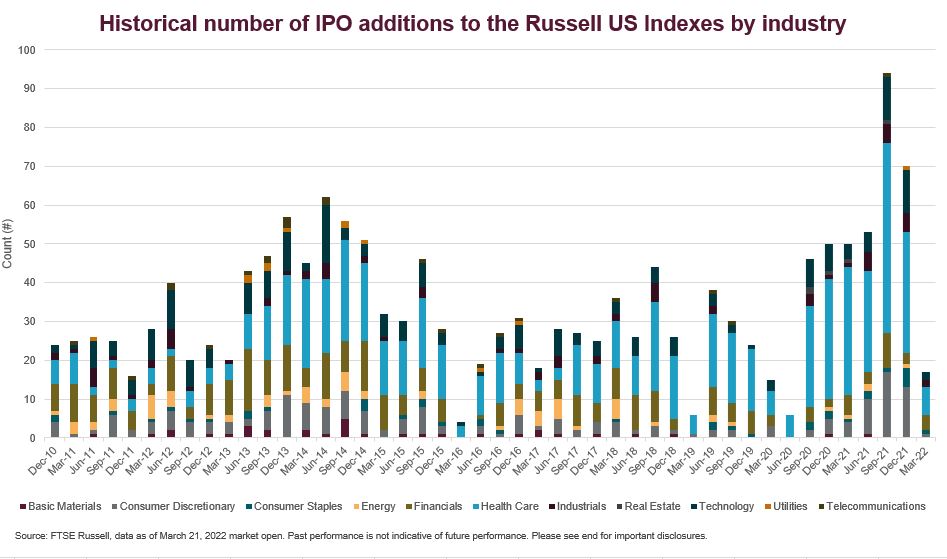

IPO additions surged in 2021, primarily driven by Health Care and Consumer Discretionary companies—many of them meeting the evolving needs of an economy that’s been reshaped by the pandemic. As shown, 2021 Russell US Index IPO additions totaled 30 for the Russell 1000 Index and 172 for the Russell 2000 Index, with the majority of additions taking place in the third quarter.

2022: IPO additions down amid a volatile start

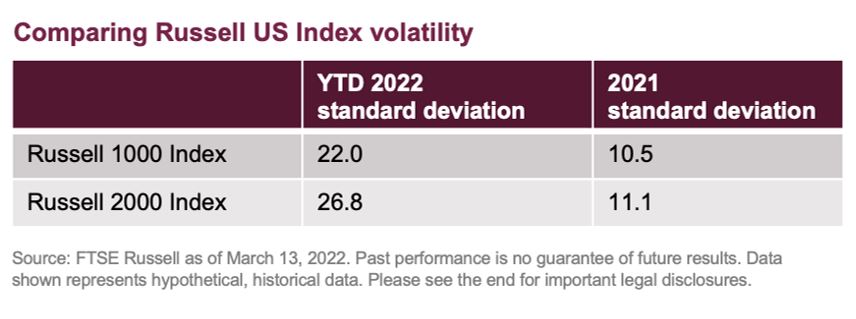

Geopolitical turmoil has made for a volatile start to the year for US equities, particularly when compared to 2021. As shown, both Russell 1000 and Russell 2000 first quarter 2022 volatility—as measured by standard deviation of returns—has been more than twice that of 2021 volatility.

Amid this heightened market volatility, Russell US Index IPO additions have dropped dramatically. As of 1Q2022, there are no preliminary additions to the Russell 1000 Index, and only eight additions to the Russell 2000 Index. By comparison, in the first quarter of last year there were 12 additions to the Russell 1000 Index and 32 additions to the Russell 2000 Index.

Humble beginnings for some household names

While we typically add more than zero IPOs to the Russell 1000 on a quarterly basis, it isn’t an anomaly that Russell 2000 additions outpaced them by a considerable margin. With few exceptions, looking back over the past decade Russell 2000 IPO additions far exceed Russell 1000 additions.

A primary reason for this disparity might be obvious—the majority of IPOs that meet Russell Index eligibility requirements fall short of the market capitalization threshold required for Russell 1000 eligibility. But some rising companies that are added to the Russell 2000 at the time of their public offering grow to become eligible for the Russell 1000.

Amazon and Netflix are perhaps the most well-known examples of this. Amazon was an IPO addition to the Russell 2000 in July 1997 and became eligible for the Russell 1000 one year later. Netflix had a longer journey from IPO to large cap, debuting as an IPO addition to the Russell 2000 in June 2002 and meeting Russell 1000 eligibility seven years later in 2009.

Representing the ever-evolving opportunity set

While IPO activity has ebbed and flowed over the past decade, the drop in number of IPO additions from 2021 to 2022 has been particularly dramatic. Adding IPOs to our Russell US Indexes not only enhances index representation, but also offers a snapshot of IPO activity across industries—offering insight into market trends and investor sentiment.

This post first appeared on April 1, 2022 on the FTSE Russell blog

PHOTO CREDIT: https://www.shutterstock.com/g/VideoFlow

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

The Russell 1000® Index measures the performance of the large-cap segment of the US equity universe; The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. Investors cannot invest directly into indexes.