By Brie Williams, Head of Practice Management, State Street Global Advisors

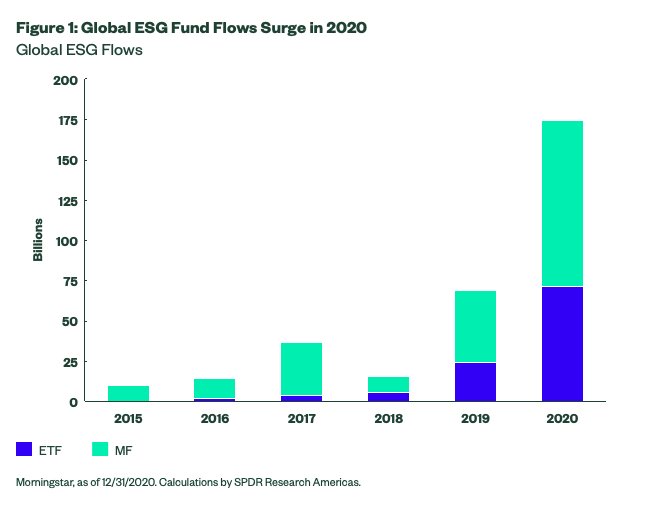

So much transpired across society, economies and the investment community to advance ESG investing in 2020. Moving out of an exceptional third quarter, global inflows into ESG funds held strong, amassing $45.8 billion in Q4 2020, with Europe pushing past $821 billion in AUM to close the year.1 We believe ESG flows will continue to accelerate in 2021 as these four trends drive momentum:

1. An emphasis on ESG to pursue better risk-adjusted returns

The debate over whether positive ESG characteristics can afford a stock premium performance has dissipated over recent years. In fact, in 2020, ESG indices outperformed their non-ESG counterparts. Compared with the S&P 500 Index, the S&P 500 ESG and S&P ESG Exclusions II indices achieved ~1.5% outperformance, with less volatility of returns.2

These better risk-adjusted ESG returns were strongly correlated with quality and large-cap stocks in 2020. Although market dynamics are likely to be different in 2021, ESG strategies (whether exclusionary, best-in-class/positive screening and/or benchmark aware) could continue to benefit as they could remove potential threats to performance and help investors pursue lower downside risk. Given the evolution of views, we see investors becoming more willing to accept tracking error to standard benchmarks.3

2. The pandemic highlighting ESG’s lower-profile S pillar

Historically, the E in ESG has taken the spotlight, with vital emphasis on mitigating climate change through corporate and investor action. The climate story was not forgotten in 2020, and indeed many people reveled in the fact that lockdowns caused emissions to fall. However, the challenges that COVID-19 inflicted on workforces and underprivileged parts of the population made corporate social responsibilities more relevant, increasing the focus on the S in ESG and new means of measuring it.

Throughout the pandemic, we saw companies that were better prepared for upheaval prosper. During shareholder engagements by State Street Global Advisors, we saw how strategic planning on supply chains — including more diverse sourcing, digitalization and robust supply-chain risk management processes — helped companies in more strained times.

In the US, while President Biden has already rejoined the global effort to curb climate change, it is too early to gauge the administration’s impact on social issues. However, the inclusion demonstrated by Biden’s Cabinet picks sends a reinforcing message on the importance of diversity.

3. Increasing ESG integration into investment policy statements

Although ESG investing is not mandatory, global regulators and policymakers have published increasingly strict guidelines to ensure that asset managers who incorporate ESG considerations into their investment strategies can provide end investors with a transparent understanding of their methodology. For example, the United Nations-backed Principles for Responsible Investment (PRI) now requires its signatories to adopt mandatory climate-related financial disclosures, or face loss of their accreditation.

As Europe continued to advance toward ESG investment data standardization in 2020, the US made progress to regulate how companies disclose ESG information. To provide transparency for this information, a slew of reporting frameworks and scoring systems have been developed, although despite collaboration between the Sustainability Accounting Standards Board (SASB) and GRI (formerly named the Global Reporting Initiative), standard criteria on specific disclosures remains elusive in the US. And although the Securities and Exchange Commission has yet to take specific action to implement ESG requirements, expectations for transparency and comparability, as well as complete and accurate information, are rising.

Looking ahead, we believe that companies that engage in stakeholder capitalism (considering the impact on clients, employees, society) are likely to be better positioned for long-term value creation. This remains a core argument for value-based ESG integration.

4. Greater recognition of the climate emergency

While the COVID-19 crisis could have knocked climate from the top of the ESG agenda – and efforts were derailed by the postponement of United Nations Climate Change Conference (COP26) – a tipping point was reached in global consciousness in 2020 with more action to limit the use of fossil fuels and speed up the low-carbon transition. The PRI lists climate change as the biggest risk faced by investors, citing physical and transition risks to portfolios. And Task Force on Climate-related Financial Disclosures (TCFD) on the governance of climate risks and their strategic impact became compulsory for PRI signatories last year.

2020 also featured the European Commission’s launch of two climate benchmarks that align with a 1.5-degree scenario: the Paris-Aligned Benchmark (PAB) and the broader Climate Transition Benchmark (CTB), which permits fossil fuel investments in transition. These benchmarks demonstrate how the European Commission has pulled ahead in terms of legislation to support sustainable finance. And they will be useful for investors who want to be at the forefront of change.

Looking ahead, Europe’s wide-ranging Green Deal, presented in 2020, has the overarching aim of making Europe climate neutral in 2050. It was Europe’s “man on the moon moment,” to quote European Commission President Ursula von der Leyen. Policy areas in the action plan include clean energy, sustainable mobility, sustainable food systems, and biodiversity. And in the US, President Biden’s “build back better” approach could also support ESG as planned fiscal stimulus is directed to low-carbon projects such as electric vehicle charging networks, hydrogen and renewable energy infrastructure, and improving building energy efficiency and retrofits.

To read this article in its entirety please click here. This article first appeared on the State Street Global Advisors blog.

Photo Credit: Pictures of Money via Flickr Creative Commons

Footnotes

1Morningstar, as of 12/31/2020. Calculations by SPDR Research Americas.

2S&P Dow Jones Indices, December 31, 2020.

3State Street Global Advisors, Global Market Outlook, “Investments Theme: Momentum Will Carry ESG Investing Far Beyond the Pandemic” Carlo Maximilian Funk https://www.ssga.com/etfs/insights/esg-investing-momentum-will-carry-it-beyond-the-pandemic

DISCLOSURE

The returns on a portfolio of securities which exclude companies that do not meet the portfolio’s specified ESG criteria may trail the returns on a portfolio of securities which include such companies. A portfolio’s ESG criteria may result in the portfolio investing in industry sectors or securities which underperform the market as a whole. Investing involves risk including the risk of loss of principal. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

The Standard and Poor’s 500, or simply the S&P 500, is a free-float weighted measurement stock market index of 500 of the largest companies listed on stock exchanges in the United States. The S&P 500 ESG Index is a broad-based, market-cap-weighted index that is designed to measure the performance of securities meeting sustainability criteria, while maintaining similar overall industry group weights as the S&P 500. The S&P 500 ESG Exclusions II Index is designed to measure the performance of S&P 500 constituents, excluding companies involved in controversial weapons, tobacco products, small arms, and thermal coal. Investors can’t invest directly in indexes.