By Anqi Dong, CFA, CAIA, Senior Research Strategist

We have seen a noticeable shift in market sentiment as the vaccine rollout picks up speed and stimulus spending trickles into the economy. Rising inflation expectations and improving growth prospects have lifted 10-year yields to their highest level since 2015.1 Value stocks, which have historically shown a higher sensitivity to interest rates, have outperformed growth and high momentum stocks by a wide margin of late.2

Meanwhile, elevated return dispersion and low correlation among sectors underscore a constructive environment to potentially generate alpha by using sector and industry exposures. Given this reflationary regime shift and favorable economic outlook, we see three industry opportunities that may benefit from the continued economic recovery.

Banks: Bright Earnings Prospects with Attractive Valuations

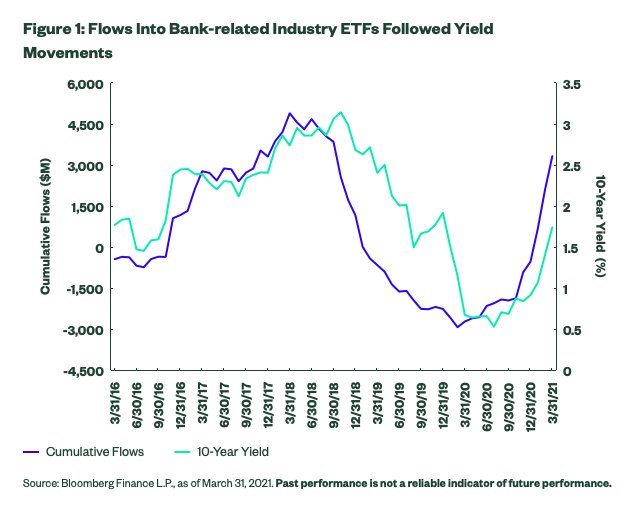

As higher long-term rates has driven the 10-and-2-year yield spread to its widest level since 2015, the bank industry outperformed the broad market by 18% in Q1.3 This is not surprising as, historically, bank stocks have shown a higher correlation to long-term rates than the broad market and the broader financial sector.4 Investors have taken advantage of banks’ rate sensitivity to position for a higher rate environment. As shown in the chart below, flows into bank-related ETFs picked up significantly following the increase in long-term rates in 2016 and have done so again recently.

The case for investing in the bank industry becomes even stronger when considering the segment’s improving earnings prospects and attractive valuations. Despite the dire economic environment last year, banks have shown resilience during the pandemic. The industry posted its first positive earnings growth since the beginning of the pandemic, 7.8% in Q4, exceeding analyst expectations of negative growth of -17.3%.5 This positive earnings sentiment could continue into the coming quarters, as net interest income is likely to show further improvement on the back of the sharp steepening of the yield curve. As more people get vaccinated and economic reopening shifts into higher gear, business activities are likely to pick up, leading to more loan demand later this year. And as of right now, the industry is expected to post earnings growth of 38% in 2021, more than double the estimate of 16% at the start of the year.6

Reserve releases may provide another tailwind for bank earnings. Banks built up their largest loan loss reserves since the financial crisis in the first two quarters of 2020 in anticipation of higher credit losses stemming from the pandemic.7 However, due to faster-than-expected vaccine developments and an improved economic outlook for 2021, banks started to release reserves in Q4, led by big banks.8 The recent Federal Reserve announcement of lifting restrictions on bank dividend and share buybacks on June 30th may further boost industry earnings and return of capital to shareholders in the second half of 2021. It is projected that major banks will repurchase $83 billion in stock this year, 6% of their market cap.9

Despite strong performance over the past few months, bank stock prices may not fully reflect this improvement in earnings growth sentiment. The industry is currently trading at the 35th percentile over the past 15 years, based on 1-year forward price-to-earnings ratio.10 Its valuations relative to the broader market are even more attractive, trading within the bottom decile based on 1-year and 2-year forward price-to-earnings, as well as price-to-book ratios.11

To position for rising rates and potentially improving profitability at inexpensive valuations, consider the SPDR® S&P® Bank ETF (KBE).

Metals and Mining: Strong Metal Demand and Rising Inflation

Global manufacturing activity is expanding at the fastest rate in more than a decade,12 creating robust demand for industrial metals this year. Although Chinese demand may grow slower than last year, given the government’s lower-than-expected growth and fiscal deficit targets for this year, strong demand driven by manufacturing recovery outside of China and the potential multi-year infrastructure plan in the US may support the industrial metal market further in the coming years.

While China manufacturing PMI is currently growing at its lowest level in the current 11-month period of expansion, eurozone and US manufacturing activity are expanding at their fastest pace on record.13 This bodes well with increasing demand for industrial metals globally. Additionally, President Biden’s infrastructure proposal of more than $2 trillion includes around $721 billion for transportation infrastructure, power grids and electric vehicles and charging stations.14 Metals are indispensable materials for infrastructure, from traditional highways, bridges and ports to renewable infrastructure. President Biden’s emphasis on ‘Buy America’ provisions may create more demand for metals, benefiting domestic producers and miners the most. On the other hand, China — the largest producer of aluminum and steel — is accelerating capacity cuts in the mining sector to reduce pollution and achieve its environmental targets.15 With increasing demand chasing constrained supplies, the global metal prices rally that began last year is likely to continue, providing another tailwind for the industry.

Given strong demand and metal prices, metal producers and miners are expected to post earnings growth of 242% in 2021, up from 133% at the beginning of Q1 earnings season. Their growth estimate ranks highest among all GICS industries in the S&P Composite 1500 Index universe, exceeding the broad market by more than 200%.16 The industry’s strong growth prospects have not been fully priced in, indicating more upside potential for the industry. Even given its 20% gain in Q1, the industry’s forward price-to-earnings ratio is near the bottom quartile over the past 15 years.17 Compared to the broad market, its valuations are even more attractive, trading at the bottom 5th percentile over 15 years, based on the forward price-to-earnings ratio.

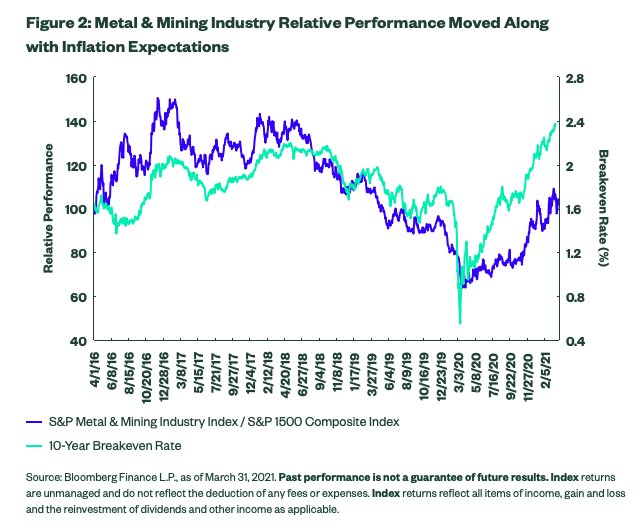

Furthermore, the industry has historically outperformed the broader market when inflation expectations moved higher, as shown in the chart below. To position for rising inflation expectations and strong metal demand, investors may consider the SPDR S&P Metals and Mining ETF (XME).

Retail: Economic Reopening and Consumer Spending Recovery

The US leads the world in total vaccines administered. It’s estimated that at the current rate of daily vaccinations, it will probably take another four months to have 75% of the population vaccinated.18 Reaching that 75% threshold would enable a “return to normal,” according to government officials.19 As a greater percentage of the population gets vaccinated, people may feel more comfortable visiting physical stores and gradually return to more normal shopping behaviors. While e-commerce has surged, online shopping is not the only way consumers want to experience products. Consumers still prefer to touch and feel the product before making a purchase for certain items.

After having out-of-home activities restricted for almost a year, consumers have shown a strong desire to venture out and start spending. According to McKinsey’s March consumer sentiment survey, more than 50% of US consumers expect to “spend extra by splurging or treating themselves” starting now and continuing post-pandemic, particularly on discretionary categories such as apparel, beauty and electronics. And with younger consumers showing even greater desire to spend extra, we are likely to see higher retail spending in the coming months as the younger population becomes eligible for the vaccine.

To read the rest of this post, which first appeared on April 16 on the State Street Global Advisors’ blog, please click here.

Photo Credit: Hefin Owen via Flickr Creative Commons

Footnotes

1Bloomberg Finance L.P., as of March 31, 2021.

2Bloomberg Finance L.P., as of March 31, 2021. Past performance is not a reliable indicator of future performance.

3Bloomberg Finance L.P., as of April 5, 2021. Past performance is not a reliable indicator of future performance.

4Bloomberg Finance L.P., as of March 31, 2021. Based on 5-year correlation to 10-year yields of the S&P Bank Select Industry Index, the S&P 1500 Composite Index, and the S&P 500 Financials Index.

5FactSet, as of March 31, 2021. Past performance is not a reliable indicator of future performance.

6FactSet, as of March 31, 2021. Past performance is not a reliable indicator of future performance. Targets are estimates based on consensus analyst estimates compiled by FactSet. There is no guarantee that the estimates will be achieved.

7“US loan loss reserves approach Great Financial Crisis levels,” S&P Global Market Intelligence, September 2020.

8“US banks release billions from reserves in anticipation of lower COVID losses,” Financial Times, January 15, 2021.

9Goldman Sachs, April 5, 2021. Targets are estimates based on consensus analyst estimates compiled by Goldman Sachs. There is no guarantee that the estimates will be achieved.

10FactSet, as of March 31, 2021. Past performance is not a reliable indicator of future performance.

11FactSet, as of March 31, 2021.

12J.P. Morgan Global Manufacturing PMI, April 1, 2021.

13FactSet, as of March 31, 2021.

14“US loan loss reserves approach Great Financial Crisis levels,” S&P Global Market Intelligence, September 2020.

15“US banks release billions from reserves in anticipation of lower COVID losses,” Financial Times, January 15, 2021.

16FactSet, as of March 31, 2021. Targets are estimates based on consensus analyst estimates compiled by FactSet. There is no guarantee that the estimates will be achieved.

17Goldman Sachs, April 5, 2021. Past performance is not a reliable indicator of future performance. Targets are estimates based on consensus analyst estimates compiled by Goldman Sachs. There is no guarantee that the estimates will be achieved.

18FactSet, as of March 31, 2021.

19J.P. Morgan Global Manufacturing PMI, April 1, 2021.

Disclosures

Information Classification: General Access

The views expressed in this material are the views of SPDR ETFs and SSGA Funds Research Team through the period ended March 31, 2021 and are subject to change based on market and other conditions and do not necessarily represent the views of State Street Global Advisors or any of its affiliates. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided does not constitute investment advice and it should not be relied on as such.

Past performance is not a reliable indicator of future performance.

Targets are estimates based on certain assumptions and analysis made by SSGA. There is no guarantee that the estimates will be achieved.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Diversification does not ensure a profit or guarantee against loss.

Concentrated investments in a particular sector or industry tend to be more volatile than the overall market and increases risk that events negatively affecting such sectors or industries could reduce returns, potentially causing the value of the Fund’s shares to decrease.

Passively managed funds invest by sampling the Index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the Index.

Equity securities may fluctuate in value in response to the activities of individual companies and general market and economic conditions. Funds investing in a single sector may be subject to more volatility than funds investing in a diverse group of sectors.

Investing involves risk including the risk of loss of principal.

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.