This month we will explore the idea of “gambler’s ruin” in the stock markets. In its basic form, gambler’s ruin refers to a betting strategy that will ruin or bankrupt the person using it. One way this can happen is by continuing to parlay wins into increasing bet sizes and never taking money off the table.

When the gambler then experiences losses, the impact is ever larger. In a series of all-or-nothing bets, a single loss wipes out the gambler.

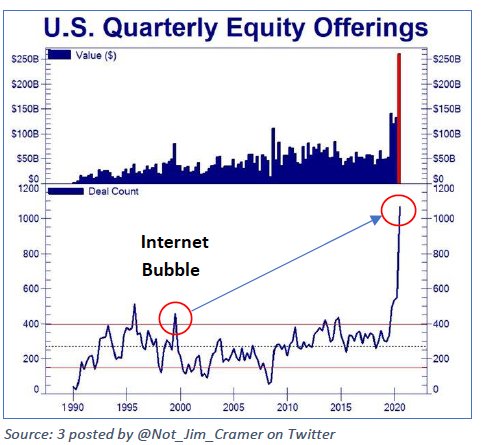

We are seeing a similar situation play out in the stock market today. First, we note that the amount of money and the types of bets in the market have reached record levels in recent months.

Leverage Worries

Second, we review the extreme use of leverage in the markets. And last, we discuss the recent spectacular blow ups among firms using leveraged bets that are hidden from view.

A new record in money entering the stock markets has been set in the last 5 months through the end of March. Since the Coronavirus vaccines were announced, $569 billion has entered stock funds.

In comparison, over the prior 12 years only $452 billion entered global stock funds. It is significant that those prior

12 years constitute the entirety of the bull market. The stock market was generally rising throughout this period.

Capital Onslaught

Thus, the increase of the past few months is outsized compared to the entire bull market. The sudden increase in these last 5 months indicates a rush of capital entering the markets after 12 years of moving up. The rapid increase in capital inflows at the end of a long bull market is common to markets that are peaking.

These last few months have also seen a peak in investments in money-losing companies and newly listed companies. This is the most speculative part of the market.

In the first quarter, companies that were losing money or that had poor finances outperformed established companies with earnings. As backwards as that sounds, it is common in today’s market.

Speculators are betting on companies whose stock has been moving up simply because the price has been moving up. In the short term this kind of circular reasoning works because of the “greater fool theory.” The greater fool theory states that there will always be someone, a “greater fool,” willing to pay more for a given stock.

Greater Fool

Predictably, the kind of market created by a belief in the greater fool theory lures all sorts of charlatans and promoters into the stock market. Think of the iconic pets.com company of the Internet bubble. The company with the sock puppet commercial went public in February 2000 and by November of that year had filed for bankruptcy.

Over the first three months of the year new companies being sold to the public have skyrocketed. New initial public offerings (IPOs) of companies have more than tripled the number during the Internet bubble. And, predictably, these companies are heavily promoted to deliver the next groundbreaking technology or product.

Swimming Naked

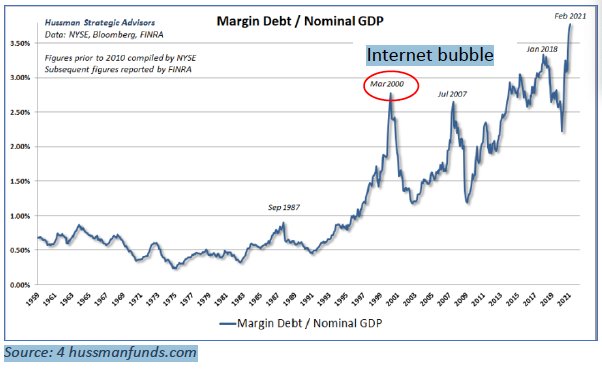

Warren Buffett, the world’s most famous investor, has a terrific saying for times like these, “you don’t know who is swimming naked till the tide goes out.” Buffett is referring to the amount of leverage that investors are using to place bets in the stock market.

The chart at the right tells us that, at approaching 4%, we are at the highest level of margin debt as a percent of the

economy in history. For comparison, during the Internet bubble that number was about 3%. Margin debt is the primary way most investors use leverage in their portfolio to increase the impact of their investments.

When markets are moving up margin debt can enhance returns significantly. However, when markets turn down losses multiply quickly. In a downturn, brokers will first look to protect themselves.

In March of 2020, for example, brokers protected their own capital by quickly liquidating client accounts that used margin debt. This sort of forced selling escalates on

itself as selling further drives down stock prices.

Option Bets

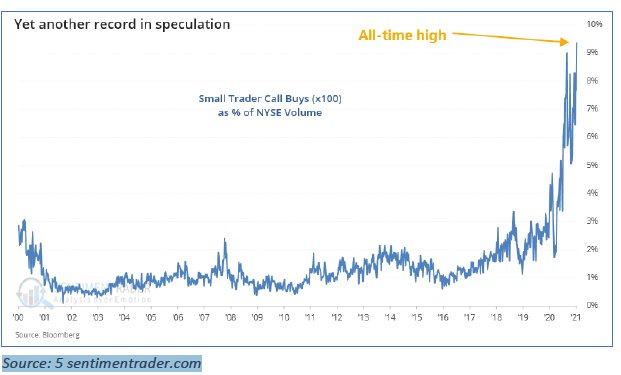

Another type of leverage that has become popular over the past year is provided by options on stocks. An option can be thought of as an all-or-nothing bet on a stock moving in a certain direction in a given amount of time.

If the bet pays off, it can pay multiples of the original wager. If it doesn’t, the entire wager is lost. In recent months the amount of call options used by small traders has been more than 9 times what it has been for most of the past 20 years.

In addition to margin and options, banks that act as prime brokers offer their hedge fund clients even more leverage.

Fund Failures

The first quarter has seen 3 major funds blow up. In January, Melvin Capital took losses of 53% on its short positions in Gamestop. A short trade is one in which the investor makes money when the stock goes down. Melvin Capital subsequently had to raise $2 billion in capital to keep its doors open.

At the beginning of March, Greensill Capital blew up when news surfaced that Tokio Marine would no longer back its financing schemes. Up to that point Greensill had offered investors a way to get increased yields by engaging in the financing of short-term receivables or payables of companies. The scheme was billed as a safe way to earn extra yield.

When the financing scheme imploded and the dust settled, it turned out that Greensill had moved into the risky business of offering long term unsecured loans. Credit Suisse, the large Swiss bank, is now trying to minimize its losses as it unwinds a $10 billion fund based on Greensill’s loans.

Internet bubble

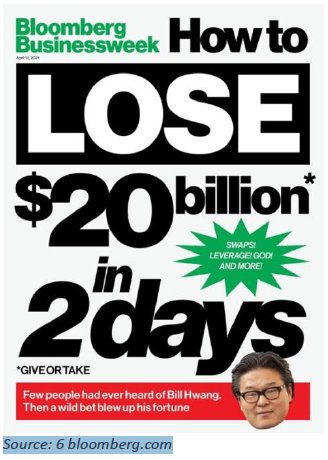

The largest fund disaster to date concerns the Archego fund, Bill Hwang’s family office. As the cover on Businessweek claims, Hwang lost approximately $20 billion dollars in two days when one of his bets went against him.

Hwang ran a highly concentrated fund that levered up its positions. Not content with the typical 2- or 3-times leverage, Hwang used multiple banks to make the same bets and achieve leverage of 6-8 times his capital base.

Each bank was unaware of the others, so the total risk of Hwang’s approach was unknown even to his own bankers. The Archego fund likely kept only a small 5% buffer in case some of its bets soured, according to Businessweek.

The fallout thus far totals in the billions for the banks that were unable to liquidate Hwang’s holdings quickly. Credit Suisse is once again in the headlines.

Its total losses among the Greensill and Archego fiascos is estimated to exceed $10 billion.

Failed Bets

On Tuesday, March 23rd, Archego’s ViacomCBS stock holdings dropped 9%. When they fell a further 23% on Wednesday, March 24th, that was enough to wipe out the fund.

Leverage is a sword that cuts both ways. When markets are moving up quickly, leverage increases return and makes investors feel like geniuses. However, when markets turn down that same leverage quickly wipes out gains.

Plentiful liquidity sloshing through the financial system has encouraged leveraged risk taking among hedge funds and other market participants.

As we saw above, increasing levels of leveraged bets can have catastrophic consequences. So far, the market has shrugged off these losses. Under the surface, however, the fragility of the market has increased.

One indicator of fragility is the weakening performance of previously hot sectors in the stock market. The chart at left shows that an index of new companies peaked in February and are now below their October 2020 level relative to the Nasdaq.

Market Fragility

This relative weakness shows that the hottest sector in the market is losing momentum. For those that have been betting on these stocks moving up, they are now struggling or losing on their trades.

Another indicator of fragility in my opinion is the decreasing volume of stocks traded. As the stock market made recent highs, the volume of transactions has decreased since peaking in January. This likely indicates that the market is running out of buyers, new funds, or some combination of the two.

When a stock market is at all-time high levels it takes increasing amounts of money to keep prices moving up. At highly stretched valuations the situation resembles that of rolling a boulder up a hill.

When the strength of the upward push gives out that boulder begins to roll back downhill. This is what we should expect to see next in the stock market.

Takeaway

One of Hemingway’s characters describes how he went bankrupt as, “gradually and then suddenly.” As Hwang discovered with his Archego fund, suddenly can happen very quickly indeed. Hwang’s approach was the very definition of gambler’s ruin.

The amount of leverage, known and unknown, in the market today argues for more such losses. When that happens, brokers will force the levered players to liquidate their holdings. Forced selling can quickly escalate on itself.

Given the extreme levels of leverage in the system, in my opinion a sharp drop in the market is a strong possibility. For now, we continue to stand on the sidelines in the safety of cash and bonds waiting for our opportunity to emerge.

Photo Credit: Mathieu Lebreton via Flickr Creative Commons

Disclosure

This publication may contain forward-looking assessments, which are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. This letter is provided as educational information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument, or to participate in any particular trading strategy.