By Robin Marshall, director of fixed income research, FTSE Russell

Before the COVID-19 shock, several factors combined to suggest the US housing market was more robust than in 2008. These factors were (1) greater financial regulation in mortgage finance since the Global Financial Crisis (GFC), (2) lower borrower leverage, (3) a smaller share of non-agency mortgage issuance after the sub-prime bust, (4) homeowners with greater equity in housing valuations, (5) absolute mortgage rates much lower than in 2008, helped by lower US Treasury yields, and (6) US unemployment at 40-year lows.

Nor was the US housing market at the epicenter of the 2020 crisis and recession, as it was in 2008. So, although the primary/secondary mortgage spread spiked early in the COVID-19 crisis, taking mortgage spreads back to 2008 highs as Treasury yields collapsed, parallels drawn with the GFC in 2008 appeared misplaced.

US Primary/Secondary mortgage Spread

Source: FTSE Russell Yield Book. Data as of June 10, 2020. Past performance is no guarantee to future results. Please see the end for important disclosures.

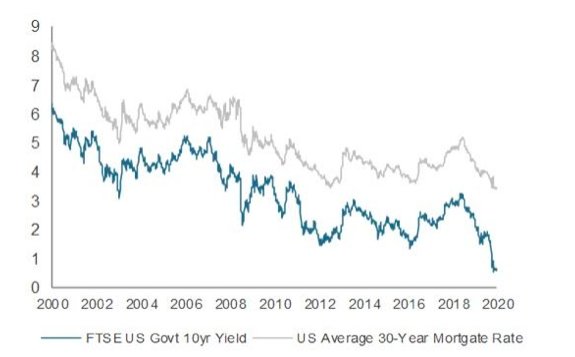

Substantial Fed QE purchases of MBS also prevented outright mortgage rates from increasing significantly, as the Covid-19 recession and Lockdown developed. Indeed, mortgage rates are now near all-time lows, reflecting the collapse in US Treasury yields and Fed QE, as the next chart shows.

US 30-year mortgage rates and the 10-year Treasury yield

Source: FTSE Russell / Refinitiv. Data as of June 2020. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

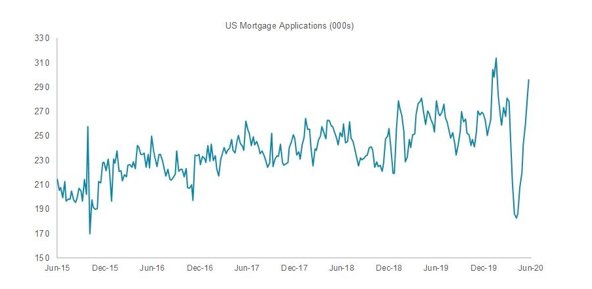

Predictably, the COVID-19 lockdown caused a sharp drop in new mortgage applications as economic activity came to a halt and the mortgage finance market destabilized. However, as the lockdown has eased, low outright mortgage rates drove a recovery in mortgage applications, which surged in April and May; the V-shaped recovery in mortgage applications appears to suggest some normalization in the US housing market.

US mortgage applications

Source: Refinitive. Data as of June 2020.

But deep recession, and the spike in unemployment, have created serious challenges.

Despite this apparent normalization, closer examination of the US housing market suggests a number of COVID-19 related structural challenges. This time around, it is the feedback loop from dislocation in the real economy to the US housing market that is the main problem, rather than the reverse, as it was in 2008.

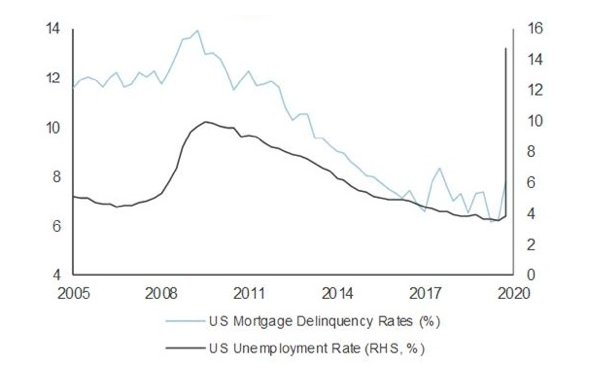

Therefore, the first challenge is the impact from the spike in unemployment. This caused a surge in mortgage loans in forbearance, as borrowers who are furloughed, or unemployed, accessed the support offered by the CARES act, allowing payments to be deferred or reduced for up to 12 months. Historically, mortgage delinquencies have been strongly correlated with the US unemployment rate, as the following chart shows.

Mortgage delinquencies and the US unemployment rate

Source: Refinitiv. Data as of June 2020.

As a result, mortgage lenders—who were squeezed by the collapse in interest payments and faced increased credit risk—tightened credit standards. The MBA*’s Mortgage Credit Availability index fell to 129.3 in May, the lowest level since 2014, from above 185 in Q1 2020, as credit standards tightened across all loan types.

A second major challenge has occurred via the complex web of securitized US mortgage finance. Ironically, massive Fed (agency) QE MBS purchases, designed to stabilize the market, appear to have reinforced financial pressures on mortgage lenders by driving down MBS yields sharply from mid-March onward.

This is because mortgage lenders, who routinely hedge against higher interest rates, found those hedges to be deeply under water, as yields collapsed, compounding the problem of the collapse in interest payments from mortgage borrowers. The MBA even requested that the Fed reduces MBS purchases to offset the squeeze on mortgage lenders.

This presents more policy challenges for the Fed and the QE transmission mechanism. Recent evidence suggests simply buying large quantities of (agency) MBS, using the GFC playbook, may have less predictable consequences for housing finance and the economy at very low yield levels.

Finally, non-agency mortgages do not benefit from either Fed MBS purchases, or Federal Housing Finance Agency support programs. Unsurprisingly, non-agency mortgage loans in forbearance are considerably higher than the 8.5% of total agency mortgages in forbearance (May 31 MBA data), and mortgage originations have collapsed in the non-agency sector. High mortgage delinquency rates and distress in the non-agency sector create the risk of a spike in foreclosures, much lower house prices due to enforced sales, and another hit to consumer expenditure, particularly if US payment protection schemes are not renewed beyond July 31.

*Mortgage Bankers Association

As this implies, though the worst may be behind us, it’s still too early to sound the “all clear” on the negative earnings cycle.

Photo Credit: bambe1964 via Flickr Creative Commons

DISCLOSURE

© 2020 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained in this document or accessible through FTSE Russell Indexes, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and/or their respective licensors.