Michael Arone, CFA, Chief Investment Strategist, State Street Global Advisors

Physicians are required to take the Hippocratic Oath, “First, do no harm.” Evidently, there is no such oath for central bankers. The prescription for lower interest rates, and now in too many instances, negative rates, isn’t the remedy for what ails the global economy. On the contrary, low and negative rates just might be killing the patient.

Just ask Japan or, more recently, Europe. Similar to chemotherapy and radiation, zero and negative rates aggressively attack the powerful cancer cells of subpar economic growth and below-target inflation, but with harmful side effects. And although at times it seems as if the treatments are working, the global economy cannot be described as fully cured from the disease.

Everyone has conveniently, and seemingly all at once, abandoned the belief that positive real interest rates are an important signal for a healthy economy. They provide a powerful hurdle rate discipline to corporate executives making long-term spending decisions and also deliver compelling incentives for savers. From my perspective, zero and negative interest rates are symptoms that still diagnose the global economy as sick more than a decade after the Great Recession.

Check the warning label

There are plenty of nasty side effects from zero and negative interest rates. Businesses have greedily stuffed their collective fists deep into their pockets, refusing to spend a dime on almost anything but repurchasing their own shares.

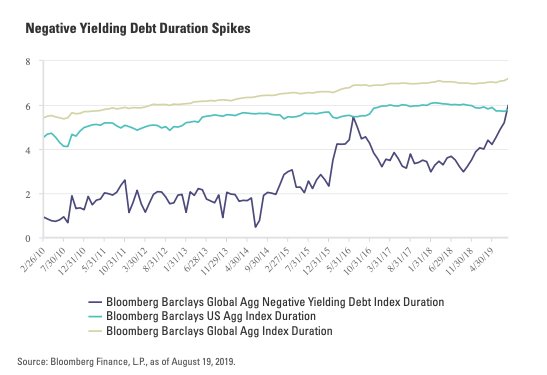

Borrowing by both consumers and businesses has surged — piling up even more debt on top of an already huge mountain of debt. Low rates have penalized savers, hurt the banking industry’s profitability and resulted in growing wealth and income inequality. Potential asset price bubbles may also be forming. Look no further than the nearly $16 trillion in global debt with negative yields.1

The bull run in these bonds has been so spectacular that buying now and holding on until maturity guarantees the investor future losses. Yet, investors enthusiastically buy more!Sadly, to the dismay of Chairman Powell and many others, zero and negative interest rates haven’t done much to permanently repair sluggish economic growth or reignite inflation. And yet they continue on the same path, making the central bankers’ motto, “If at first you don’t succeed, try, try again!”

The placebo effect

How can President Trump and so many economists be certain that lower rates are the solution to the US economy’s challenges? That policy hasn’t worked for Japan. It hasn’t worked for Europe, either. For example, today, the deposit rate of the European Central Bank (ECB) is -0.4%. The deposit rate is the interest rate that the ECB pays for deposits that banks hold at the central bank. It has been negative since June 2014. This means that banks have to pay for the balances they keep with the ECB. Will lowering the deposit rate to -1% revive Europe’s stalling economy and save its failing banking industry? I doubt it.

For more, please read the rest of the post originally published on the SPDR Blog on Aug. 27.

Photo Credit: Zooey via Flickr Creative Commons

This material is from State Street Global Advisors and is being posted with State Street Global Advisors’ permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Advisors is not endorsing or recommending any investment or trading discussed in the material. The opinions expressed may differ from those with different investment philosophies. This material is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed or relied on as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, strategies, tax status, investment horizon, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.