The current seven-year plus bull market is anything if not resilient.

US stock prices have continued to bound from strength to strength despite predictions in recent years from skeptics that the rally would soon run off the rails.

Yet consider: Since the darkest days of the financial crisis back in March 2009, some $14 trillion has been restored to the value of US equity prices, according to Bloomberg data.

Lift Velocity

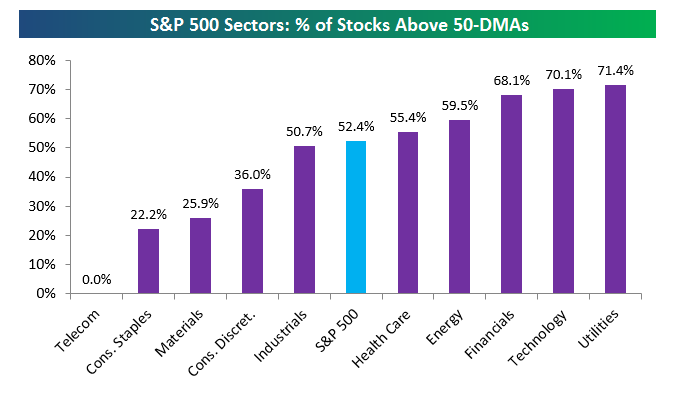

While the US economy may be sputtering along, many stock sectors — led by technology, utilities and financials — are enjoying an uptrend based on an analysis of 50-day moving averages (DMA) by Bespoke Investment Group.

Overall, some 52.4% of stocks in the S&P 500 are now trading above their 50-DMAs as of September 23.

Valuations

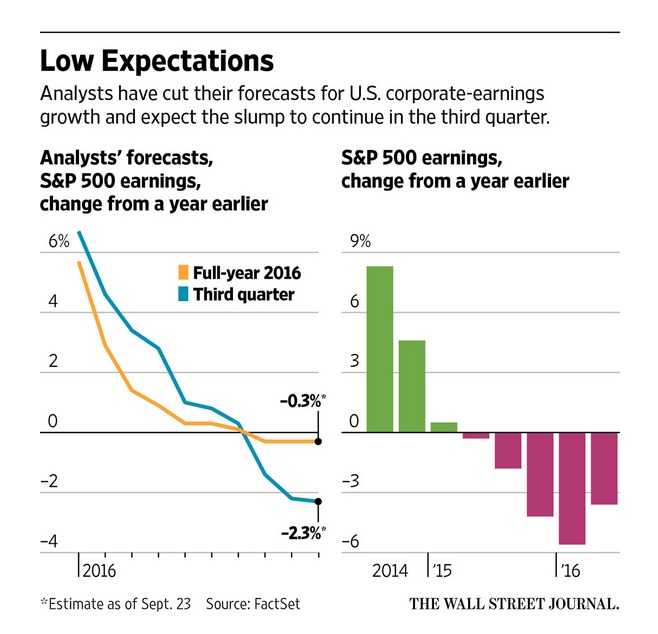

That said, sluggish corporate earnings and high valuations remain a cause for concern.

Should S&P 500 profits drop 1.4 percent in the July-September period as forecast, that would make the sixth straight quarterly retreat.

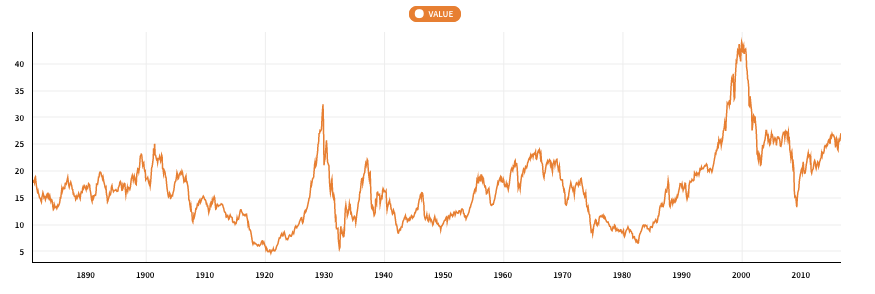

At the same time, the S&P 500 Index trailing price-to-earnings (P/E) ratio is clocking in at 24.81 as of September 23. That’s up about 20% over the year-ago level.

Or consider the Shiller P/E ratio for the S&P 500, based on average inflation-adjusted earnings from the previous 10 years.

That reading is hovering around 27. That’s 80% above the level in 2009 at the start of the current bull market.

Perma Bears

That’s why the prognosticators of doom just won’t go away.

Jim Rogers, who founded the Quantum Fund with George Soros, sees gut-wrenching declines ahead for the US stock market.

So does economist economist Andrew Smithers, who believes US stocks are overvalued by 80%.

Takeaway

Technical indicators such as the 50-day moving average show resilience in certain sectors such as technology and financials.

Yet valuations are lofty even as US earnings continue to decelerate.

The bears have been consistently wrong about the longevity of America’s long-running bull market.

Of course, they will be right someday. The trick for the discerning investor is figuring out when.

Photo Credit: Sam Valadi via Flickr Creative Commons