There’s a big disconnect in outlook between Wall Street money pros and individual investors.

As the third quarter of 2015 draws to a close, the S&P 500 Index is off about 6.2% on the year, while the Dow Jones Industrial Average is down 8.4% as of September 25.

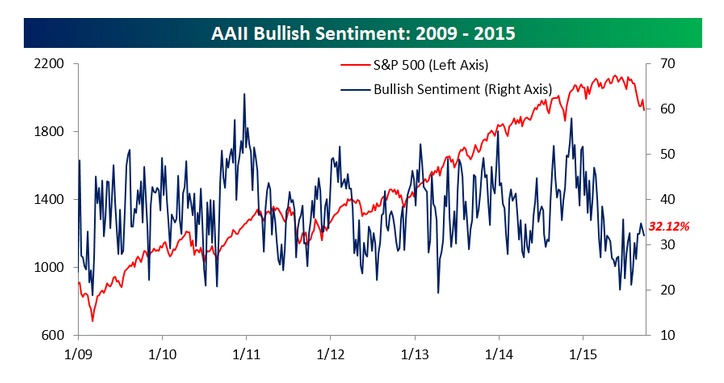

Retail investors are skittish after this summer’s market turmoil, in which the US stock market experienced its first 10%-plus correction since 2011.

Gloomy Investors

Only 32% of investors recently surveyed by American Association of Individual Investors (AAII) said they were bullish. That’s the 27th straight week that bullish sentiment has been below the overall average of the stock rally that began in March of 2009.

Sunny Analysts

On the flip side, Wall Street money pros see prices roaring back in the fourth quarter.

Strategists surveyed by Barron’s predict the S&P 500 index will finish the year at 2,150.

If so, that would be a roughly 11% gain from the S&P’s 1,931 close on September 25–implying a 5% gain for the year.

US Economy

Why so upbeat?

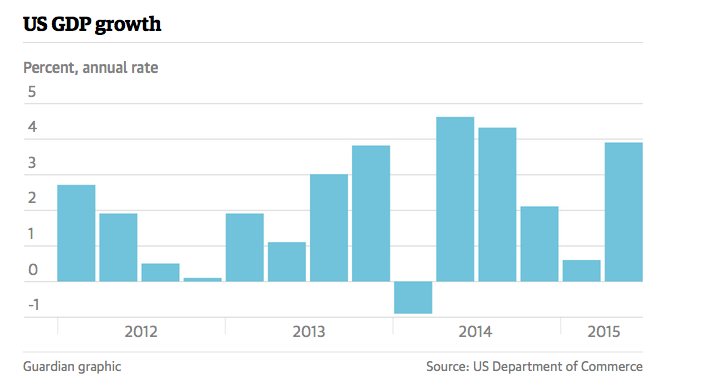

Optimists note the American economy remains a standout among Eurozone nations and Japan.

The US second quarter GDP number was recently revised up to an annualized growth rate of 3.9%.

On top of that, new home sales in the US are growing at the strongest pace since 2008.

Valuations

Stocks are more reasonably priced. The summer selloff has brought stock market valuations back down to earth.

The S&P 500 index, as of September 25, traded at 14.8 times estimated 2016 earnings.

That’s slightly below the long-term average of 15 and down from 16 to 17 times forward estimates earlier in the year, according to Barron’s.

Earnings

True, earnings are not spectacular.

Corporate profits are forecast to contract 6.5 percent, its biggest loss since the third quarter of 2009, according to data compiled by Bloomberg.

Yet analysts generally see earnings back on the growth track in 2016.

China Impact

Much of the global market turmoil has been tied to the economic slowdown in China and stock market routs in Shanghai and Shenzhen.

While this is bad news for Japan and other Asian economies, it’s not going to have a huge impact on the US economy.

Only 2% of the collective revenue from companies listed on the S&P 500 and 1% of total US exports come from China.

Stocks Versus Bonds

Finally, US stocks look pretty attractive to Treasuries, which will face headline risk should the Federal Reserve start to raise rates as expected later in the year.

The yield on the benchmark 10-year Treasury stood at 2.15% as of September 25.

By comparison, the dividend yield on Dow Industrial stocks is 2.63%.

Takeaway

After a rocky couple of months, Wall Street analysts see a rally pulling major US stock indices into positive territory in the last three months of 2015.

A robust US economy, rebounding housing market and expected earnings rebound in 2016 are powering the optimism.

China may be dragging down growth in Asia and parts of Europe, but the impact on the US will be negligible, the optimists argue. Here’s hoping the US stock market is the comeback kid in the fourth quarter.

Photo Credit: Jeffrey Beall via Flickr Creative Commons