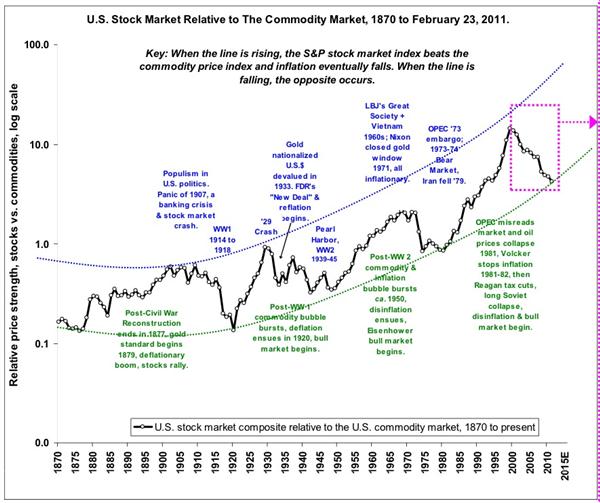

The U.S. economy continued to perform at a modest pace during July and capital markets held up in the face of global worries about Greece, China, emerging markets and commodity prices.

U.S. inflationary pressures continue to be muted, but employment is looking good.

In my opinion, however, slow wage growth may cause the “data-dependent” US Federal Reserve to re-think the start of its tightening cycle thought to begin later this year.

Choppy Markets

Volatility was again evident during July as global events triggered both despair and relief, while the S&P 500 Index trended close to its all-time high during the month.

The S&P 500 finished July with an uptrend ending a volatile month up 2.1%.

There continued to be significant dispersion of returns amongst industry sectors.

Emerging Market Slump

Commodity-sensitive sectors such as materials and energy struggled with weak returns. In contrast, the utilities sector rallied.

Broad emerging markets including China, Asia and Latin America were much weaker during the month. The broad MSCI Emerging Market Index struggled with its third straight month of negative returns.

Broad bonds were range-bound finishing up by slightly in July, while energy-related MLPs and high yield bonds lost ground.

Photo Credit: Day Donaldson via Flickr Creative Commons