Energy stocks have been mauled since the middle of 2014 when oil prices began their steep descent.

Since then, investors with heavy exposure to the energy sector have had reason to grimace when they’ve opened up their portfolio statements.

Survivors

For investors, the immediate challenge is to limit losses and reposition holdings to enjoy the bounce back when oil prices finally bottom.

After plummeting since last summer, the S&P 500 index of energy stocks has started to claw back some gains in recent trading sessions.

There are already signs that the global energy glut may be abating.

The money pros suggest focusing on energy companies that have moved quickly to lower production and costs, but also have huge cash piles to carry them through the tough times.

Mergers

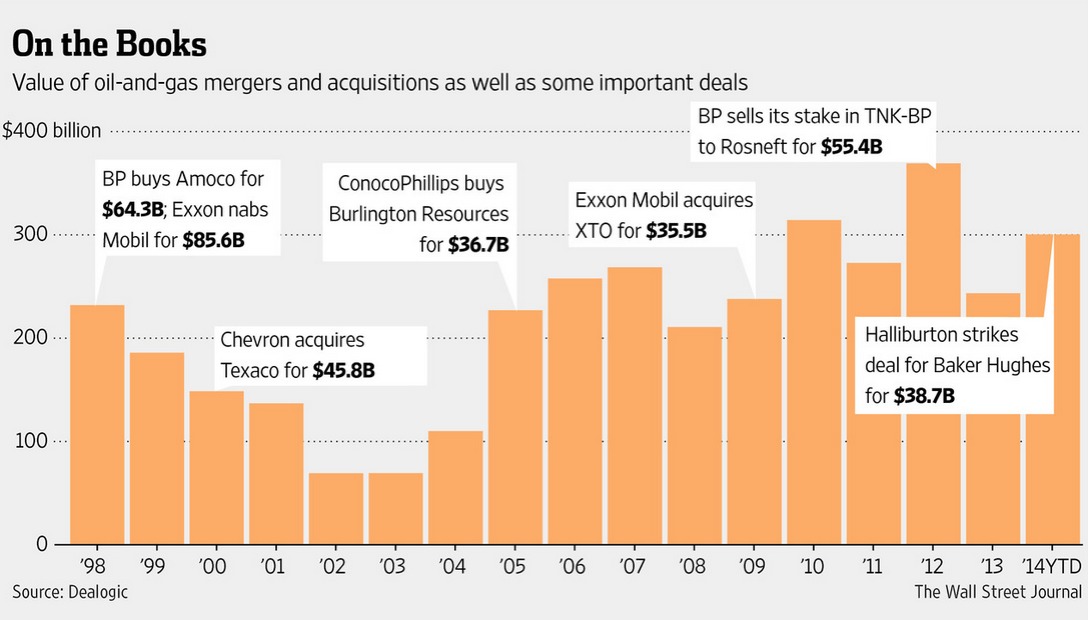

On top of that, history shows that when oil prices swoon, as they did in the late 90s and mid-2000s, energy industry merger and acquisition activity picks up.

Looking for possible acquisition candidates is another strategy to boost returns in a tough energy industry climate.

Halliburton (HAL), which just announced plans to cut up to 6,400 jobs, is expected to emerge from the current industry slump stronger.

Last November, it agreed to takeover Baker Hughes (BHI) for $34.6 billion in a move designed to increase its position in the oilfield services industry.

Shale plays

Another favorite is Schlumberger (SLB), which has a solid balance sheet and a record of share buybacks and dividend increases that delight investors, according to Split Rock Private Trading & Wealth Management which manages the North American Shale Energy portfolio .

The company is the ideal all-purpose shale play, according to Tyler Kocon with Split Rock.

The company offers many services and products including seismic graphing, drilling, characterization, completions, subsea, production, well intervention and well testing.

It also offers comprehensive worksite management solutions.

Scale Matters

Big, well-capitalized players such as Royal Dutch Shell (RYDAF), Chevron Corp. (CVX), and Norway’s Statoil (STOHF) have taken earnings hit but are diversified and have cash resources.

Covestor manager Yale Bock, who oversees the Long Term GARP and Concentrated GARP portfolios, continues to own BP Plc.(BP) in one of his portfolios.

“Sticking with the large integrated oil names is a safe way to own energy,” he noted in his monthly commentary.

Covestor manager Ben Dickey, cofounder of Texas-based registered investment adviser BSG&L who looks runs the Growth Plus Income portfolio, likes midstream energy sector stocks.

Such companies derive much of their revenue from fees through the pipelines and processing facilities and less directly hit by price swings in hydrocarbons.

One of these mid-stream plays is Enterprise Products Partners (EPD), which owns pipelines and processing plants

Takeaway

There’s no question these are tough times in the oil patch. Job cuts among energy companies worldwide have already reached about 100,000, according to one estimate.

Yet for many investors, the energy sector is too big to ignore. Supply will eventually align with demand and prices will firm up.

Nobody can say for sure when that might happen. But if you want to be well-positioned for the rebound, now might be a good time to recalibrate your portfolio and consider Big Oil plays or likely acquisition targets.

Photo Credit: Mike Mozart via Flickr Creative Commons

DISCLAIMER: The investments discussed are held in client accounts as of January 31, 2014. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.