FXCM is an online foreign exchange broker that suffered significant losses when the Swiss National Bank (SNB) unexpectedly removed a cap on the value of the Swiss Franc, leaving many of its highly leveraged customers with negative equity balances.

It’s also the newest short position in the Hedged Value portfolio.

I was not among the prescient short sellers who identified the risks in FXCM’s (FXCM) business model ahead of time.

Leucadia

However, I may be among the relatively few investors who have bothered to read the details of the rescue package provided by its acquirer Leucadia National Corp.

In exchange for a $300 million loan, FXCM provided Leucadia with priority claims on a NewCo, a newly-formed wholly-owned subsidiary, that now holds substantially all of its assets.

Leucadia has the right to force asset sales and receives cash proceeds according to a waterfall schedule that effectively makes FXCM shareholders minority partners in their own business.

Enterprise Value

Leucadia and convertible bondholders receive the first $650 million in proceeds; FXCM shareholders are entitled to only 10% of the next half billion and 40% thereafter.

In my opinion, only a rebound in enterprise value to all-time highs before the SNB decision would come close to justifying the current share price of $2.33.

By my estimates, the valuation implied by media reports of proposed disposals (and market prices as recently as August) suggests a fair value below $1 per share.

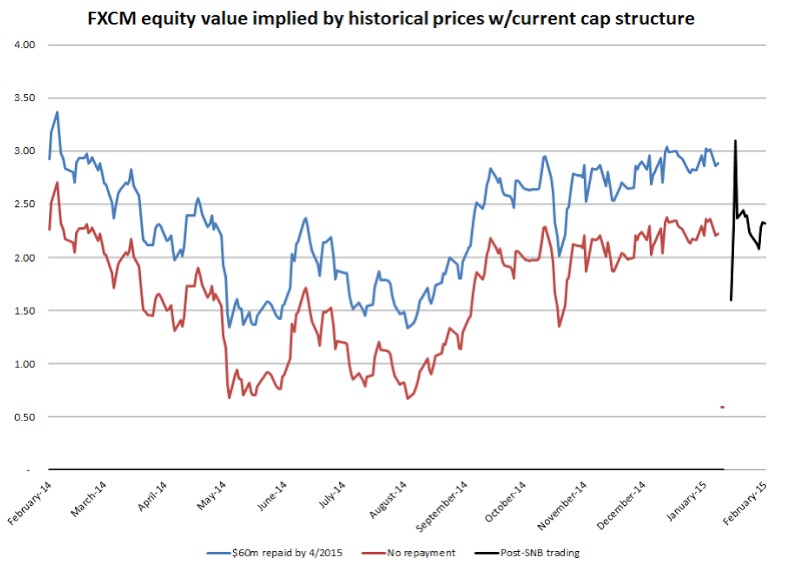

Since it appears some traders are still anchoring on FXCM’s historical share price in the mid-teens, I put together a quick-and-dirty analysis that re-calculates historical prices in terms of the new, post-bailout capital structure.

Adjusted valuation

The trailing twelve-month price chart below has been rebased to show the remaining per-share equity value after repayments to convertible bondholders and Leucadia, according to the waterfall schedule in the credit agreement.

The difference between the red and blue lines is the point at which FXCM equity holders begin receiving 40% of any remaining enterprise value, which will be a function of the amount of debt repaid through asset sales over the next two months.

For simplicity, I used a constant share count of 81.9 million shares including Holdings units, and I assumed that the resulting market cap (price times share count) was equal to the historical enterprise value (net debt assumed zero).

This is inexact given changes in excess capital and draws on the previous line of credit, but it is approximately correct. Both assumptions err on the side of increasing enterprise value, to be generous, because the share count increased during the period and net debt (convertible + credit line – excess capital) was negative.

Takeaway

The question for investors going forward—and the reason I am short—is whether FXCM deserves the nearly $200 million in market equity value it maintains—in line with or even above its implied post-Leucadia valuation just before the SNB action.

No matter how much of the $225 million in negative customer equity is ultimately absorbed by the firm—amounts which should ultimately reduce equity recovery—the entire enterprise value has surely been reduced by the prospect of a fire sale of the institutional business, previously a key growth driver; reputational damage due to the controversial decision to pursue recovery of some negative balances; and loss of trading revenue due to increased margin requirements and the loss of at least 25% of customer equity balances.

In my view, it is hard to imagine that the company’s operating business will be entirely unaffected by the negative publicity. The brokerage business requires trust, and despite clear and omnipresent marketing materials promising that margin loans were non-recourse, FXCM is attempting to recover 60% of the client account deficits caused by the SNB move.

Legal fight?

The decision smacks of desperation and is likely to result in a protracted legal fight, in my opinion. At the very least, it may slow account growth or encourage customer defections.

There are already early indications that trading volume on FXCM platform and customer equity have declined sharply in the past few weeks. Should additional customers decide to defect to competitors or trading volumes remain depressed, there is a near-term risk of insolvency.

Even if FXCM manages to muddle through, the imposition of $33 million in incremental annual interest costs significantly reduces the company’s ability to implement its strategy and its attendant equity value.

As the exceptional costs and ongoing operational fallout of the SNB decision become clear, I expect little to no equity earnings in the medium term, especially if FXCM is forced to sell off profitable business units to meet the Leucadia financing constraints.

Photo Credit: Martin Abegglen via Flickr Creative Commons

DISCLAIMER: The investments discussed are held in client accounts as of January 31, 2014. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.