What could the NFL possibly teach investors?

It’s not as crazy as it seems. There are some common threads between running a championship-caliber football team and managing a high-performing portfolio.

So ahead of the NFL’s Championship Sunday (Packers Vs. Seahawks; Patriots Vs. Colts) let’s draw some inspiration from the most popular U.S. sports league for 30 years running.

Stats Matter

The most successful franchises size up their team’s and individual player’s performance with rigorous data analysis.

You should expect no less from your financial adviser.

Don’t just look at the overall return of your portfolio and how it compares with a particular benchmark. That’s just the beginning.

If you really want to know how your portfolio is performing, ask your manager about its alpha.

This is a measure of an investment’s risk-adjusted performance compared to a benchmark, such as the S&P 500.

It will give you a better true indication of what a portfolio manager actually brings to the party. In a rising market, it shows whether your financial adviser is outperforming the broader market or just going along for the ride.

How much risk did he or she use to get there?

Other statistical measures worth familiarizing yourself with include the Sharpe Ratio and standard deviation.

If you don’t study the game films, it’s hard to spot the weak performers.

Transparency

The best NFL team general managers, who recruit and negotiate player’s contracts, demand transparency.

Performance goals and expectations are clearly defined. Players and coaching staff know exactly what marks they need to hit to land those big bonuses.

You miss agreed-upon targets and there are consequences.

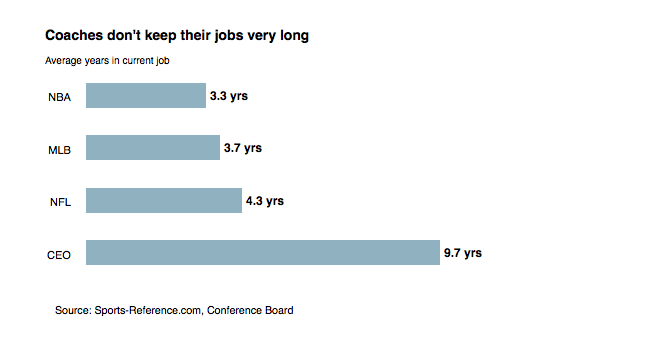

Ever wonder why the average tenure of an NFL coach is about 4 years (it’s even worse for the NBA and Major League Baseball) compared to 10 years for your typical CEO?

A financial adviser should be no different. If he or she, has a record of underperformance or is less than open about fees and commissions it’s time for a serious talk.

Audibles

The best quarterbacks can walk up to the line of scrimmage, read the defense and adjust their play nimbly for maximum yardage gain.

That doesn’t mean you dump the entire game plan of course. It does mean that as conditions change, so should your short-term strategy.

Actively managed portfolios have long-term strategic aims tied to economic assumptions, risk tolerance and asset allocation.

Yet when opportunities (or risks) arise, managers aren’t shy about taking losses, or doubling down, if that is where their analysis takes them.

Player trades

When the season is over, the top management at NFL teams size up their talent and try to make dispassionate personnel decisions.

Weaker performers are let go. Mid-career players are evaluated and sometimes traded for more promising alternatives. Franchise players are valued.

The stocks, bonds and investment vehicles in your portfolio should be treated the same way.

Think of portfolio rebalancing as your opportunity improve the lineup, bring in fresh legs and build a strong team in the long run.

Takeaway

Successful investing requires a long-term view and a certain amount of discipline. These are the same traits that define a NFL Super Bowl champ as well.

Investing, like football, can be a game of inches.

The most successful portfolios are built on best practices and a clear strategic vision even in the face of changing market conditions and uncertainty.

And the winners are often in it for the love of the game.

Continued Learning: Risk adjusted return 101: What it is, and why you should care

Disclaimer: All investments involve risk and various investment strategies will not always be profitable. No investment strategy, including asset allocation or diversification, can guarantee a profit or protect against a loss. Past performance does not guarantee future results.