For new graduates, it’s a time of celebration and high expectations about the future. And for many, it’s also the beginning of a new challenge many are unprepared for — paying off student loan debt.

The Class of 2014 is saddled with record student loan debt, with college graduates on average facing more than $30,000 of debt.

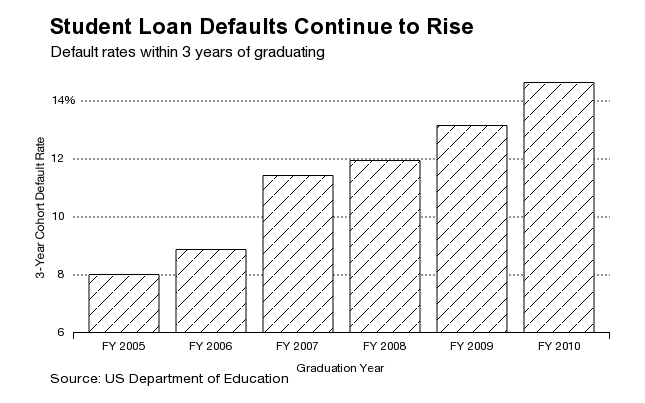

Unfortunately, a growing percentage of young Americans aren’t up to the task. Default rates are steadily rising and have eclipsed the 14% mark.

Things are so bad that President Obama recently signed an executive order expanding the number of students eligible to cap their payments at 10% of their monthly income.

Managing student loan debt is doable, but takes some preparation and careful thought, according to the experts. The Department of Education offers a variety of repayment plans and choosing the right is key.

The DOE has an online repayment calculator to help younger Americans figure out their student loan debt load and different repayment plans available for federal loans such as Stafford Loans and PLUS loans.

The standard 10-year repayment plan requires payments of at least $50 a month, though students should generally expect to pay $125 per month for every $10,000 borrowed. Payments are fixed for up to ten years, although payments on variable interest rate loans may increase or decrease over the life of the loan.

If students have the financial wherewithal (or their parents do), another option is accelerated repayments. Good news: There are no prepayment penalties for student loans. Stepping up your payments will save you a lot of money on interest payments.

That isn’t always an option for students who have part-time jobs or relatively low entry level salaries. So students should also explore Income-Based Repayment (IBR) or Income-Contingent Repayment (ICR) to help manage the burden.

IBR and ICR plans base your monthly payment amount on your income and can be capped as low as 10% of one’s income, depending on the borrower’s eligibility.

Getting help

Whatever plan you choose, sticking to it takes some discipline. Student loan experts suggest the following: Keep track of your balance and interest rate and understand the grace period after graduation required before payments begin.

If you get into trouble, don’t panic and reach out to your lender and find a good credit counselor to get you back on track. Some borrowers might be able to arrange a deferment to temporarily postpone payments if you have a temporary disability or become unemployed.

In some extreme cases, loans can be forgiven in full if the borrower dies, is permanently disabled or was defrauded by a trade school. Bankruptcy, however, usually isn’t an option in Chapter 7 filings and judges will rarely discharge student loans, though it can be an option to temporarily end collection actions and wage garnishments.

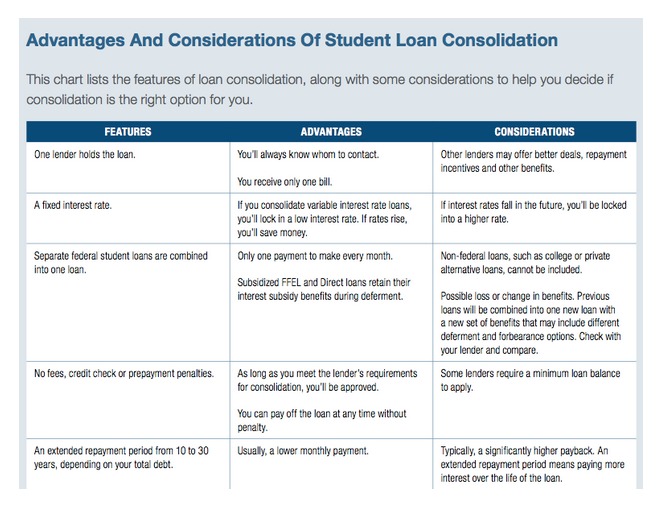

A better strategy is to get in touch with your lender and work out a repayment plan or apply with the federal government for a consolidated loan plan that, in some cases, can save you money, though there are trade-offs that need to be considered.

Managing student loan debt can be a tall order but it’s also crash course in personal finance. Look on the bright side: The lessons one learns here will come in handy later in life as the financial challenges become even more complex.

For more on Covestor’s services, visit Covestor.com or try a free trial.

Photo credit: Will Folsom via Flickr Creative Commons