The Nasdaq Composite was down nearly 100 points on Thursday afternoon and a lack of market-moving news has some observers blaming the recent weakness in U.S. stocks on the looming April 15 tax deadline.

“The need for investors to raise cash in 2014 to pay substantial capital gains, or taxable income from the sale of investments held longer than a year, has added to selling pressure ahead of the April 15 deadline to file tax returns,” the MoneyBeat blog reports.

Some investors may be unloading stocks to generate cash since they’re facing higher tax bill due to a more than 30% gain for the S&P 500 last year, and increasing taxes.

The theory is that this selling may be at least partly responsible for recent turbulence in the market.

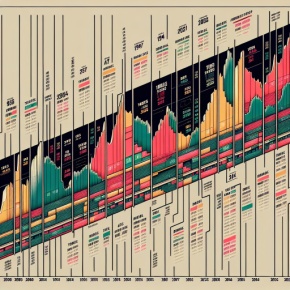

Blogger Ryan Detrick notes that going back four decades, U.S. stocks tend to see some jitters before the April 15 deadline, although the trend for the second half of the month is higher on average.

WSJ.com’s MarketBeat adds that history shows the pre-deadline weakness in U.S. stocks tends to be more pronounced following a big up year for the S&P 500.

Of course, investors shouldn’t rely too much on history. Just because something happened in the past, it doesn’t mean history will repeat.

“These types of seasonal influences are tertiary at best, but it does suggest a very slight headwind, if anything for stocks in the coming days,” said Jason Goepfert, founder of Sundial Capital Research, in the MarketBeat post.

Paying taxes is painful enough, so investors are hoping the U.S. stock market will get back on track after April 15.

Photo credit: eFile989 via Flickr Creative Commons.

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. Neither Covestor Limited nor its representatives are engaged in rendering tax, accounting or legal advice. A qualified professional should be consulted regarding the effect of such considerations on the matters covered in this article. Past performance is no guarantee of future results.