As I mentioned at the start of 2013, last year marked the beginning of multi-year secular bull market phase. Because of the expected strong 2013 Q4 corporate earnings growth, the equity market ended at all time highwith the S&P 500 Index (SPX) delivering a total return of 32.39% for the year

Most of my Covestor portfolios took advantage of the opportunity to outperform S&P 500 in 2013. The top performing Midcap/Smallcap value model Opportunistic Value and large cap growth model Focus Growth delivered 61.9% and 54% net of advisory fees, respectively.

2014 Investment Outlook

Bond: The 30 plus years of bond bull market is over, and I remain bearish on bonds. In my opinion, the bond market will to stay in volatile trading range for a while. It is a place for fast traders, not fixed income investors.

Real Estate: Historically, the U.S. Federal Reserve’s stimulative policies have always ended up with either a bear market or a crisis. Liquidity becomes increasingly important for investors who need the option to push a button to sell everything when the inevitable crisis or bear market hits. As the Fed starts winding down its quantitative easing program and interest rates start to rise, I will be be wary of real estate assets.

Equity: Overall equity earning growth will be moderated to around 10% in 2014, so I don’t expect equity market to have a banner year like 2013. Even so, in my opinion, the equity market is still the place to be comparing with other asset classes.

In addition, don’t underestimate the impact of falling commodity prices and the ample supplies of cheap clean/fossil energy for the next 5 years, which could potentially provide upside surprise to equity market. I will continue to take advantage of what equity market has to offer before the music stops.

Based on most of my economic models, the equity market is fairly valued in my opinion and global economies will continue their recovery. I have no way of knowing for sure, but I don’t believe there is bear market in sight for the next 6 to 9 months.

I’m having a harder time finding mis-priced stocks to trade. Therefore, my portfolios are more invested in cash.

Even with 10 to 20 years of secular equity bull market, there will be large corrections and bear markets in-between, so investors should not jump in with both feet now.

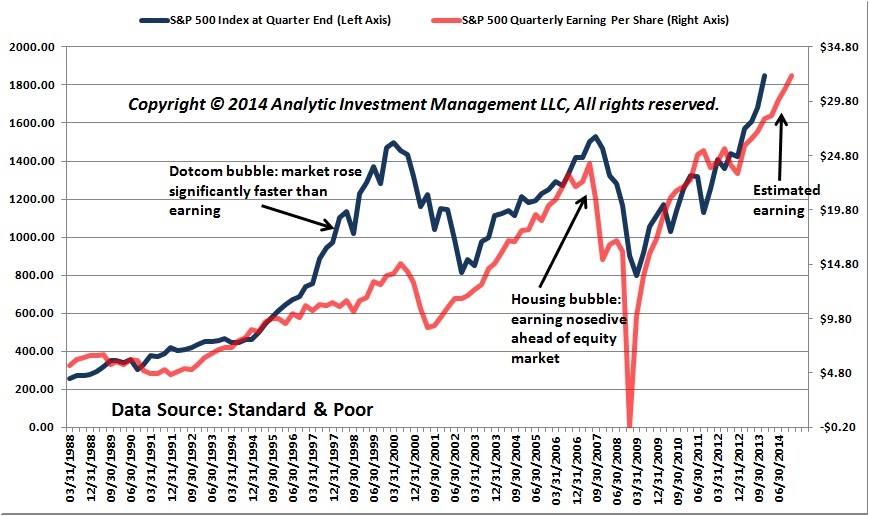

From the following chart, we can see equity market growth (black line) is slightly ahead of earning growth (red line), and we probably will see corrections within the first 2 months of 2014. These corrections are healthy for long term growth of the market and present better entry points for investors to increase equity allocation.

Disclaimer: Certain information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The manager believes that such statements, information and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions. Past performance does not guarantee future results.