The once-enshrined investing maxim that there’s no high reward without high risk is getting a serious rethink these days from both finance academics and stock market investors. As I noted earlier this month, the conventional wisdom that volatility creates attractive investing opportunities isn’t always the case if you examine the historical data.

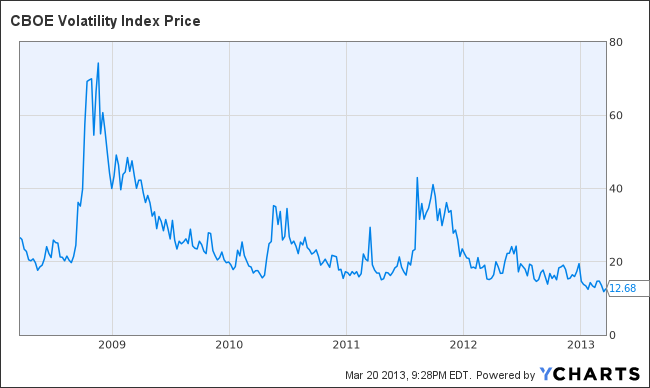

According to a report (.pdf) by Wells Capital Management published last month, the market has seen long stretches– between 1992 and 1996, or between 2003 and 2007—when stocks performed well yet volatility was relatively low. Right now, we are in one of these relative periods of calm:

Back in 2011, Brendan Bradley of Acadian Asset Management, along with Harvard’s Malcolm Baker and NYU’s Jeffrey Wurgler, published a widely cited study in the Financial Analysts Journal on the returns of low-volatility stocks. (Here’s a direct link to the study.)

According to their research, the least-volatile quintile of the 1,000 biggest stocks in the U.S. returned 10.2% annually from 1968 to 2010. In contrast, the most-volatile quintile gained just 6.6%.

In October, Tadas Viskanta at Abnormal Returns took note of the growing popularity of low volatility trading strategies and the ‘low volatility anomaly’ that seemed to be boosting their performance.

In a piece out today, Bloomberg points to the remarkable success of the PowerShares S&P 500 Low Volatility Portfolio (SPLV), which is designed for protection from stock market swings. Since its debut nearly two years ago (May 5, 2011), the exchange-traded fund has gained 30 percent vs. 21 percent for the S&P 500 Index. It has attracted $4.1 billion in assets.

Of course, traders with a short-term horizon still love stocks that display big daily moves. And Bespoke Investment Group late month published this useful list of S&P 1500 with the biggest intra-day trading ranges so far in 2013. They include 3D Systems (DDD), JC Penney (JCP), Netflix (NFLX) and Geospace Technologies (GEOS).

If you are intrigued by volatility-based trading strategies, check out:

- LakeView’s High Dividend, Low Volatility model, which holds stocks and ETFs that produce above-market average dividends while exhibiting below-market average volatility. Its current indicative yield is 4.72% (as of 3/20/13, data from Bloomberg).

- Robert Zingale’s Covestor Volatility Mean Reversion model. In his latest commentary, Robert outlines his trading strategy should the market become more choppy in the months ahead.

Photo: Gabriella Camerotti