The Bureau of Labor Statistics reports that US inflation is relatively moderate, with the latest reading showing a 1.7% increase in the year-over-year Consumer Price Index (CPI). The Federal Reserve continues to flood the economy with freshly printed currency in an effort to jumpstart employment.

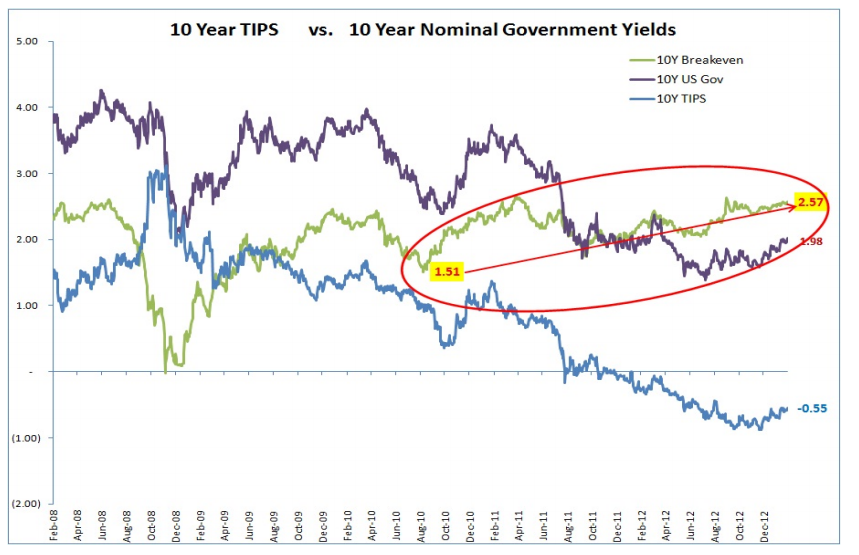

The Fed does so under the firm belief that inflation is not a concern; they are still more concerned about deflation. So if inflation worries are so benign, why does the market continue to bid up the price of Treasury Inflation Protected Securities (TIPs)? Why do breakeven yields between TIPs and nominal US Treasuries continue to expand? (See chart below.)

(For a quick refresher on Inflation Protected Securities and breakeven yields, please refer to our earlier writings found on our website.)

In the example above, an investor would need an average annual inflation rate of 2.57% for their 10-year TIP investment to do as well as a basic 10-year Treasury. Two things grasp us as significant when analyzing the graph. First, breakeven yields on 10 year securities have risen from 1.51% to the current 2.57% in the last 2 1/2 years, while inflation has not been a concern.

Second, investors are increasingly willing to accept negative nominal yields on 10-year TIPs in exchange for locking in inflation protection for the next 10 years. We believe the market is simply stating that while current inflation is low, it has a good chance of rising over the next 10 years.

Additionally, the market is not too confident that policy makers, both fiscal and central bank (monetary), have the skills to manage a future economy addicted to fiscal and monetary regimes that are historically unprecedented.