With the presidential debates over and both President Obama and GOP candidate Mitt Romney sprinting across the swing states to make their closing arguments, it’s time to start thinking about what sort of portfolio makes sense heading into 2013.

The candidates appear very far apart – at least in their rhetoric – on spending priorities and tax policy. Which candidate will create the better market climate?

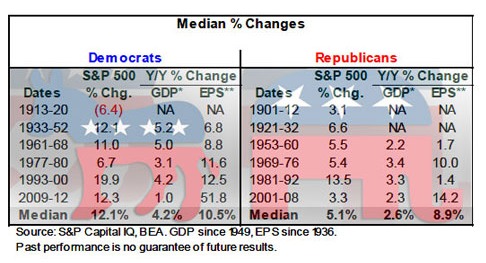

Research firm S&P Capital IQ recently crunched the numbers and examined stock market performance, corporate earnings and GDP growth back to 1901. Matt Egan at Fox Business has their data.

Though the Republicans are generally perceived as better stewards of the economy and business interests, the historical record suggests otherwise. S&P data shows that the stock market rallied an average of 12.1% per year since 1901 during Democratic administrations, versus just 5.1% for the GOP.

Also, when the Democrats controlled the White House, GDP increased 4.2% each year since 1949; Republicans, only 2.6%. Corporate earnings also grew more briskly in the years Democrats ran the executive branch.

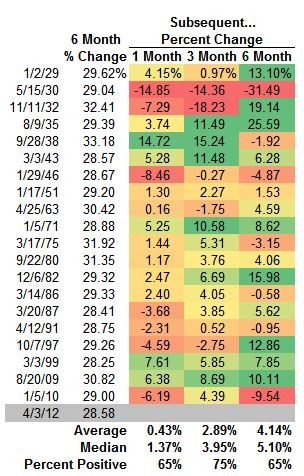

Another historical study by Bloomberg Government also concluded that stock investors do far better under Democratic administrations. The BGOV researchers imagined investing $1,000 in a hypothetical fund that tracked the S&P 500 only when Democratic Presidents called the shots starting with the Kennedy administration.

That stake would have been worth $10,920 as of early February. “A $1,000 stake invested in a fund that followed the S&P 500 under Republican presidents, starting with Richard Nixon would have grown to $2,087 on the day George W. Bush left office,” the study noted.

Skeptics say such studies are fun to ponder but aren’t reliable guides to the future. And they’re right. USA Today’s Adam Shell talked to money pros about how best to ready post-election portfolios depending on whether President Obama or Gov. Romney prevails. His piece is definitely worth reading in full, but here’s a quick summary:

Romney Plays: banks, defense contractors, luxury goods, coal, and energy companies.

Obama Plays: hospitals, infrastructure, alternative energy, home builders, and muni bonds.