by Michael Tarsala, CMT

Stocks are near five-year highs. Market breadth has improved greatly. Still, there’s one group that is looking green around the gills:

Utilities.

Up until a few months ago, utilities had been one of the top-performing stock sectors in 2012. The group became popular as a yield alternative to bonds, and also as a way to invest in stocks that were not tied to cyclical economic trends. As a result, utility stocks in June were more expensive based on price-to-earnings ratios than technology stocks.

Yet the markets are now embracing a risk-on trade in multiple asset classes. As a result, more investors appear to be turning away from the defensive utility group.

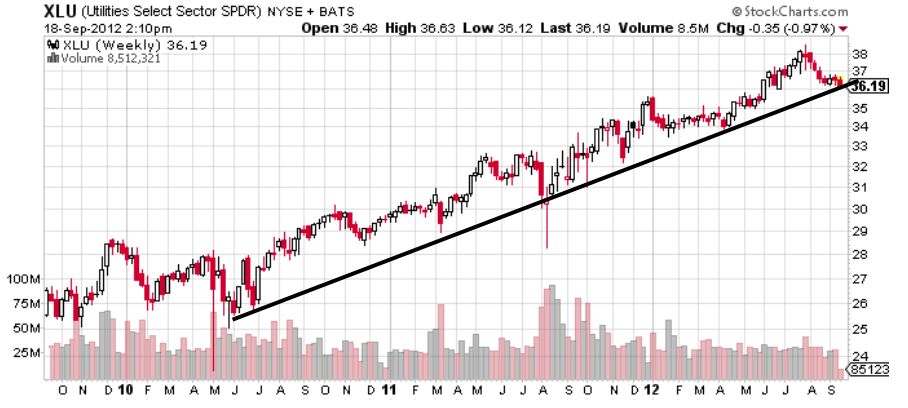

Source: Stockcharts.com

Above is a chart of the Utilities Select Sector SPDR, (XLU) the main utilities ETF. You can see that the group’s uptrend is still intact, although the ETF is now testing its cross-trendline. A breakdown is possible as early as this week.

Source: Stockcharts.com

Another chart to check out is the XLU, relative to the S&P 500 Index. In this chart above, you can see that the XLU began to underperform the benchmark index in July, and has been sliding relative to it for several months now. Its underperformance continues.

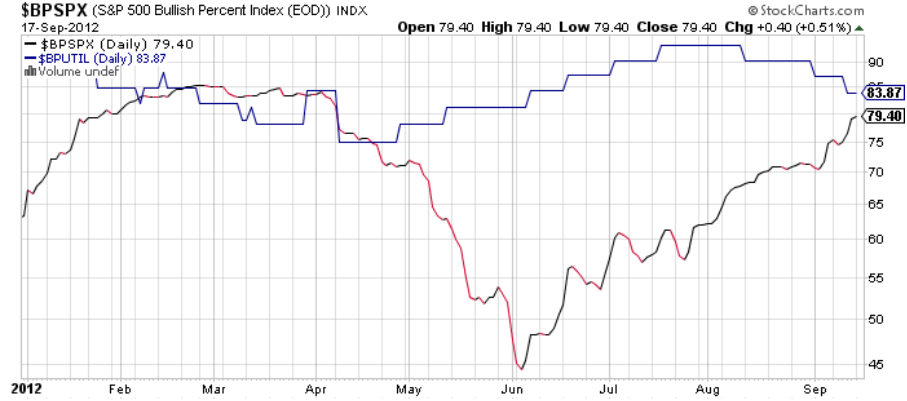

Source: Stockcharts.com

Finally, let’s take a look at the percentage of “buy” signals based on the Point and Figure charting method. The line in blue is the percentage of utility stocks with a “buy” signal. The line in red and black is the percentage of S&P 500 stocks with the same buy signal. What you see is that the number of utility buys is shrinking, while the number of S&P 500 buys continues to improve.

Put it together, and it makes sense to at least be on the lookout for a possible breakdown in the utility stocks.