by Michael Tarsala, CMT

It’s a “risk-on” market right now with the S&P 500 near four-year highs and several market indices showing growing investor willingness to take on risk.

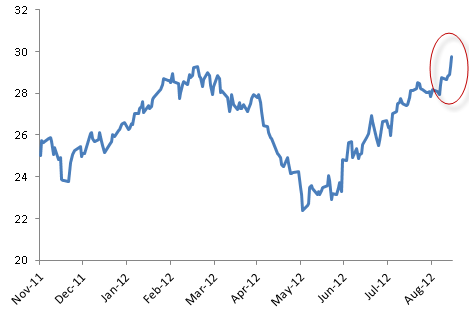

The Fisher-Gartman Risk Index is one such indicator. It’s a mix of both long and short positions. It is designed to rise when investors are broadly willing to make risky bets, and to fall when they are not. It includes large exposures to global stocks, oil and the euro.

The blog Sober Look posted the latest index chart: The peak above the February highs suggests that the risk-on mentality is the highest so far this year.

Source: SoberLook.com

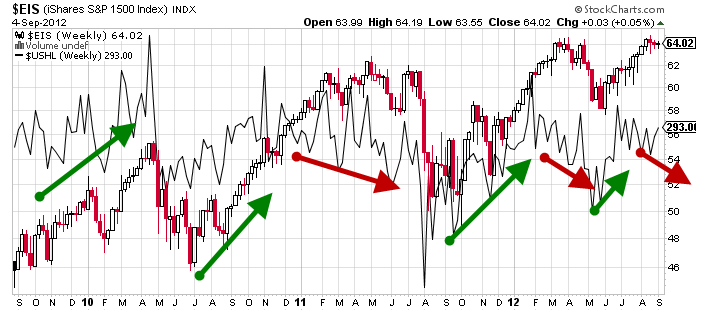

Another risk-on index with a longer track record is the Citi Macro Risk Index. It uses credit spreads, foreign exchange and equity volatility to measure global risk levels. A reading of zero represents very low risk aversion. A reading of one indicates extreme risk aversion.

As the chart below suggests, there was near-complete risk aversion this time last year. It’s now at its lowest point since early 2010.

Source: SoberLook.com

Both charts can be a good sign for bullish equity investors. It shows that stocks are not the only asset class that global investors are buying right now, and helps to validate the trend higher for stocks.