Two reports released last week indicate that hedge funds in aggregate are performing very poorly so far in 2012. This comes on the heels of 2011’s ‘year of horrors’ for the hedge fund industry.

The latest reading from Bank of America Merrill Lynch’s investible hedge fund composite index finds that hedge funds are up just 1.85% so far in 2012, while the S&P 500 has rallied to gain nearly 12% over the same period. A separate tally from Goldman Sachs shows that the average hedge fund is up 4.6% so far in 2012, and that only 11% of the hedge funds it tracks have beaten a low cost S&P 500 index fund.

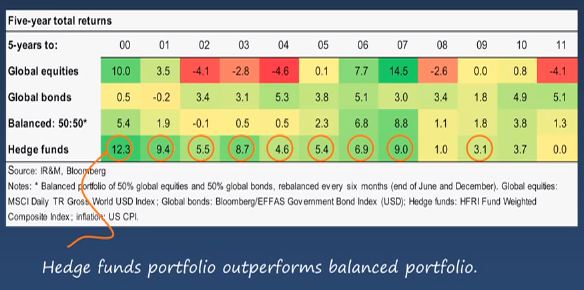

To go back a bit further, take a look at this table from Alexander Ineichen, which shows how hedge funds (as measured by the HFRI Fund Weighted Composite Index) performed against global stocks, global bonds and a hypothetical balanced 50/50 stocks/bonds portfolio since 2000. Note these are five-year total returns leading up to the dates indicated:

You can see that hedge funds enjoyed some very strong years from 1996-2007, until the financial crisis hit, and it’s been tough going since.

If 2012 registers as another losing year – the third straight versus a balanced index portfolio since 2010 – will high net worth individuals and institutions begin a massive withdrawal of hedge funds assets? Has that process already begun?

Ineichen, for one, argues in this interesting interview with Opalesque that certain hedge funds remain a sound choice due to the active risk management they employ:

The qualitative aspect – the investment case for hedge funds – hasn’t gone away, it’s still there… at the end of the day, all investors are interested in absolute returns… and the hedge fund industry is the only part of the asset management industry that is involved in what I like to call active risk management.

But if this generally poor performance continues across the industry, the memories of the good years will fade and it’ll be much more difficult for the hedgies to justify their high fees and liquidity limitations. And when even John Paulson hits an extended losing streak, it becomes harder to make the claim that particular managers are consistently superior from the pack.

Despite Ineichen’s claim, there are now other ways for investors to obtain active risk management – often at lower cost and far greater transparency.