by Michael Tarsala

Financial advisor and technical analyst JC Parets mounted a rare defense for sliding shares of U.S. Steel ahead of earnings scheduled for Tuesday morning.

He appeared as part of a three-person panel on Bloomberg TV analyzing the stock.

Steel stocks are not loved at all, and especially not U.S. Steel, down about 70% from last year’s highs, amid a global building slowdown.

On fundamentals, Mark Parr at Keybank Capital Markets said that he doesn’t think U.S. Steel can get going to the upside without improved demand from China, until steel prices start moving higher, and a turnaround for the strong U.S. dollar, which continues to crimp sales for U.S. multinationals that convert revenue from weaker currencies.

On options, analyst Andrew Keene at KeeneontheMarket.com said that U.S. Steel’s at-the-money straddle for the stock implies a move to either $18 or $20 – roughly a 6.5% move. Yet he is inclined to think the stock will see $18 first, mainly because, “weak stocks get weaker.”

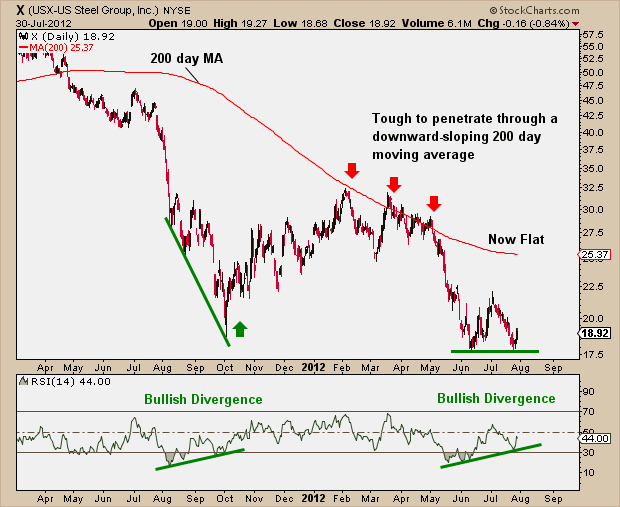

On technicals, JC Parent sees potential upside. Parets notes that the stock is down 90% from the 2008 highs. Still, he says $18 is a strong support level, offering good risk-reward. He notes that the 200-day moving average is now rising, and that he sees some signs of rising momentum.

Source: AllStarCharts.com

Each of the three analysts had a very plausible take on what could unfold for the company and why (I hope Bloomberg takes up this fomat more often). It’s hard to ignore that macro forces remain to the downside, so U.S. Steel may not be a quick turnaround story. Yet there is reason to think the stock is indeed technically oversold.

One potential scenario on disappointing earnings is that the stock could then be sent down to the $18 support that Parets mentions. Perhaps the stock could then see a decent bounce, with help from potentially higher scrap steel prices in August and perhaps better pricing for some integrated suppliers.