by Michael Tarsala

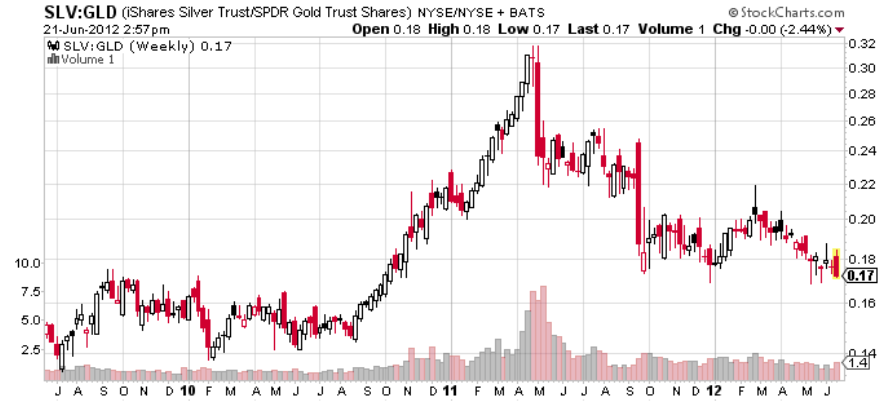

Silver took a dive in this week’s trading, and it may be saying something about economic expectations.

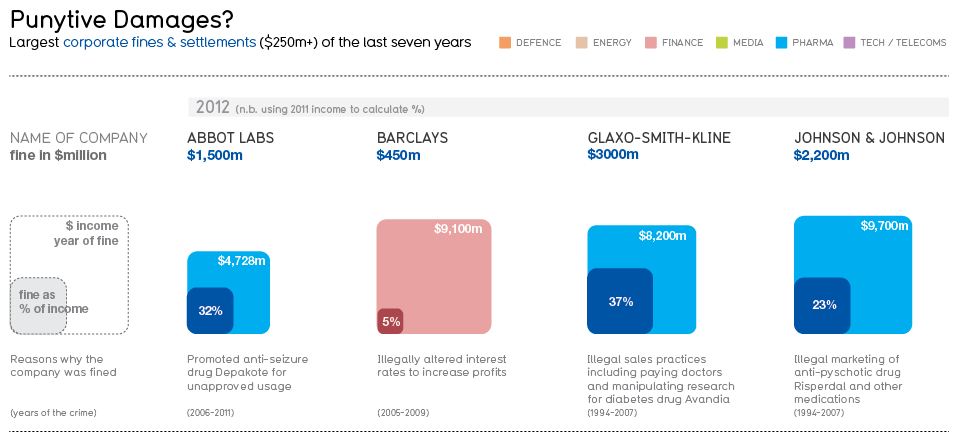

Check out this chart:

Source: Stockcharts.com

It’s a look at the silver ETF (SLV) relative to the gold ETF (GLD). It’s a chart that’s watched carefully by market strategists.

It’s only one tool at their disposal among many. But when economic expectations are strong, silver tends to outperform gold.

And when they are weak, gold tends to outperform.

You can see, the silver-gold chart has mostly moved sideways since October.

What’s interesting, though, is that the weekly closing price may be starting to break lower from that sideways movement — possibly reflecting expectations for an economic slowdown.

And silver on its own is showing similar breakdown potential.

Source: Stockcharts.com

We will have to see how it closes this week, but there’s a chance it could break support at the December weekly close.

I”m not the only one taking note of this chart, by the way.

Mike Arold, manager of the Technical Swing model, says he just shorted the SLV this week, and sees more potential weakness ahead.

“Not only is silver underperforming gold, it didn’t even benefit from the recent dollar weakness,” Arold said. “I think it’s in a very technically difficult position.”

Read this post from Arold for more thoughts specifically about silver.

If he’s right on his silver bet, it’s not a good sign for the economy.