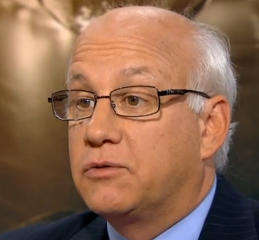

Scott Rothbort is the founder and portfolio manager of LakeView Asset Management, a Milburn, NJ based registered investment adviser. LakeView has just launched a new Covestor model: Restaurant and Food Chain

Scott Rothbort is the founder and portfolio manager of LakeView Asset Management, a Milburn, NJ based registered investment adviser. LakeView has just launched a new Covestor model: Restaurant and Food Chain

We recently had a chance to ask Scott a few questions about LakeView’s new model.

Covestor: What’s the macro theme you’re hoping to capture with your new Food & Restaurants model? And what are the major trends you see within that theme?

Scott: The theme we operate under is the “Need to Feed.” Human beings require food to survive. Without eating we won’t get the required nourishment to exist. We can do without cars, cell phones, jewelry, television, books and even oil. However, food is the basic necessity of life. The world population is growing at a rapid pace. It is currently estimated that there are 7 billion mouths to feed on Planet Earth. By 2020, just 8 years away, that population will grow to about 7.6 billion.

Covestor: The model covers everything within the “farming, preparation, production, delivery, sale, marketing and consumption of food, beverages and agricultural products” – so this includes everything from a fertilizer producer to a hamburger chain? That’s not too broad?

Scott: No, we believe these subsectors are not too broad at all. Getting food to one’s table, whether at home or in a restaurant is a huge endeavor. Taken together, through what we call the “Food Chain,” everything from the farm to your mouth is vital to feeding the world.

Let me put it another way. If you are a technology portfolio manager, would you only concentrate on computers? You would not. Anything having to do with computerization – semiconductors, disk drives, peripherals, glass screens, networking equipment and software – are all part of your mandate. Technology investors have their Cisco (CSCO) and I have my Sysco (SYY). So, everything from the farm to your mouth is the right approach to the sector we cover in this portfolio offered at Covestor.

Covestor: What is your specific expertise with this sector?

Scott: For ten years LakeView Asset Management LLC has actively managed portfolios which include or specifically target stocks in the “Food Chain.” I written about this sector extensively over those years for my blog, The Finance Professor, Wall Street All-Stars, Seeking Alpha and The Street.com. I frequently appear on television and radio such as Bloomberg and CNBC to discuss this sector. Finally, I am the CEO of my own restaurant – which certainly adds to my knowledge of the sector.

Covestor: How does your model differ from other options available to investors in ETF or mutual fund form?

Scott: There is one generic ETF in the marketplace for food and beverage stocks, the PowerShares Food & Beverage ETF (PBJ). This ETF, like many such offerings, is a static portfolio, is not managed actively and is quite illiquid. To my knowledge, there is no actively managed mutual fund in this sector. Thus, LakeView Asset Management, LLC has filled for investors what we believe is a huge void in the market.

Covestor: How does your Covestor model differ from the one mentioned here on your site?

Scott: It differs in many ways. We have specifically designed for Covestor a long-only stock portfolio which limits stock selection to companies with market capitalization of at least $100,000,000. The portfolios that we normally manage at LakeView Asset Management, LLC are both long and short, can at times actively trade stock and options and do not have market capitalization limitations.

Covestor: Thanks for the overview, Scott.

Scott: My pleasure.

Photo: Bruce Tuten