By Michael Tarsala

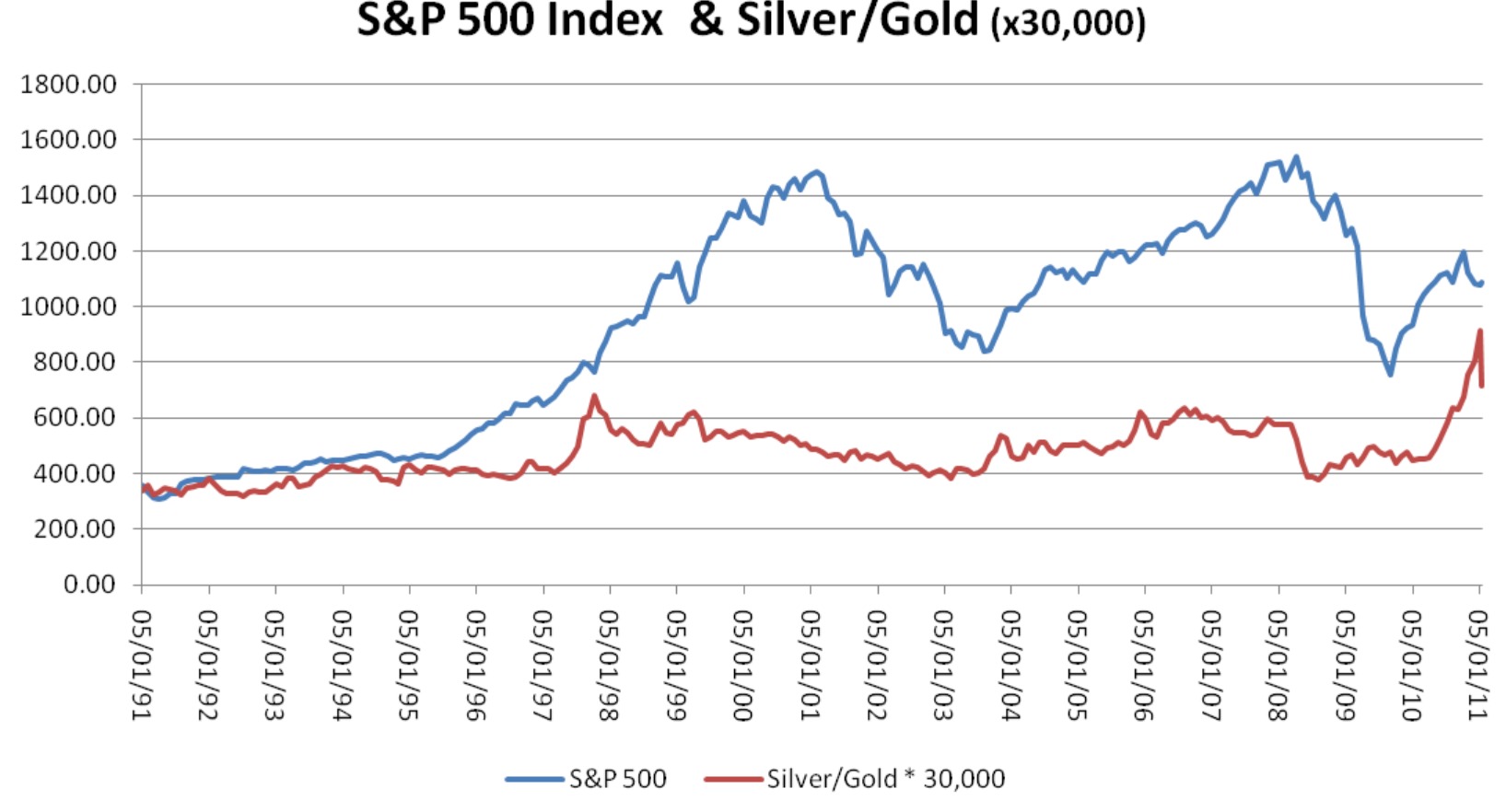

The ratio of silver relative to gold may be saying something important about the future direction of U.S. stocks, according to the latest from Market Anthropology.

This metals ratio is not just for gold bugs: Stock investors should watch it, too. It has a long history of moving more or less in line with the S&P 500. As a result, extremes in the ratio and movements that run counter to the benchmark equity index can be telling about stock direction.

Source: Richard Shaw, QVM Group LLC

There’s a logical reason for this:

- Both silver and gold are precious metals, but silver is more closely tied to the economy relative to gold because of its industrial uses.

- As a result, silver will tend rise faster than gold when investors are optimistic about the economy.

- Conversely, gold tends to rise faster than silver when invetors are pessimistic.

- The price of silver/gold, therefore, mirrors stock price optimism (the equity market) over time.

Plan B Economics on Seeking Alpha includes a historical bar chart of the silver/gold ratio.

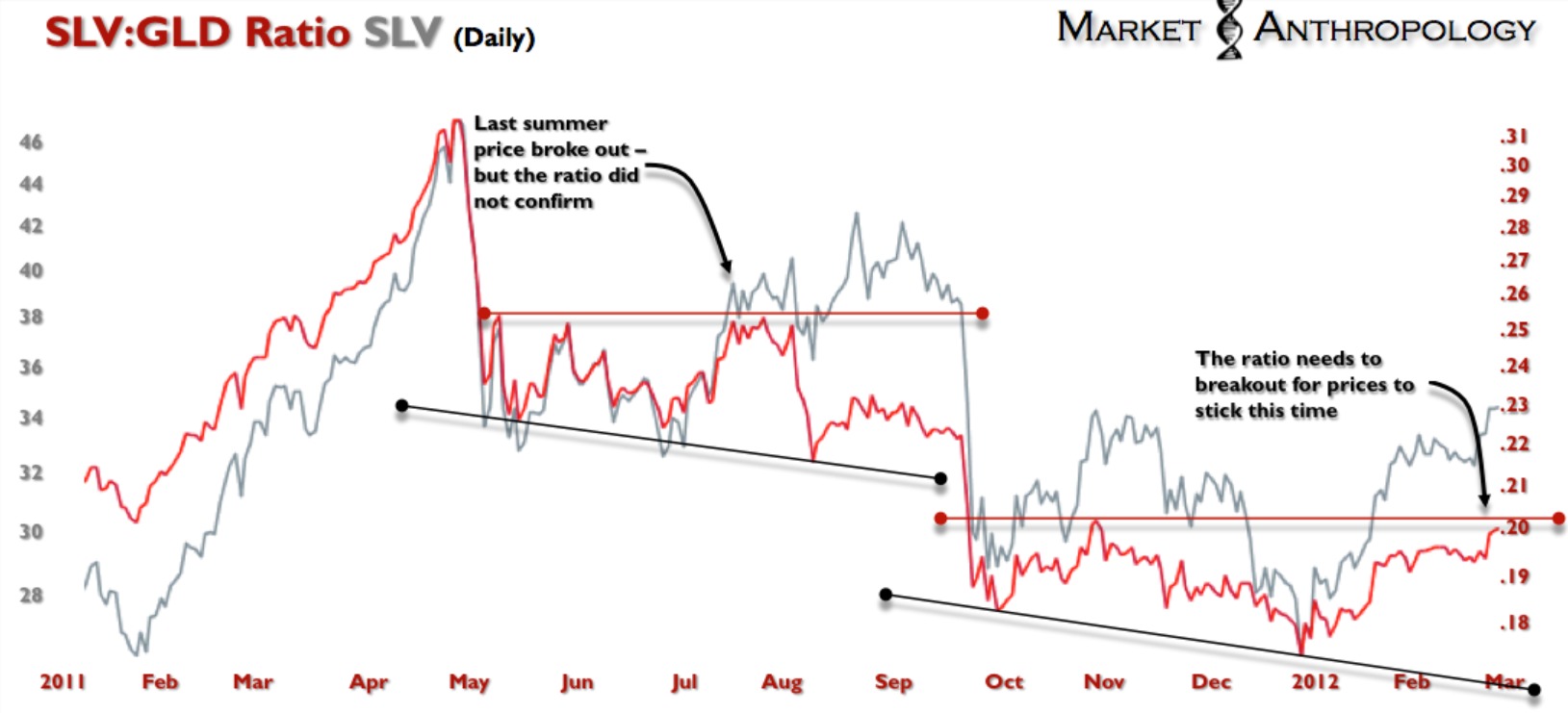

If you ask me, this chart is the interesting one right now:

Source: Market Anthropology

You’ll see the S&P 500 in grey, and the silver/gold ratio in red. You’ll notice that right now, the S&P is again rallying faster than the silver/gold ratio.

This happened last summer (starting in August), and served as a warning sign. Silver/gold couldn’t keep pace with stocks, and the equity rally failed.

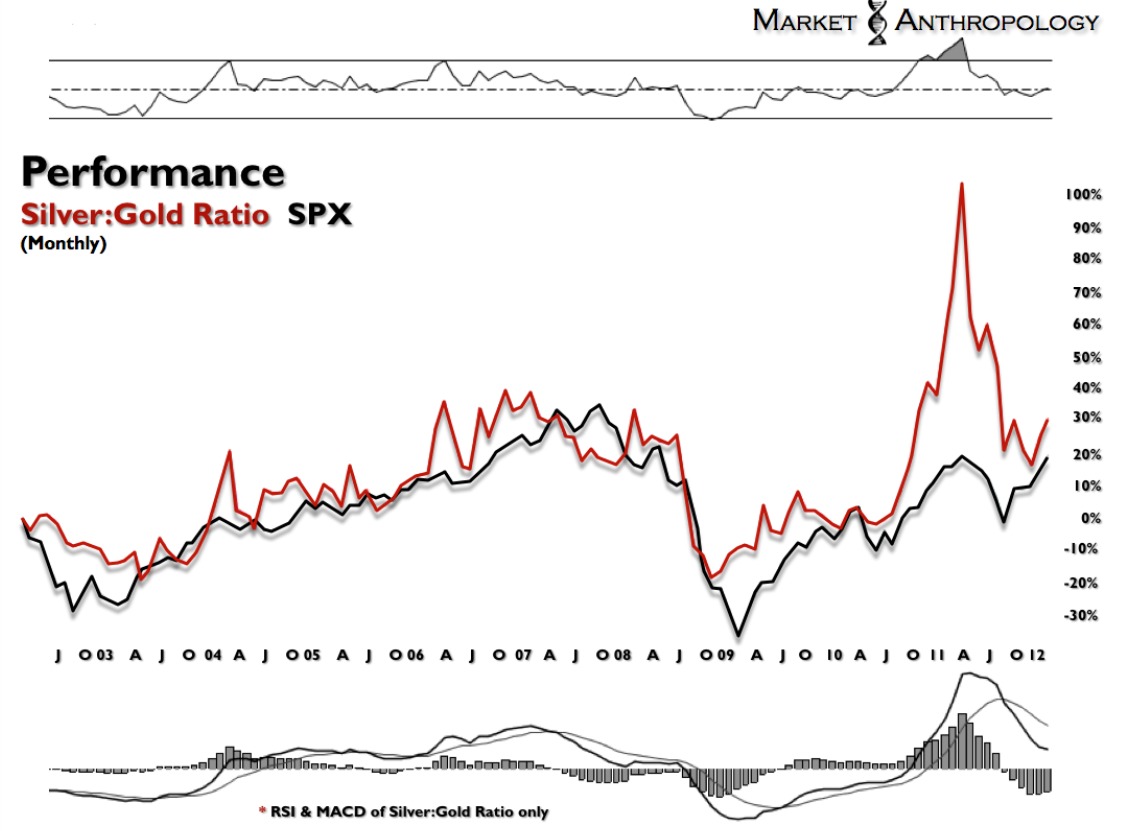

This one, however, puts things in a a longer-term perspective. It’s a monthly chart that shows the performance of silver/gold relative to the S&P, 500, as a percentage.

Source: Market Anthropology

What you’ll notice (as you might expect), the ratio moves with the S&P 500 over time. The exception was last year’s run in metals.

The upshot: Silver/gold remains in an uptrend right now. Stocks do, too. However, it’s important that silver/gold keeps pace. That’s happening in the long run, but not in the recent weeks — something of note for short-term traders.