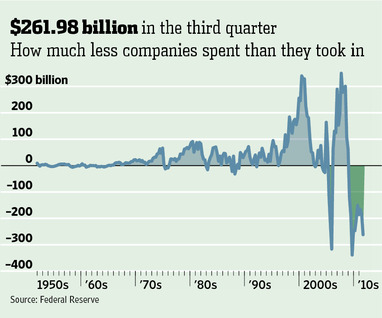

As many Covestor managers have mentioned in recent commentaries, U.S. corporations are near historic highs in profitability but broadly speaking are not investing those proceeds at a similar pace. On the WSJ’s Real Time Economics blog, Phil Izzo presents a helpful graph of this dynamic, which is clearly one of the reasons why the U.S. jobs market remains so weak:

Josh Brown weighs in from an investor’s perspective:

Profit margins are at almost disturbingly high levels but without some revenue growth and investment, it’s meaningless. Multiples won’t expand so long as growth looks like a fourth priority (behind profitability, liquidity and compensation).

Time to do something. Take some risk already, will ya? Jump!