Author: Donald Jowdy, Suncoast Equity

Author: Donald Jowdy, Suncoast Equity

Covestor model: Suncoast Equity

Fears of another dip in the U.S. Economy, European banking stress, specifically Italy and Spain, and efforts by the Swiss and Japanese policy makers to reduce the value of their currencies contributed to a sharp decline in equities and commodities in August. These factors, along with concern about the employment picture, will lead to continued market volatility.

This recent market decline and the fear it breeds should not guide an investor’s decisions. Despite the increased volatility in the capital markets, we believe courage and a focus on fundamentals is the best path. With equity valuations at historically attractive levels and fixed-income alternatives providing miserly returns, we continue to favor “owning” rather than “lending to” various enterprises. The recent turmoil in the commodities markets and Washington reinforces our bias towards predictable profit streams from high-quality companies. Thus, we are “staying the course” with our portfolio.

Below are our current Portfolio Strategy and Economic Outlook:

PORTFOLIO STRATEGY

In our assessment, equities on a valuation basis are more attractive than other asset classes such as cash, fixed income, or real estate. However, certain short to intermediate term corporate and high-quality municipal bonds remain attractive.

Corporate profits remain robust and should support equities. Aggregate corporate earnings and revenues are both up about 13% from Q2 a year ago, according to Yardeni Research, and we expect revenues and profits for the companies in our portfolio to surpass those growth rates for 2011. (Yardeni source: “3 Strategies for a Rocky Market” Dave Kansas, The Wall Street Journal, 8/5/11 http://online.wsj.com/article/SB70001424053111903885604576488610061220534.html)

Corporate cash balances, especially for our companies, are at record levels and return of capital to shareholders via share buybacks and increasing dividends is growing.

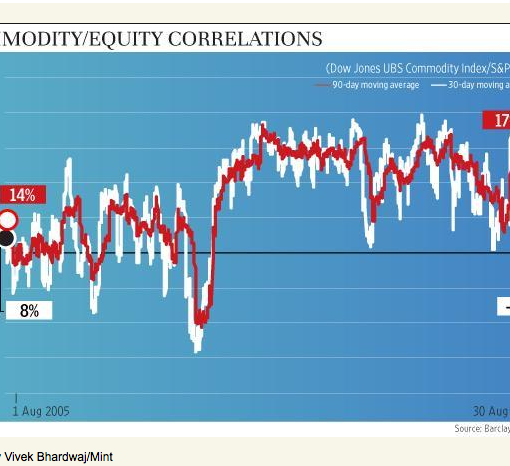

Valuations and earnings remain key elements of our long term equity strategy. We have no exposure to volatile financial companies and commodity-sensitive stocks that we believe would be most vulnerable to a global growth slowdown.

ECONOMIC OUTLOOK

We remain comfortable with a moderate economic growth outlook in both 2011 and 2012 on a worldwide basis.

We expect positive GDP growth in 2011 and 2012. Inflation should remain contained in 2011. The de-leveraging of consumer balance sheets brought on by the debt bubble will act as a “headwind” to normal economic activity.

We expect interest rates at the short end to remain stable for now at the current levels with the yield curve remaining positive sloping.

Currencies around the world are volatile due to desperate monetary policies. Further moves will depend on Fed actions, global interest rates related to Europe and China, and the balance of trade developments. The recent movements in the dollar will affect the outlook for U.S. exports and multi-national profits.

A possible risk in the near term is a relapse into recession after the stimulative effects of fiscal and monetary policy wane. A “Double-Dip” recession appears less likely in the U.S. in the near-term, while economic growth in the emerging markets should keep world growth nicely positive through 2011 and 2012. Japan and the Eurozone should continue to be a drag on worldwide growth. Longer term concerns include “stagflation” triggered by slower than expected recovery and persistent unemployment.

FINAL THOUGHT

As bleak as Wall Street may make it seem near-term, we should keep in mind that America is a great place and we will pull through this. We all know that leaders and politicians have been increasingly placing their own self political interest ahead of what’s best for our country. As we all work hard to do the best we can and elect better people, do not underestimate America’s ability to resume its greatness.

Courage and Fundamentals will carry us through. Hidden beneath the emotions of the global issues, corporations are proving they can generate healthy profits even while the economy is sputtering along. Fundamentals will come back into focus and valuations should reflect the positive corporate results over time.

– Donald Jowdy, Suncoast Equity