Editor’s note: As of 9/7/11, James Peera no longer manages a Covestor model

James Peera manages Covestor’s Total Alpha model, which combines a macro/fundamental strategy with market timing via technical assessment. This approach determines both the securities held and buy/sell timing. He recently sold Citigroup Inc. (NYSE: C) and bought Sprint Nextel Corporation (NYSE: S). We asked him to share his thoughts on these trades. His response follows.

James Peera manages Covestor’s Total Alpha model, which combines a macro/fundamental strategy with market timing via technical assessment. This approach determines both the securities held and buy/sell timing. He recently sold Citigroup Inc. (NYSE: C) and bought Sprint Nextel Corporation (NYSE: S). We asked him to share his thoughts on these trades. His response follows.

***

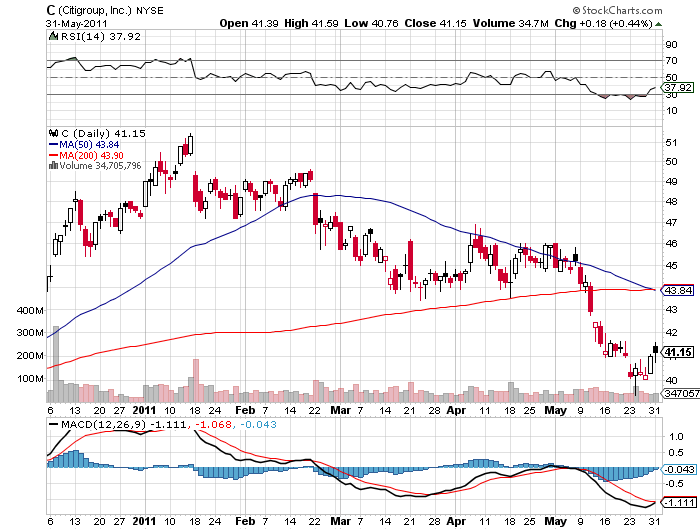

Citigroup was sold because of bearish fundamentals and technicals. The macro fundamentals for the financial services sector remains negative in the near term due to continued high unemployment and weak housing and consumer spending.

The technicals for Citigroup are bearish in the near term as the stock price broke below its 50 day moving average – the blue line here:

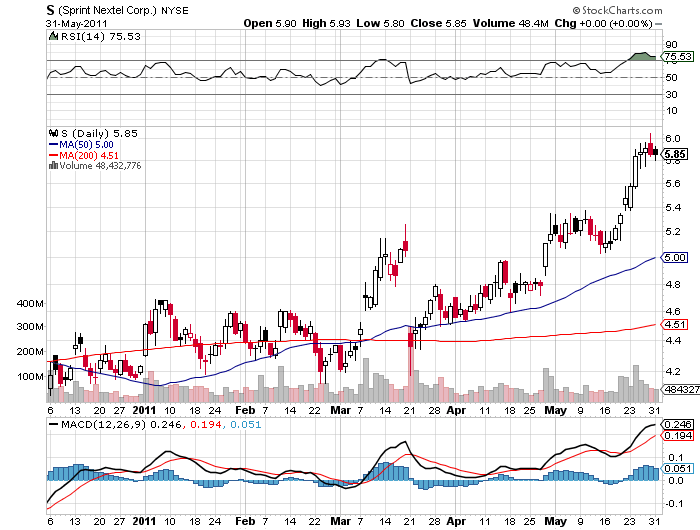

Sprint Nextel was purchased because of bullish fundamentals and technicals. The macro fundamentals for the mobile telecom business are positive due to increased consumer interest in smartphones and higher priced mobile data plans. Sprint Nextel’s stock price is showing bullish technicals as it recently broke above key resistance levels.

Sources:

Stock charts as of 5/31 from StockCharts.com