Editor’s note: As of 9/20/11 Lucas Krupinski no longer manages a Covestor model

Lucas Krupinski manages Covestor’s Small Cap Fundamentals model, which seeks to generate returns through a variety of methods including holding long term positions, trading around short term positions and seeking exposure to investments that generate current income.

Lucas Krupinski manages Covestor’s Small Cap Fundamentals model, which seeks to generate returns through a variety of methods including holding long term positions, trading around short term positions and seeking exposure to investments that generate current income.

Krupinski recently shorted Great Northern Iron Ore Properties (NYSE: GNI), a non-voting trust that owns interests in both mineral and non-mineral lands on the Mesabi Iron Range in northeastern Minnesota. We asked him to share his reasons for the purchase. His response follows.

***

I’ve been trying to short GNI for several months now, and only recently did shares become available from the broker to short.

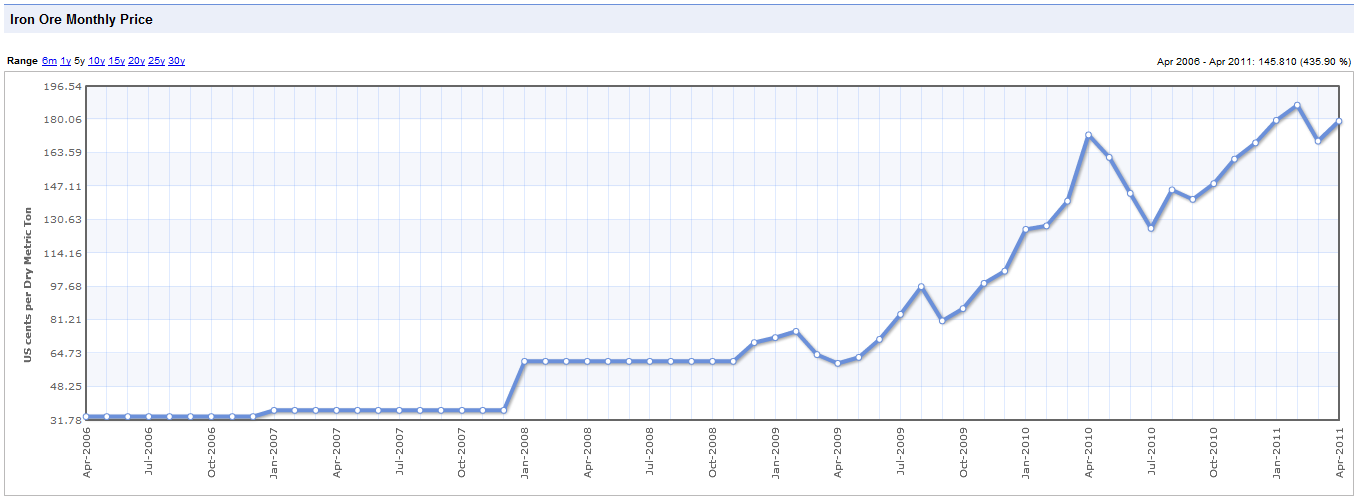

The reason is not because of a forecast in future prices for iron ore, nor is it an attempt to make a diagnosis on China’s economy (though a slow-down in the economy of the world’s largest consumer of iron ore would probably benefit the position).

The reason for the short is found on a link right at the top of the company’s homepage, namely that the Trust is terminating in 2015. On April 6, 2015 the Trust plans to terminate, and whatever remaining cash there is will be distributed to Unitholders, and that’s that. So even though it looks as though it current trades at an extremely low P/E ratio (7.64 as of 5/31/2011) with an outsized dividend yield, it doesn’t look like the market has factored the dissolution of the trust into the pricing.

Simply, the Trust makes distributions quarterly in March, June, August and December. There are three more distributions due this year (2011), four distributions due to be made in 2012, four to be made in 2013, four to be made in 2014, and one to be made in 2015, for a total of 16 remaining distributions. See history of distributions here: http://www.gniop.com/distribution.html

If those 16 remaining distributions are made at the highest payout rate that the Trust has ever made ($4.50/qtr) the total remaining payouts would be $72.00. If all of the Trust’s remaining equity is liquidated at 100% cash value, that would create another $10.116 million, which, divided by the 1.5 million shares outstanding, means the liquidation value would be an additional $6.75 per share.

My math says that the most the Trust is likely to generate (absent an enormous increase in iron ore prices) is therefore $78.75 per share between now and its dissolution in 2015.

If you forecast the Trust making distributions as it did in the last four quarters, going forward, that gets you $12.50 per 4 distributions, or $50 of expected remaining distributions (plus the $6.75 final distribution) – for total value in this scenario of $56.75.

If you average the distributions over the last 3 years (which includes that outsized $4.50 distribution), your expected future distributions equal only $42.93 (plus the $6.75).Total value in this scenario is $49.68.

Using a $101 share price and a trade execution date of today (5/31/11), the above mentioned scenarios yield the following rates of return (using Excel’s XIRR function):

$72.00 in remaining dists + $6.75 6.67% ROR

$50.00 in remaining dists + $6.75 16.14% ROR

$42.93 in remaining dists + $6.75 20.22% ROR

So, absent a huge increase in Iron Ore prices, this short position to me looks like it should yield positive results. Maybe that will mean holding until the end, but I think the more likely scenario will be that many holders of GNI who may have stumbled across it because of its outsized dividend will realize what they bought into and dump it. That, or iron ore prices continue marching skyward and I am proven wrong in this short position due to much larger future distributions than I projected here.

Click to enlarge the chart of iron ore pricing:

Sources:

“Termination of the Trust – April 6, 2015” Great Northern Iron Ore Properties. http://www.gniop.com/termination.html

“Distribution Releases” Great Northern Iron Ore Properties http://www.gniop.com/distribution.html

GNI P/E, Balance Sheet information from Yahoo Finance, http://finance.yahoo.com

Iron Ore price chart from Index Mundi, http://www.indexmundi.com/commodities/?commodity=iron-ore&months=60