If you have bought anything in recent months, you’ve noticed prices were higher.

The official Consumer Price Index for July showed inflation popping by a full 5.4% over the last 12 months.

And producer prices, which are often a precursor to consumer prices, are rising at an even faster clip. The Producer Price Index (PPI) was up 8.3% in the 12 months through August.

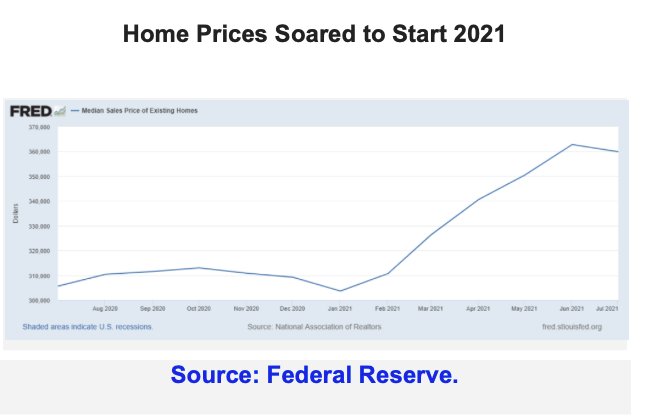

The numbers are crazier when you look at certain high-profile pockets of the economy like housing. The median price of an existing home sold in July was 17.8% higher than the year before.

Transitory Inflation

At that rate compounded, a house would double in value in a little over four years.

Federal Reserve Chair Jerome Powell believes the inflation is “transitory” and the result of a perfect storm of pandemic-related supply disruptions, higher-than-usual demand due to government stimulus, virus fatigue and a lack of spending options.

I’ll admit, I was skeptical.

Once inflation gets out of the bottle, it’s hard to stuff it back in. The Fed under Paul Volker had to get downright nasty and engineer one of the worst recessions in decades when the economy finally broke the last bout of inflation in the early 1980s.

Labor Supply

Today, with labor in extremely short supply, we looked uncomfortably close to a wage inflation spiral in which rising wages led to rising prices which in turn led to even higher wages and even higher prices.

But here’s the thing. The market is agreeing with the Fed. As unlikely as it seemed just a few months ago, inflation might actually be transitory.

Gold Prices

Let’s start with that most iconic of inflation hedges: gold. Between 2013 and 2019, the gold price barely budged. It was stuck in a long trading range.

But then, it started trending higher in 2019 and then exploded higher in the early stages of the pandemic as investors ran for safety.

And that was it. Gold has been trending lower since August of last year. If investors are concerned about inflation, that concern isn’t manifesting itself in higher gold prices.

Let’s look at industrial metals. The S&P GSCI Industrial Metals index bottomed out at 259 in March of 2020. It then rocketed as high as 483 by May of this year. Since then, the index – which includes aluminum, copper, lead, nickel and zinc – has mostly traded sideways, in a range.

Commodities markets are volatile and subject to short-term fluctuations. It’s hard to conclude the direction of inflation based on a year’s worth of commodity price movements, particularly given the general “weirdness” of post-COVID supply chain problems.

Bond Prices

Bonds appear to tell the same story. The 30-year U.S. Treasury bond is highly sensitive to inflation assumptions. Its yield has fallen throughout 2021. In March, the bonds yielded 2.5%. Today, they yield 1.9%.

More inflation may still come. I can’t definitively say it won’t. But let’s just say the market isn’t pricing it in at the moment.

This post first appeared on September 14 on the Money & Markets blog.

Photo Credit: XXX via Flickr Creative Commons

DISCLOSURE

This piece is provided as educational information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument, or to participate in any particular trading strategy.

The S&P GSCI Industrial Metals Index provides investors with a reliable and publicly available benchmark for investment performance in the industrial metals market. Investors can’t invest directly in indexes.

This article is not intended as tax advice and is provided for educational and information purposes. Interactive Advisors does not provide tax advice. All references to tax matters or information provided here are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.