The White House recently launched the Taxpayer Receipt, allowing citizens to identify exactly where their money is going, dollar for dollar. As reported by NPR’s Planet Money:

You enter how much you paid in income taxes, and how much you paid for Social Security and Medicare (which have their own special taxes, and are broken out on your W-2).

The calculator tells you, dollar by dollar, what you taxes paid for.

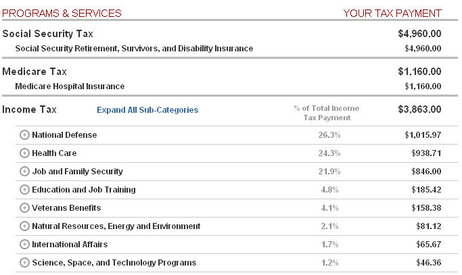

Take, for example, a married couple that made $80,000, has kids and put 5 percent of their income into a tax-deferred retirement plan. This screengrab shows part of their receipt (click on the image to see a bigger version):

They paid $4,960 for Social Security, $1,160 for the Medicare hospital fund, $1,015.97 for defense and $938.71 for other health care costs (including Medicaid and some parts of Medicare).

They paid $285.86 in interest on the national debt. They paid $46.36 for science, space and technology (NASA, the National Science Foundation and the like). They paid $15.45 for responses to natural disasters. Etc.

The receipt calculator (online here) includes a bunch of other categories, and the larger categories include more detailed breakdowns.

The idea of a taxpayer receipt has been kicking around for a while now, and some people have gone out and created their own using publicly available data.

A think tank called Third Way launched one. A couple computer engineers in Minnesota created What We Pay For, which in turn gave rise to a project where people create data visualizations (graphs and the like) based on the data from What We Pay For.

Sources:

“This Receipt Tells You Where Your Tax Dollars Go” Jacob Goldstein. NPR Planet Money, 4/15. https://www.npr.org/blogs/money/2011/04/15/135438878/this-receipt-tells-you-where-your-tax-dollars-go