By: Trevor Yates, Investment Analyst (Emerging Markets)

Gold has staged an impressive rally thus far in 2024, with the metal recently hitting an all-time high. We believe that recent price levels could be sustainable, potentially supported by likely Federal Reserve interest rate cuts, the possibility of a “higher for longer” inflationary environment, and recently robust physical market demand. In our view, gold miners could be particularly well positioned to capitalize on elevated bullion prices, based on what we see as attractive valuations and the potential for increased M&A activity.

Key Takeaways

- Gold’s function as a store of value has stood the test of time, helping owners maintain their purchasing power over thousands of years.

- Gold’s year-to-date (YTD) rally to all-time highs was driven by both the physical and financial markets. Current prices may be sustainable, with the Fed funds futures market currently pricing in a high probability of interest rate cuts this year.1

- Gold miners and explorers have historically offered higher leverage to rising gold prices, with possible increased M&A activity potentially driving outsized returns for miners and explorers, such as those in the Global X Gold Explorers ETF (GOEX), relative to physical gold.

Gold as a Store of Value

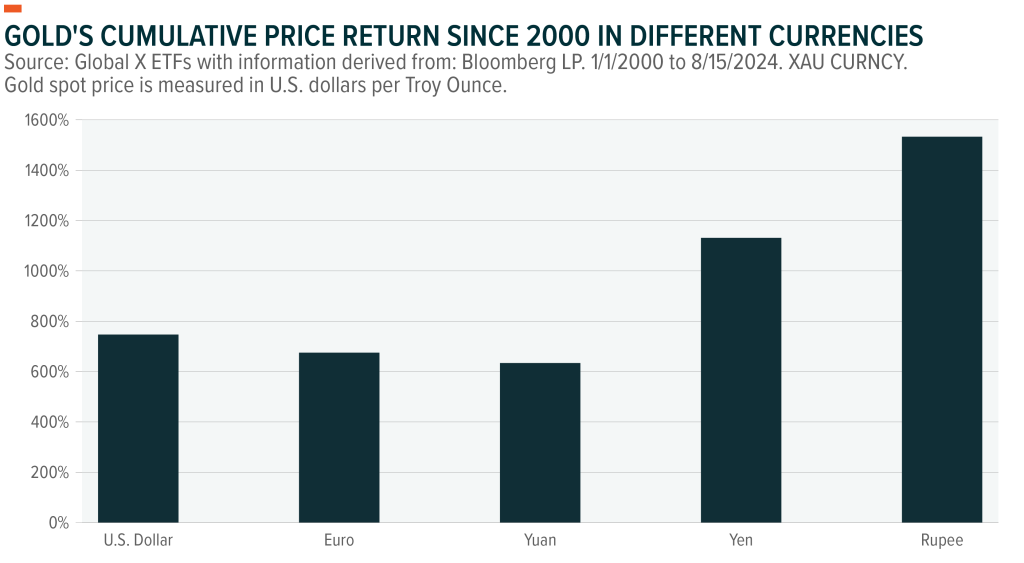

Gold’s long-term track record as a store of value is unmatched by any other asset, standing the test of time and preserving its value for thousands of years. The most pronounced example of this is the salary of Centurion soldiers under Roman Emperor Augustus, who were paid 38.58 ounces of gold per year.2 This equates to nearly $94,000 today, which is roughly equivalent to the salary of a U.S. Army Captain with six years of experience.3,4 Gold’s scarcity, as well as the metal’s physical characteristics, including its natural beauty, durability, and malleability, can help explain its lasting allure over time. Gold, which was historically used as a means of trade or money, has also maintained its value despite all major currencies no longer being pegged to the metal, appreciating nearly 70x since the U.S. abandoned the gold standard in 1971.5 Although gold’s price appreciation in U.S. dollar (USD) terms has been remarkable, its ability to protect purchasing power in other currencies is even more impressive, illustrated in the chart below. This track record as a store of value has also led to gold becoming a “flight to quality” beneficiary, often providing downside protection during times of economic, geopolitical, and financial uncertainty.

Market Update

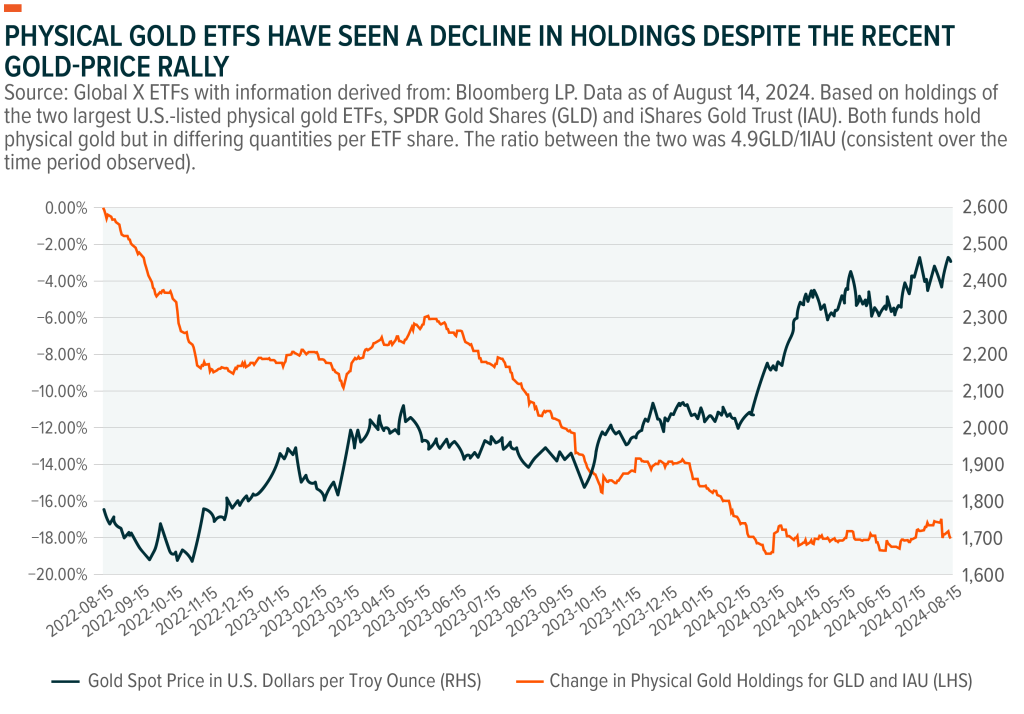

The gold market has defied expectations thus far in 2024, rallying in the face of the Federal Reserve’s higher for longer monetary policy stance. This strong price appreciation also occurred despite U.S. investors selling, with the two largest U.S.-listed physical gold ETFs seeing decreases in their number of physical gold holdings over the previous two years.6 We see this price appreciation being driven by a mix of both the physical and financial markets. First, physical market demand has remained robust, with major central banks, such as the People’s Bank of China (PBOC) and the National Bank of Poland, being large buyers of the bullion.7 Although we have seen the PBOC slow purchases over recent months, which is not unprecedented given the strong YTD rally, the central bank remains committed to increasing gold’s share of its reserves, which stood at 4.9% in June versus the global average of 16%.8 In addition to global central bank demand, we have also seen strong retail buying across many geographies, especially in Asia. This strong physical market demand has helped offset the aforementioned selling pressure from U.S.-listed physical gold ETFs. On the financial market side, gold’s historical inverse relationship with real interest rates also provides insight into the rally.9 On the surface, the decline in U.S. YOY inflation seen in the first half of 2024 pushed real rates higher, which should have weighed on the price of gold. However, we believe the market is looking beyond this, pricing in a higher-for-longer inflation scenario, with the Federal Reserve potentially embarking on an easing cycle. This should push real yields lower and possibly add to the sustainability of the gold rally. Heightened geopolitical tensions could also be adding to the bullion’s appeal, with its “flight to quality” attribute providing diversification to portfolios.

Why Gold Explorers in this Context?

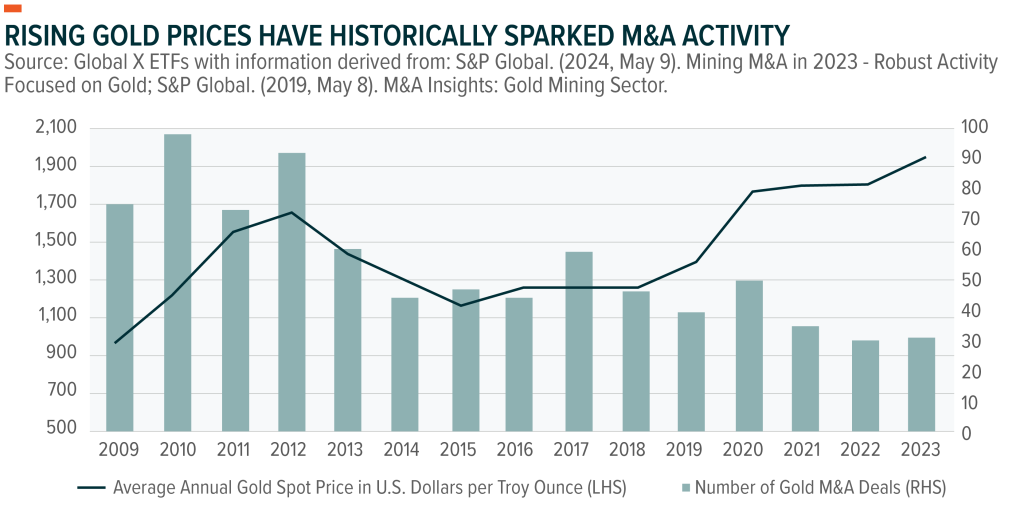

Gold miners and explorers have historically offered higher leverage to a change in gold prices (moving more dramatically than the underlying commodity). This is due to these companies’ abilities to use operating leverage to increase profits. Unlike investing directly in gold, miners and explorers may be able to expand production as profit margins grow. That said, being exposed to the operational risks of individual companies poses risks, especially when gold prices are falling, as the aforementioned leverage cuts both ways, and miners and explorers may see steeper declines than bullion prices when they fall. Despite this relationship, when looking at year-to-date performance, six out of eight pure play gold mining ETFs delivered weaker returns than the underlying commodity price. While the spot price of gold was up 20.65% YTD through September 6th, pure play gold mining ETF returns ranged from as low as 10.40% up to 23.51%.10 As a result, we believe the market has yet to price in a potential higher-for-longer gold price environment, providing potential upside to miners/explorers on a valuation basis if current bullion prices prove sustainable. We also believe smaller gold miners and explorers are particularly interesting at this juncture. Historically, as the chart below shows, higher gold prices drove significant market consolidation within the gold mining sector. Although we have seen some deals in the past 12 months, such as Newmont acquiring Newcrest and Goldfields acquiring Osisko, this appears to lag past cycles. As a result, we see room for a high gold price environment, declining production profiles for certain large players, the fragmented nature of the industry, and the cheaper valuations that the market has assigned small-cap gold miners relative to large caps driving consolidation moving forward. This could open up the potential for outsized returns for smaller miners and explorers. Alternatively, from a portfolio construction perspective, gold miners can offer diversification. This could be especially compelling now, with geopolitical risks remaining elevated. Investors should be aware that, similar to direct physical gold ownership, physical gold ETFs are taxed at the collectibles rate, meaning that the top long-term rate can be 31.8% versus 23.8% for shares of gold miners and gold miner ETFs.11 In both cases, short-term capital gains are taxed as ordinary income, with rates ranging from 10% to 37% depending on income levels.12,13

Conclusion

Gold’s extensive track record as a store of value is unmatched, providing potential portfolio diversification during times of economic uncertainty and heightened geopolitical risk. Despite the strong year-to-date rally, we think the potential for Fed rate cuts, a higher-for-longer inflation environment, and robust physical market demand all point to potential price sustainability. While GOEX invests across the market-cap spectrum (the free float market cap must be at least $200 million for companies that are not constituents and at least $100 million for companies that are constituents), we believe the fund could benefit from its smaller-cap gold miners and explorers, which stand to be outsized beneficiaries of the current gold price environment, with valuations yet to price in the potential sustainability of the rally, while higher prices could possibly spark further market consolidation.

Originally Posted September 11th, 2024, GlobalX

PHOTO CREDIT: https://www.shutterstock.com/g/OscarDominguez

Via SHUTTERSTOCK

Footnotes:

1. CME FedWatch. Data as of August 15, 2024.

2. Erb, Claude B. and Harvey, Campbell R. (2024, May 7). Is There Still a Golden Dilemma?

3. Ibid.

4. Bloomberg LP. Data as of August 15, 2024.

5. Ibid.

6. Bloomberg LP. Data as of August 14, 2024. SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). GLD and IAU are not investment companies registered under the Investment Company Act of 1940 (the “1940 Act”) and not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders of these funds do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA.

7. Gold.org. (2024, Jul 30). Gold Demand Trends Q2 2024.

8. Reuters. (2024, Jul 16). China’s Gold Buying Break Seen as Fleeting Given its Long-Term Needs.

9. Money.com. (2024, Feb 14). What Drives the Price of Gold?

10. Bloomberg LP. Data as of September 6, 2024. Based on YTD performance of eight non-leveraged pure-play gold mining ETFs compiled by ETF.com (AUMI, GOAU, SGDJ, GOEX, SGDM, RING, GDX, and GDXJ) relative to the spot price of gold “XAU CURNCY”.

11. Wall Street Journal. (2024, May 31). You Bought Gold at Costco. What Are the Taxes When You Sell it?

12. Ibid.

13. Internal Revenue Service. (2023, Nov 9). IRS Provides Tax Inflation Adjustments for Tax Year 2024.

DISCLOSURES:

Information provided by Global X Management Company LLC.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment advice and should not be used for trading purposes.Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or guarantee against a loss. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments may be subject to higher volatility. There are additional risks associated with investing in Gold and the Gold exploration industry.