Facebook could disappear in five years, says Ironfire Capital's Eric Jackson. If that happens, another company must take its place in terms of Web relevancy.

Having the humility to reassess your plan - rescuing it from failing to meet your needs - is a key part of successful investing.

Australia's decision to cut interest rates could in a roundabout way provide a positive influence for some U.S. stocks.

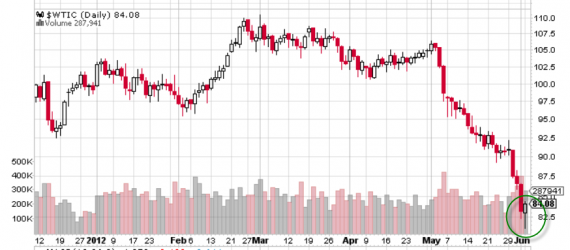

Europe was driving equity markets and the Euro south, so my short positions benefited from these developments.

If speculators are disappointed with the performance of the Facebook IPO it is because they had ridiculous expectations of what rational investors would pay.

Central bankers have been succumbing to Keynesian counterfeiting since it became all the rage in the 1930s.

Covestor manager John Lewis discusses how Baby Boomers might best position themselves for retirement.

The portfolio holds companies which are strong financially and may benefit from the continued weakness in the equity markets.

Now is the time to pay MORE attention to the markets, not less. Here are three reasons why you don't want to stick your head in the sand.