At the end of September, I resumed my short Barclay’s Bank iPath S&P 500 VIX Short-Term Futures (VXX) – long Barclay’s Bank iPath S&P 500 VIX Mid-Term Futures (VXZ) strategy. Mid-term VIX futures (VXZ) were less elevated and provided a better hedge for VXX. I will hold this pair through October as […]

Opportunities in the energy sector are in onshore drilling, oil services and midstream pipelines, says investment manager Ben Dickey.

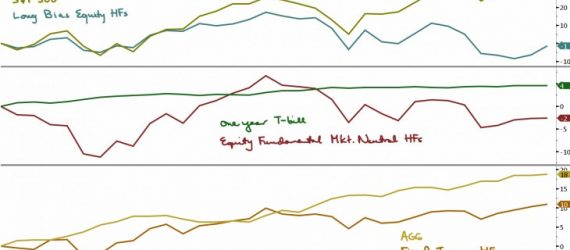

Rarely, if ever, are you going to get an “all clear” sign from the markets that tells you it’s time to invest. Being cautious and protecting yourself from big market drops is very important. In fact, it’s more important for long-term investors to beat the market’s return in a downtrend than in […]

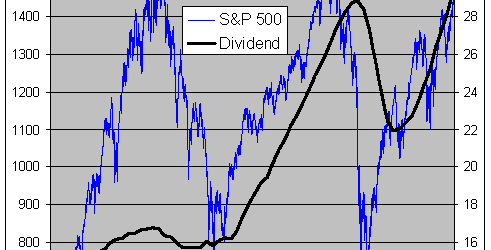

For those of us really willing to look at the numbers, there appears to be ample upside left in this market.

Buffett sees a quiet bargain in yet another old industry that would appear to have been eclipsed by technology.

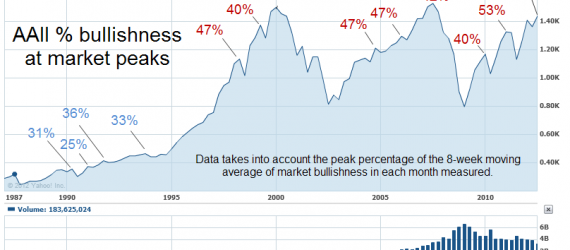

If you want to be like Warren Buffett and be greedy when others are fearful, the level of continued market apprehension may make the case for buying stocks.

Facebook (FB) is finding new ways to make money from its growing list of users, says Eric Steiman, manager of the Undervalued Opportunities investment model.

One of the most widely watched market breadth indicators is providing a healthy sign for the ongoing U.S. stock market rally.