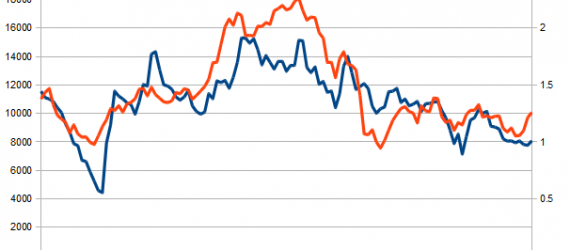

Even for long-term investors, breadth indicators such as BPI are a helpful way to get a handle on the big market trends.

Outlook

Ten consumer product conglomerates control a staggering number of products on our supermarket shelves.

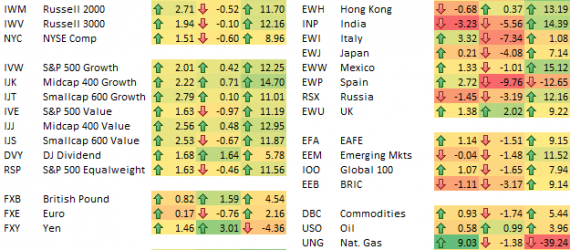

Every single US equity ETF except for Consumer Staples (XLP) posted a gain last week, with the S&P 600 Smallcap Growth ETF (IJT) up the most at +2.79%.

GDP help economists gauge the U.S. economy, but has little direct relevance for most long-term investors. Here's what it can do for you, and what it cannot.

Advisers are more bullish on the markets than their rich clients, which may also be pointing to a disconnect in risk tolerance.

Four years after the U.S. financial crisis, America’s shadow banking system is as big and potentially risky as ever.

Susan Garland, editor of the Kiplinger Retirement Report, shares seven tips that can help you to make it to age 75 and beyond while feeling financially secure.

Veteran advisor and market technician JC Parets makes a strong argument why trends in the coming months may favor stock ownership over bonds.

Foreign exchange markets are rangebound, says veteran analyst John Forman, providing a signal that the next major move for stocks may be sideways.

Covestor's Mike Arold, manager of the Technical Swing model, lays out a plan for how he plans to deal with potential market weakness using ETFs.