By:

Dane Smith, Head of North American Strategy and Research

Chris Carpenter, Senior Investment Strategist

Christine Norton, Investment Strategy and Research Specialist

Zanub Raza, Fixed Income Portfolio Specialist

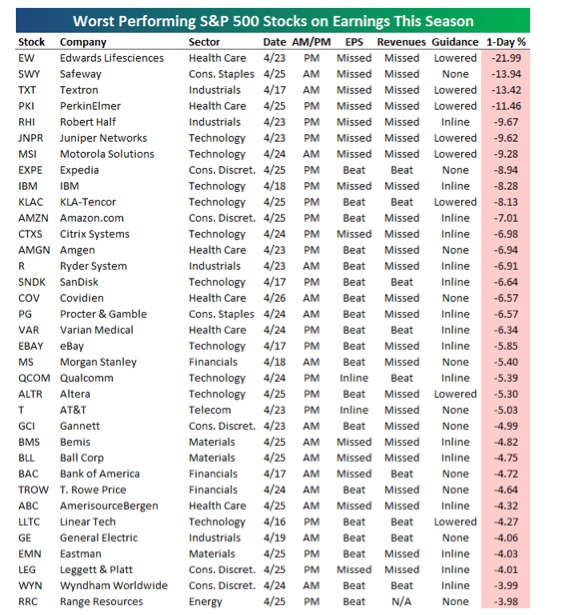

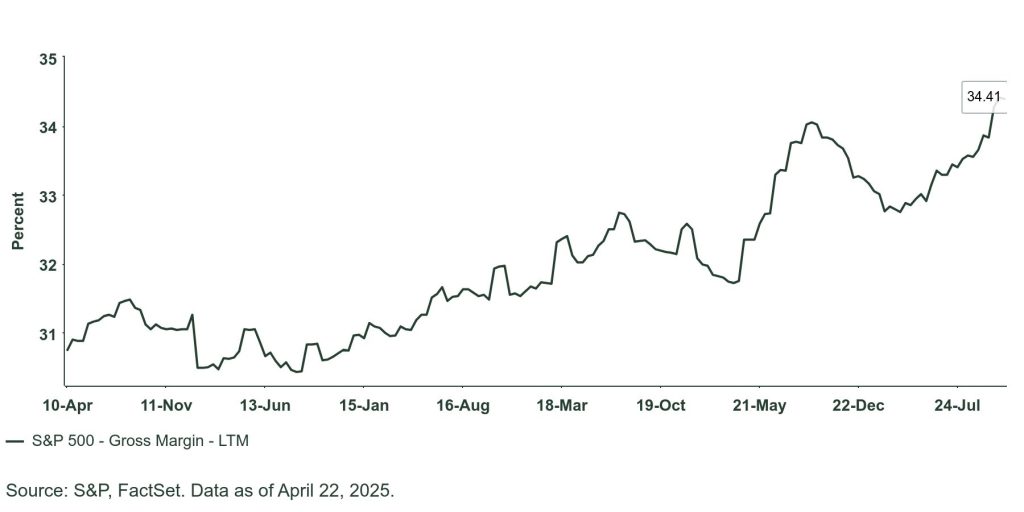

Tariffs impact consumers and corporations. US companies’ high gross margins may absorb costs without affecting profitability, but economic growth and rising input costs remain concerns. Despite these pressures, companies are currently well-positioned to handle challenges.

The prospects of tariffs continue to dominate investor anxiety. Effects from tariffs will be on consumers and corporations alike, with both likely sharing the brunt of higher prices.

The United States, currently leading the global tariff discourse, enjoys some of the highest corporate gross margins among major economies. S&P 500 gross margins are currently at historical highs (34.4%) and have an impressive advantage over MSCI Europe (28.4%) and Japan (27.2%). The question becomes, will these companies be able to pass along higher tariff costs without impacting margins? Probably not.

At a time when wage inflation is slowing, consumers probably will not have the appetite to bear all the increased prices, leaving corporations to absorb the rest which will pressure margins and ultimately profitability. But with margins at historical highs, they are starting from a healthy position.

President Trump has started his term with disruptive policies first. If consumer demand wanes and company earnings deteriorate, the prospects of tax cuts may soothe some of the effects from tariffs, but this currently remains an open question.

Originally posted on April 25, 2025 on SSGA blog

PHOTO CREDIT: https://www.shutterstock.com/g/Pla2na

VIA SHUTTERSTOCK

DISCLOSURES:

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the “appropriate EU regulator”) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

The views expressed in this material are the views of Dane Smith, Christopher Carpentier, Christine Norton, and Zanub Raza through the period ended April 24, 2025 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

Generally, among asset classes, stocks are more volatile than bonds or short-term instruments. Government bonds and corporate bonds generally have more moderate short-term price fluctuations than stocks, but provide lower potential long-term returns. U.S. Treasury Bills maintain a stable value if held to maturity, but returns are generally only slightly above the inflation rate.