Over the past two years, investors have endured heightened volatility that stemmed in part from the series of rate hikes by the United States Federal Reserve (“the Fed”). With the Fed’s July FOMC meeting coming up in just a couple of days, the question inevitably becomes if this will be the beginning of a new rate cutting cycle. While persistent inflation above the Fed’s typical 2% target is likely to ward off any significant monetary actions this week, the market’s eye is still drawn towards identifying asset classes that perform well during rate cuts. Some investors may choose to extend their duration exposure with long-term bonds that tend to see prices rise when rates fall. Others may hope that falling interest rates will push valuations on growth companies back to their 2021 highs. One asset class that may be worth paying attention to in a falling rate environment is small-cap equity as it may directly benefit from lower rates and loosening financial conditions.

Key Takeaways

- While we generally group all historic rate cutting cycles together, it is a heterogeneous group of events that are often prompted by exogenous shocks, impacting financial liquidity and market returns.

- During each rate cutting cycle, the data on returns is mixed. It becomes more meaningful when overlaying the National Financial Conditions Index, which can contextualize small cap performance across different time periods.

- After the final rate cut of each cycle, the Russell 2000 generally exhibited stronger returns over both 12- and 24-month periods compared to the average returns since inception.

Contextualizing Historical Rate Cutting Cycles

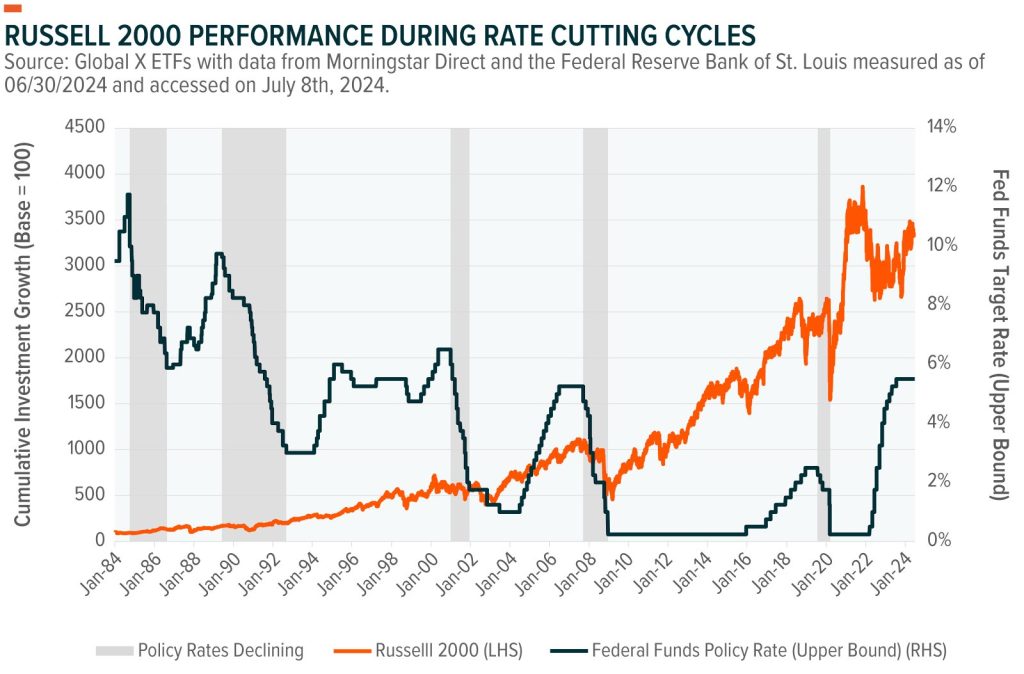

Since the Russell 2000 was incepted in the beginning of 1984, there have been five discrete rate-cutting cycles by the Fed. While they are often grouped together, they tend to be less comparable when analyzed in more detail. Each period was defined by a unique backdrop of economic events, wars, financial crises, or even a pandemic. Wars and pandemics represent exogenous, or external, shocks, which tend to be more challenging to predict than endogenous, or internal, shocks to the economy. Despite this generality, the Great Financial Crisis was an endogenous shock which still caught the world by surprise. This context demonstrates the need to examine each cycle individually. Measured from the date of the first rate cut to the last, the periods were as follows:

- 10/2/1984 – 8/19/1986: Paul Volcker’s time as chairman of the Fed is notable for having presided over the highest federal funds rate in history, achieved in 1980.1 These actions were in response to the Great Inflation period from the mid-1960s to the early 1980s, with soaring energy prices and poor monetary policy driving consumer prices higher.2 While his rate hikes were effective in mitigating inflation, Volcker moved to cut rates to reduce the strain on the economy.

- 6/5/1989 – 9/4/1992: In the midst of the Gulf War recession, the Fed cut rates from a high of 9.6% down to 3% by 1992.3 While the Gulf War only lasted from July 1990 to March 1991, it took longer for households to get back on their feet as, for example, the unemployment rate jumped to 7.8% in June 1992.4

- 1/3/2001 – 12/11/2001: After the dot-com bubble burst in 2001, the Fed began cutting rates systematically throughout the year. The pace of rate cuts slowed following the June FOMC meeting until the 9/11 terrorist attack. This exacerbated problems in the economy, leading to three consecutive 50 basis point cuts.5

- 9/18/2007 – 12/16/2008: Following a series of rate hikes in 2005 and 2006 as the Fed attempted to cool off the economy and the growing real estate bubble, markets experienced one of the most notable crashes in recent history with the Great Financial Crisis. The Fed rapidly slashed rates in 2007 before ultimately landing near 0% at the end of 2008.6

- 7/31/2019 – 3/16/2020: This rate cut began with a “mid-cycle adjustment,” as concerns that the trade war between the U.S. and China would have spillover effects in the economy. These cuts were overshadowed by those stemming from the Covid-19 pandemic, which saw the Fed cut rates by 150 bps over the course of two weeks.7

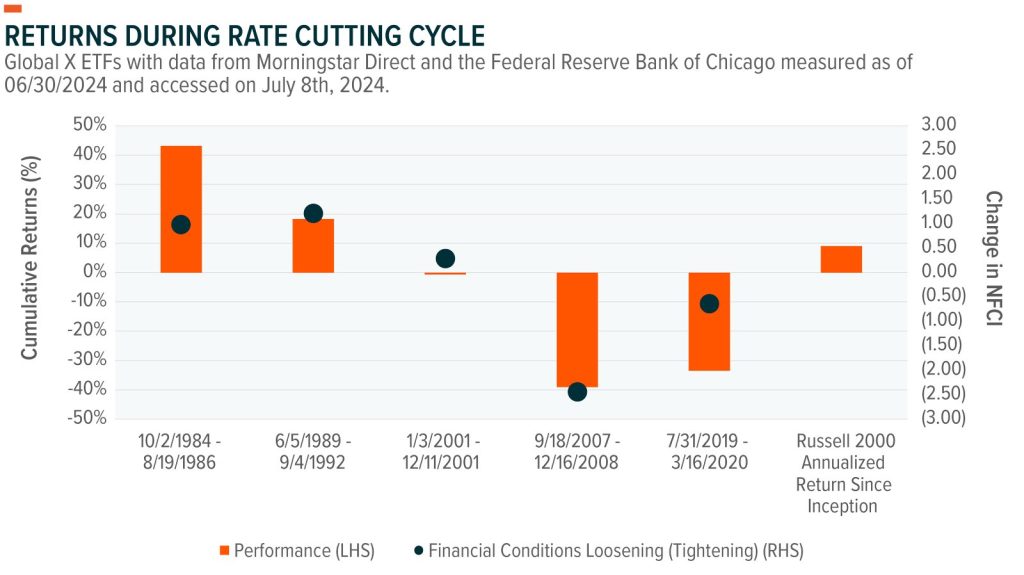

Each of these time periods had unique precipitating events as well as distinct macroeconomic and geopolitical landscapes. The severity of the cuts and the direct impact on inflation also varied between each cycle. To evaluate the potential impact of rate cuts on small-cap equities, it is necessary to overlay another metric to distinguish between the periods. One way to do this is to use the National Financial Conditions Index (“NFCI”) to identify periods of loosening financial conditions.

Financial Conditions Can Impact Small-Cap Returns

Small-cap companies, in particular, benefit from loose financial conditions. Large-cap companies frequently have better access to capital markets, relationships with lenders to draw on revolving credit, or significant amounts of cash on their balance sheet. For example, cash and cash equivalents comprised 11.5% of the total assets for companies in the Russell 1000 Index, which tracks large-cap companies, compared to 7.4% for the Russell 2000.8 Small-cap companies tend to be more reliant on bank financing, and the debt that they have access to tends to be shorter term and floating rate.9 Rate cuts could have an immediate impact on their bottom line as floating rate debt would be adjusted to reflect the lower reference rate. As an added benefit, looser conditions and stronger confidence in the economy could increase the availability of financing. The below chart demonstrates this impact as 1984 and 1989 stand out as rate cutting cycles where financial conditions loosened. Those cycles were also noteworthy as having generated positive returns for the Russell 2000, averaging 13.2% on an annualized basis, compared to the average since inception of 9.1% and -40.3% in tightening periods.10

As the U.S. potentially approaches the first cuts since the Fed began raising rates in 2022, focus will likely be on anticipated returns during the cycle. While conversations have generally been centered around the potential positive impacts on big tech valuations, a less considered impact is that rate cuts in isolation contribute towards looser financial conditions. This impact can be outweighed by exogenous factors like the Covid-19 pandemic in 2020, or the financial crisis in 2008. With the goal of a soft landing, however, financial conditions could loosen when the Fed chooses to cut rates.

Another important consideration is the relative strength of the economy, as it influences both lending and spending. Unemployment remains low, and consumers are well positioned financially, with every income group carrying less leverage relative to historical trends.11 Potentially more important is corporate investment, as quarterly capital expenditures for constituents of the Russell 3000, a broad U.S. equity market index, have grown by an average of 15% year over year for the last 10 quarters.12 While this strength has led to revisions in the market’s expectations for the number of rate cuts this year, it positively contributes to loosening conditions.

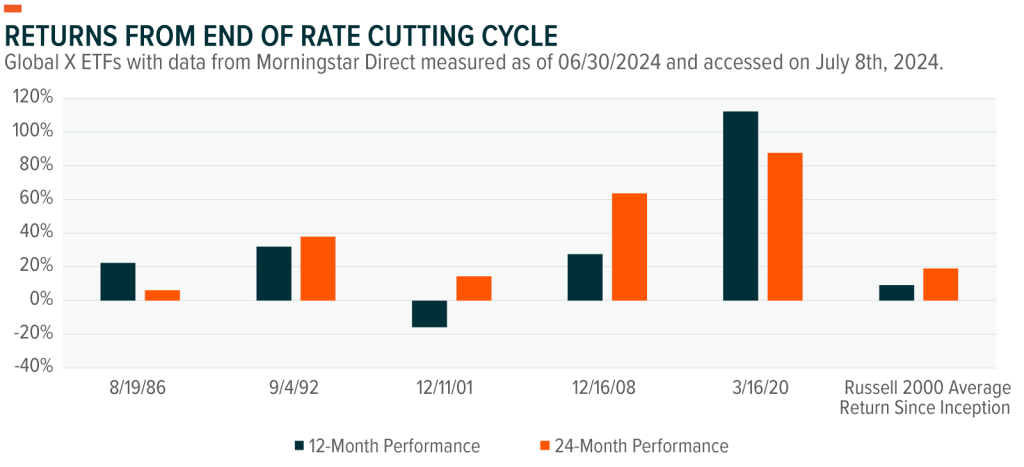

Small Caps Demonstrate Strong Returns After Rate Cuts

Even without considering the impact of financial conditions, small-cap equities have stronger than average returns after the conclusion of each cutting cycle. Following the last rate cut of each cycle, the Russell 2000 returned an average of 36% over the next 12 months, and a cumulative 42% over the next 24 months.13 This is notably higher than the Russell 2000’s average annual returns since inception, which is 9%.14

Generally, the Fed moves to cut rates quickly following signs of trouble in the broader economy. It stands to reason that performance following these periods is stronger than average as markets move into a recovery phase. While this may point towards a lagged impact of rate cuts on small cap performance, the heterogeneous nature of rate cutting cycles makes it important to consider other factors at play. As noted above, there could be a more immediate effect from rate cuts in this cycle as the economy is currently exhibiting significant strength, contrasting with the turbulence that typically precedes rate cuts.

Conclusion

At this stage in the cycle, the timing of rate cuts is challenging to forecast. The market has continuously revised its expectations with each piece of economic news and every inflation print. Despite this, there is a stronger consensus that rates are at their peak with cuts on the horizon, whenever they may come. Investors seeking to position their portfolios for this eventuality may benefit from small-cap equity exposure as falling rates, loosening financial conditions, and a strong economic backdrop could all support stronger than average performance.

Originally Posted July 26th, 2024, GlobalX

PHOTO CREDIT: https://www.shutterstock.com/g/adam121

Via SHUTTERSTOCK

Footnotes

1. Bloomberg L.P. (n.d.). Federal Funds Target Rate (Upper Bound). Data measured from January 1, 1984 to May 31, 2024.

2. Federal Reserve History. (2013, November 22). The Great Inflation.

3. Bloomberg L.P. (n.d.). Federal Funds Target Rate (Upper Bound). Data measured from January 1, 1984 to May 31, 2024..

4. Bloomberg L.P. (n.d.). GP Function. Data as of June 30, 1992.

5. Bloomberg L.P. (n.d.). Federal Funds Target Rate (Upper Bound). Data measured from January 1, 1984 to May 31, 2024.

6. Ibid.

7. Ibid.

8. Global X analysis with information derived from: Bloomberg L.P. (n.d.) FA Function. Data as of March 31, 2024.

9. S&P Global. (2023, November 23). US small caps continue to ride the interest rate roller coaster.

10. Global X analysis with information derived from: Morningstar Direct. (n.d.). Russell 2000 Total Return. Data measured from January 1, 1984 to May 31, 2024.

11. Carson Group. (2024, April 26). Underlying Economic Growth Is Strong, and Here Are 5 Reasons Why.

12. Global X analysis with information derived from: Bloomberg L.P. (n.d.). FA Function. Data measured from October 1, 2021 to March 31, 2024.

13. Global X analysis with information derived from: Morningstar Direct. (n.d.). Russell 2000 Total Return. Data measured from January 1, 1984 to May 31, 2024.

14. Ibid.

Information provided by Global X Management Company LLC.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.