By: Simona M Mocuta, Chief Economist

Various recent polls and sentiment surveys have conveyed a sense of deep pessimism among US consumers that is not validated by headline economic data. Are US citizens simply mistaken, or are their pain points not appropriately captured by core macro statistics?

We discuss various parts of the consumer reaction function that help explain the divergence between consumer sentiment and some important pieces of macro data. We also give thoughts on what this disconnect may mean for consumer and voter behavior.

Why Consumers Are Still So Glum

In recent years, there has been an important nuance between two major sentiment surveys—the University of Michigan and the Conference Board—leaving market participants to try to reconcile the differences (see shaded box below). Occasionally, though, a poll comes along with findings so far out of line with the hard data that it raises deeper questions about what surveys are missing and about just how uninformed respondents themselves are proving to be. A recent Harris poll was just such a case. It found that:

- 56% of respondents believe the US is in recession.

- 49% believe the S&P 500 stock market index is down for the year.

- 49% believe that unemployment is at a 50-year high.

Every one of these perceptions is factually wrong, so how do we reconcile them with reality?

The Sting of Inflation

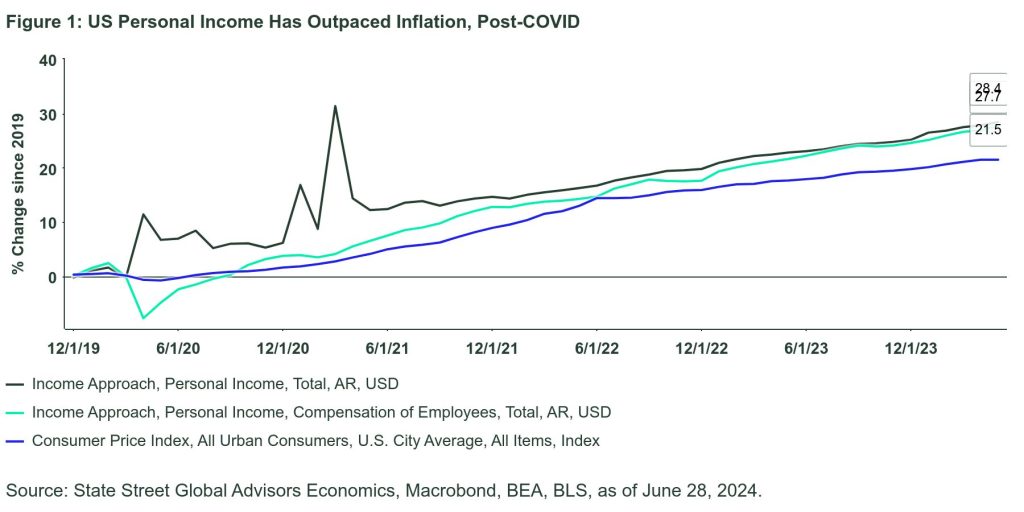

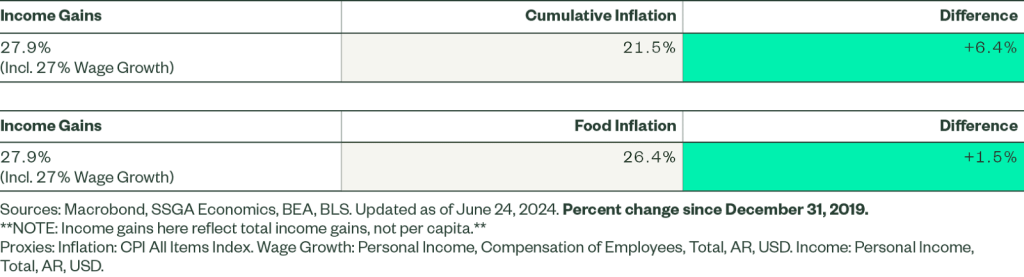

Most observers point to the surge in inflation post-COVID as the main culprit for consumers’ bleak survey responses. Nobody likes high inflation. Personal income has more than kept up with rising prices in the aggregate (Figure 1), but that fact remains deeply underappreciated by consumers.

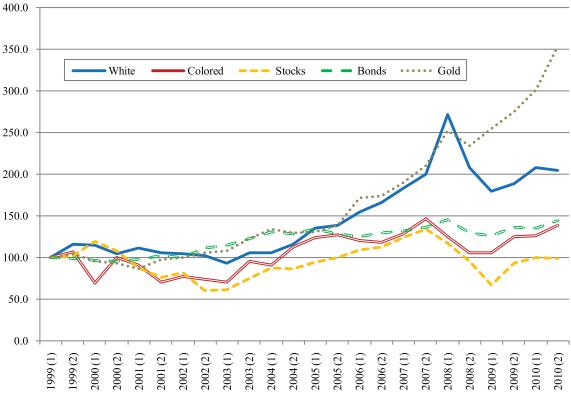

Still , now that headline inflation is back in the low 3.0% range (having peaked at 9.1% in June 2022), why haven’t consumers responded more positively to this progress? Digging into the various facets of consumers’ economic experience of the past few years offers some important insights. While aggregate incomes have indeed more than kept up with aggregate inflation, wage and salary income has barely kept pace with the rising costs of necessities such as food (Figure 2). On a per capita basis—which is how survey respondents assess conditions—wage growth has not kept up with food inflation. Consumers may be onto something, after all!

Figure 2: US Personal Income Growth Has Kept Up with Cumulative Inflation, but Not Sharply Higher Food Prices

Hitting Home

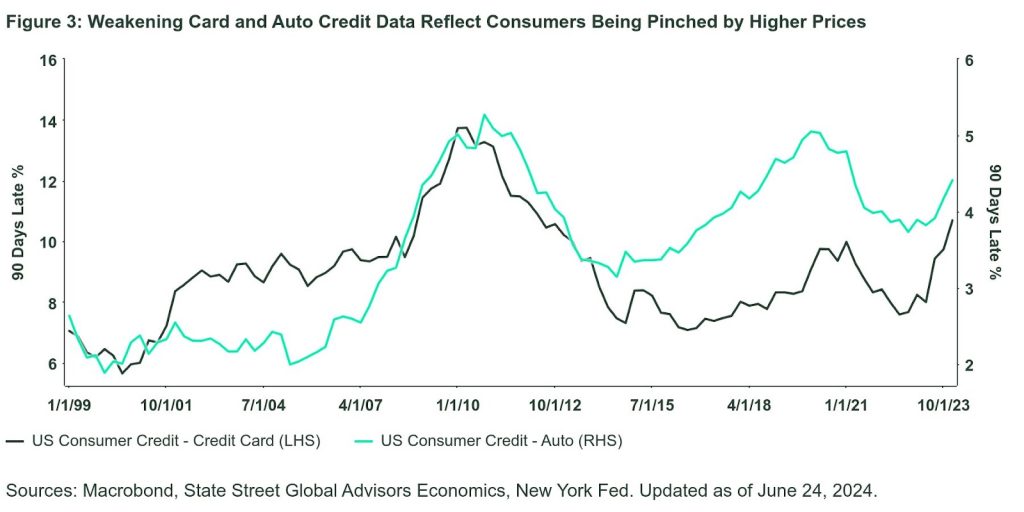

Meanwhile, housing affordability hovers near four-decade lows. Given that food and shelter are basic needs, the message here is that affording basic necessities has become more of a struggle. This is true for the average consumer, but even more so for the lower-income consumers. These expense challenges for low-income households also helps explain why—despite a very low 4.0% unemployment rate—credit card and auto delinquencies have risen (Figure 3).

Slight Uptick in Unemployment

The most puzzling finding in the Guardian/Harris poll was the broadly shared belief that the unemployment rate is at multi-decade highs. In fact, the opposite is true (Figure 4). Yet even on this front, the marginal erosion in employment experienced over the last year is now approaching a degree that has signaled recessions in the past. Hence, it may not be wise to entirely dismiss consumers’ gloomy mood as a fiction of their own imagination. This is also why we’ve been advocating for a calibration lower in interest rates from the Fed as an effort to preserve the “soft landing” economic trajectory.

Figure 4: Upturns in the Unemployment Rate Have Prefaced Recessions

Differences in Major Sentiment Surveys

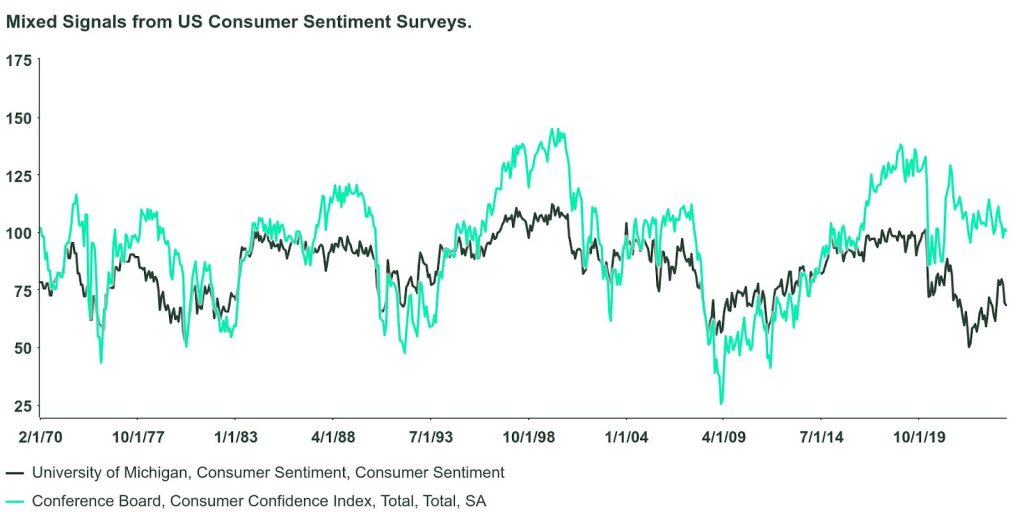

Softness in the University of Michigan (UM) consumer sentiment survey has been a steady feature of the post-COVID recovery, but it stands in contrast to better readings from the Conference Board (CB) survey. This divergence reflects UM’s heightened sensitivity to inflation versus CB’s higher correlation to labor market conditions. As such, this divergence has been both largely acknowledged—and largely ignored—by economists.

See chart below.

The Bottom Line

What does this weak consumer sentiment mean for the economy? We strongly believe that sentiment metrics are secondary to the actual performance of disposable incomes. Unfortunately, real personal disposable income has grown at a tepid rate of 1.3% y/y during the first five months of 2024, so pessimistic views of the economy are likely to result in lower spending at this point. This is why we had been favoring a “sooner rather than later” start to the Fed’s rate cutting cycle in order to avoid turning the soft landing into a recession (see 2024 Mid-Year Global Market Outlook).

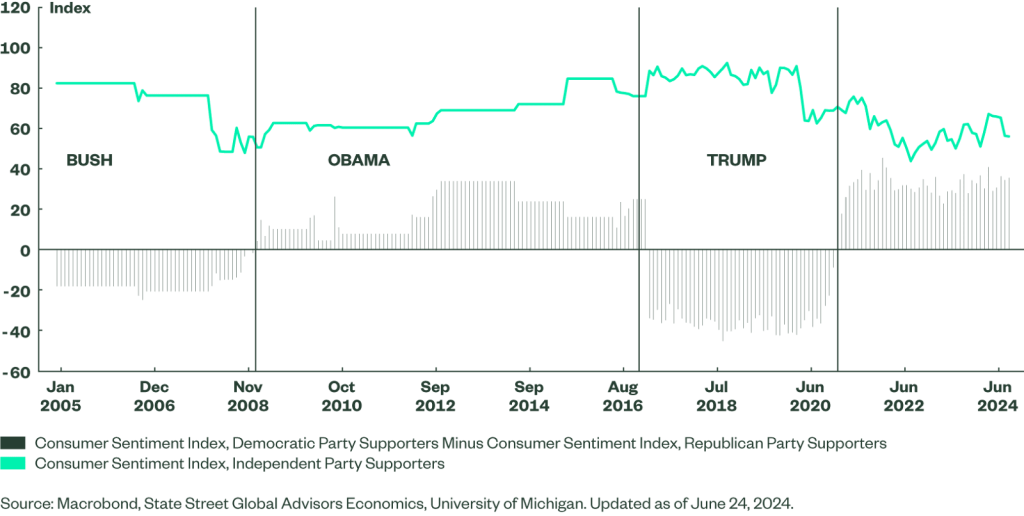

Only time will tell how the gloomy sentiment will impact the US election cycle. Consumers’ economic perceptions vary considerably depending on their political affiliation, yet the clear downshift in independent voter perception is notable (Figure 5). The combination of dismal thoughts on the economy plus a surge in independent voters both speak to a desire for “change” in leadership, regardless of how accurately the blame is assigned for perceived economic challenges.

Figure 5: Party Affiliation Drives Sentiment, but Independents Gloomy

Footnotes

1Aratani, Lauren, “Majority of Americans Wrongly Believe the US is in Recession – and Most Blame Biden.” The Guardian. May 22, 2024. Based on a Harris poll conducted exclusively for the Guardian.

2Macrobond, as of June 24, 2024.

This post first appeared on July 10th on the State Street Global Advisors’ blog

PHOTO CREDIT: https://www.shutterstock.com/g/Roman+Samborskyi

Via SHUTTERSTOCK

Disclosures

Marketing Communication

ssga.com

State Street Global Advisors Worldwide Entities

Important Risk Information

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

The views expressed in this material are the views of Simona Mocuta through July 5, 2024, and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

All information is from State Street Global Advisors unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

This document may contain certain statements deemed to be forward-looking statements. All statements, other than historical facts, contained within this document that address activities, events or developments that SSGA expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on certain assumptions and analyses made by SSGA in light of its experience and perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances, many of which are detailed herein. Such statements are subject to a number of assumptions, risks, uncertainties, many of which are beyond SSGA’s control. Please note that any such statements are not guarantees of any future performance and that actual results or developments may differ materially from those projected in the forward-looking statements.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the “appropriate EU regulator) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.