By: Kevin Flanagan, Head of Fixed Income Strategy

Key Takeaways

- Fed policy has a heightened data dependency, leading to increased volatility in the bond market.

- The UST market’s narrative has shifted toward the possibility of rate cuts, but the Fed does not appear to be in a rush to implement them based on current inflation trends.

- Even though rate cuts remain the odds-on favorite for later this year, investors should heed the tenor of recent Fed-speak, which reinforced the notion of rates being higher for longer.

There is no question that Fed policy remains the primary force driving the money and bond markets for the third year in a row. There was some speculation heading into this year that if Powell & Co. embarked on a widely anticipated rate-cutting spree, perhaps the U.S. Treasury (UST) arena could take a collective breath and just let the policy maker “do its thing.” However, as we have discovered through the first nearly five months of the year, the best-laid plans have not been realized. Instead, I believe that they have been replaced by a Fed policy that has a heightened data dependency, and according to my math, data dependence equals volatility in the bond market.

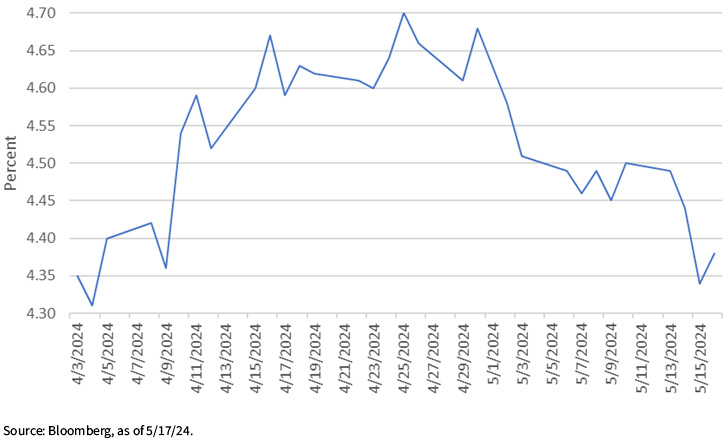

U.S. Treasury 10-Year Yield

But you don’t need to take my word for it; just look at how the UST 10-Year yield has performed over the last month or so. While the overarching trend has been for higher yields in 2024, recent price action underscores how changing Fed policy perceptions have created a noticeably elevated volatility quotient for the 10-Year. Indeed, the yield completed a round trip from the beginning of April to mid-May. To provide some perspective, investors have witnessed the UST 10-Year rate rise from 4.35% to 4.70%, only to fall back to its starting point of 4.35%. Think about it…the yield went on a formidable 70-bp journey in just over a month’s time.

Why, you might ask? The economic data. While Powell downplaying rate hikes at the May FOMC presser certainly helped, it has been recent economic data that has paved the way. Because the Fed has emphasized the importance of being data-dependent in the monetary policy decision-making process, the UST market has been “hanging” on each key piece of new information and will continue to do so in the months ahead.

With the policy maker singling out inflation and the labor markets, these two reports naturally have received the lion’s share of attention, and rightfully so. Thus, a hotter-than-expected CPI report in April, combined with a robust jobs number, helped to push the UST 10-Year yield to its highest level since early November of last year. This was followed in May with an employment report that came in below expectations, a soft showing for retail sales and, perhaps most importantly, a CPI reading that was not “hotter” than expected. Needless to say, this latest stretch of data played into the UST market’s newfound narrative that rate cuts are back on the table and pushed the 10-Year yield back down to its aforementioned starting point.

Conclusion

Although one month’s worth of data may provide for a short-lived positive reaction for bonds, I believe that the Fed will look at it differently. Given what has transpired on the inflation front up until this month’s report, Powell & Co. do not appear to be in any hurry to begin implementing rate cuts any time soon. Against this backdrop, even though rate cuts remain the odds-on favorite for later this year, investors should heed the tenor of recent Fed-speak, which reinforced the notion of rates being higher for longer.

This post first appeared on May 22nd, 2024 on the WisdomTree blog

PHOTO CREDIT: https://www.shutterstock.com/g/mentalmind1

Via SHUTTERSTOCK

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.