By: Alex Roll

With the recent fall in bond yields, the direction of the dollar index, subdued inflation, and a robust earnings environment pitted against a slightly deteriorating global macro backdrop, there is no doubt that the market is in limbo. The Treasury’s quarterly refunding announcement has cooled short-term supply risks in the Treasury market somewhat and taken a bite out of the recent run-up in the term premium. Moreover, the Fed was dovish in downplaying the September dots, which previously implied another hike, while manufacturing softened and unit labor costs fell for the first time since late 2022. Yields falling means that U.S. financial conditions are easing slightly from this year’s tightest reading. Unsurprisingly, the 60/40 portfolio had one of its best weeks recently. We also witnessed large bond moves in Europe and the U.K. compared to other markets, with their respective forward curves implying earlier cuts in the case of Europe. The investment community appears divided between those calling for an imminent recession and those banking on a soft landing, possibly counting on a Federal Reserve pivot. U.S. Q3 GDP came in at 4.9%, with consumption as the primary growth driver, almost adding two full percentage points and increasing 4%, rebounding from a softer 0.8% in Q2. Spending has also broadened away from just spending on services, with both goods and services consumption increasing in Q3. We note, however, that we had some deterioration in the ISM manufacturing data for October.

Given all these data, where should investors focus going forward? We believe investors will need to continue watching the health of the consumer as the primary driver of the U.S. economy. Parts of the investment community are concerned about an uptick in auto delinquencies, resumption of student loan repayments, and a slight uptick in continuing jobless claims in the U.S., and their impacts on consumer strength in Q4 and early next year. Nonetheless, at this stage we view this as normalization to the pre-pandemic era, and structural labor demand is still outstripping the supply of labor. It takes considerable pressure to push the labor market into a recession, and we believe the consumer could be stronger than expected into Q4 on the back of recent revisions by the U.S. Bureau of Economic Analysis on excess savings being estimated at north of $1.2 trillion versus approximately $500 billion previously. Consumer impact varies, however, with Europe and the U.K. experiencing more significant headwinds due to more variable mortgages and a deteriorating economy. We anticipate sustained growth in equities in themes that have structural secular tailwinds behind them, including cybersecurity and hydrogen power.

Investment strategies highlighted this month:

- Defending Digital Frontiers – the intersection of geopolitical tensions and escalating cyber threats shapes a favorable landscape for the cybersecurity sector worldwide.

- Retail Seasonality – a stronger-than-anticipated consumer may offer tailwinds to e-commerce and FinTech going into year end.

- Hydrogen Hubs – the Biden Administration is unleashing $7 billion from the Infrastructure Investment and Jobs Act to establish seven regional clean hydrogen hubs.

Defending Digital Frontiers – The Intersection of Geopolitical Tensions and Escalating Cyber Threats is Shaping a Favorable Landscape for the Cybersecurity Sector

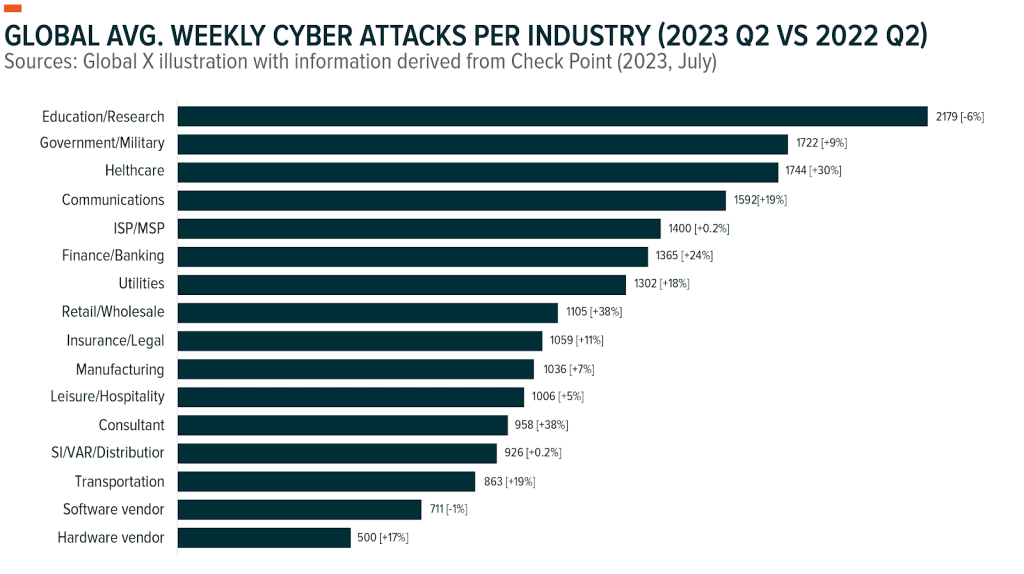

The ongoing growth in cybersecurity spending is being fueled by a surge in high-profile cyberattacks, the potential use of generative AI for advanced threat detection, and heightened geopolitical tensions. Although software spending has slowed somewhat, cybersecurity expenditures are likely to remain robust, due to the potential widespread business disruptions caused by cyber breaches.1 During Q2 2023, there was an 8% increase in global average weekly attacks compared to the previous year. The average number of attacks per organization per week reached 1,258, the highest number noted by Check Point Research in the past two years.2 Faster adoption of zero-trust products may help prevent ransomware attacks resulting from vulnerabilities in legacy endpoint and identity management products. Recent high-profile cyber attacks at companies like MGM underscore the importance of enhancing security software with zero-trust offerings like SASE (secure access service edge), which is expected to fuel demand for companies like Zscaler and Palo Alto Networks.3 SASE architecture-based security spending, estimated at $6.6 billion last year according to Gartner, could grow at approximately three times the low-double-digit expectations for the security market, which was valued at $96 billion in 2022.4 Further, cloud-security providers like CrowdStrike and Zscaler have opportunities to upsell to government entities and businesses seeking to reduce risks from state-sponsored cyberattacks and are well-positioned for growth.5

Investments in generative AI may temporarily impact gross margins for cybersecurity companies, with limited revenue expected from add-on subscriptions for AI copilots. However, generative AI features are likely to boost upsell and net expansion rates over time. Companies like Zscaler, operating their own data centers, may increase near-term capital expenditures, while others like CrowdStrike and SentinelOne, using public cloud networks for AI training, may see higher cloud-hosting costs.6 A basket of cybersecurity companies represented by the Indxx Cybersecurity v2 Index currently trades at a price to sales growth ratio of 0.27x.7 We believe this valuation remains fair on the back of companies taking on software-as-a-service models and strategically focusing on margin improvement.

The global cybersecurity landscape is evolving rapidly, driven by geopolitical conflicts and technological advancements. With the ever-increasing threat of cyberattacks, the trajectory indicates a robust future for cybersecurity, marked by technological breakthroughs and strategic collaborations.

Retail Seasonality – A Stronger-Than-Anticipated Consumer May Offer Tailwinds to E-commerce and FinTech Going into Year End

As the holiday season approaches and draws hopes for a Santa Claus rally, retail and e-commerce could be poised to benefit even more than usual this year from a seasonal upswing in shopping. Although questions about the future strength of the consumer are circulating after a blowout Q3 consumer performance witnessed by an almost two-percentage-point impact on U.S. Q3 2023 GDP results (4.8%), a recent revision by the Bureau of Economic Analysis calculated that the household savings rate was lower than previously believed prior to the pandemic.8 Given the lower pre-pandemic baseline, combined with a higher saving rate this year, the amount of excess savings skyrocketed from previous estimates of $400 billion to $1.2 trillion after the revisions, according to JPMorgan.9 These figures now imply households’ excess saving may not be exhausted until sometime in the middle of next year. In our view, this provides for a greater cushion than anticipated, which we believe will bolster consumer purchasing power and spending going into the holiday season. We particularly think the e-commerce sector is poised to outperform as it continues its upward trajectory. The e-commerce space is projected to reach over $8.5 trillion by 2026, representing a 9% CAGR.10 In 2023, 52% of businesses plan to sell through social networks, aligning with the rising trend of social commerce, where sales are projected to triple to $1.2 trillion by 2025.11,12

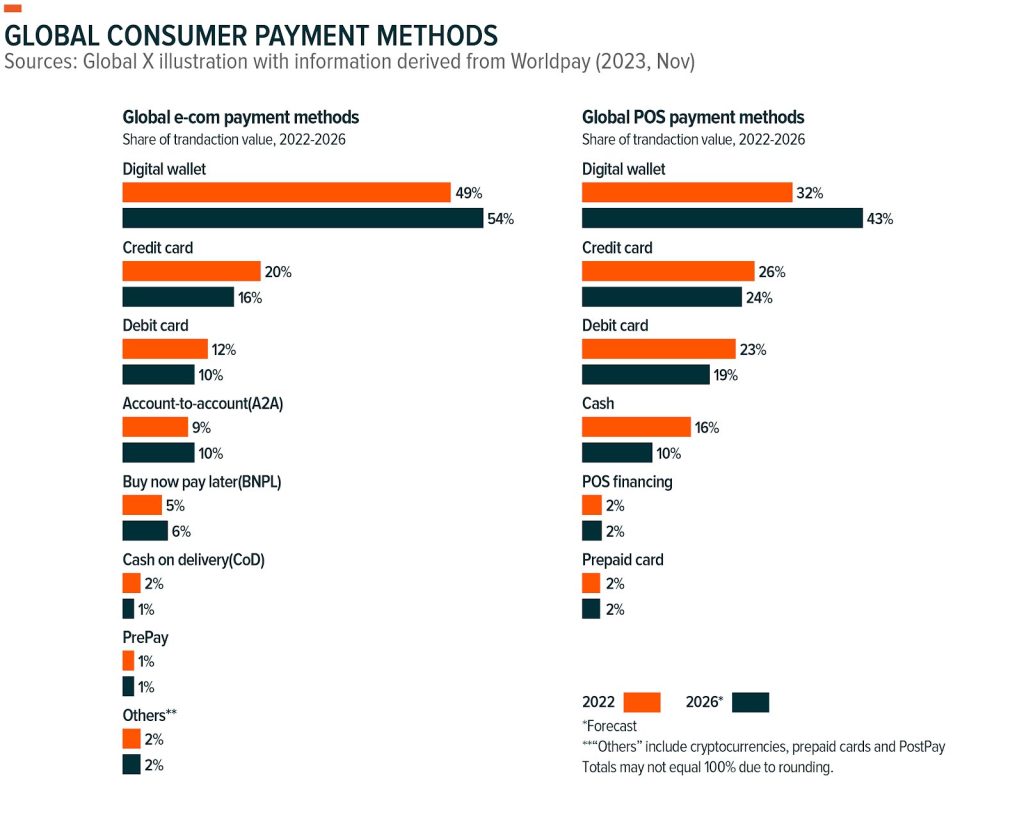

As a complement to consumer spending, the FinTech industry, spurred by the pandemic, has witnessed accelerated growth, notably in the domain of digital payments. Innovation in payment solutions continues to greatly improve the experience for customers and removes barriers for merchants. Anticipated trends include a 6% CAGR in global point-of-sale (POS) payments through 2027, driven by the popularity of smartphone and tap-to-pay options.13 Further, 50% of small and medium enterprises (SMEs) are engaging in more international business in 2023, emphasizing the importance of digital technologies.14 The demand for real-time payments drives innovation, with companies focusing on customer experiences gaining a competitive edge. China has long been the global leader in digital wallet adoption, with Alipay and WeChat Pay as the main players. The prominent role of e-commerce and marketplaces like Alibaba and JD.com, as well as the success of super app ecosystems, have all contributed to the dominance of digital wallets.15 Globally, Alipay, PayPal, and Apple Pay lead digital wallets, capturing 49% of e-commerce transactions and 32% of point-of-sale (POS) spending, totaling approximately $18 trillion.16 New entrants like Shop Pay and Cash App Pay further diversify the landscape. North America has seen increasing digital wallet adoption, constituting 32% of e-commerce transaction value and surpassing credit cards.17 As the leading payment method globally both in e-commerce and at POS, digital wallet acceptance is mandatory for merchants in all consumer-facing verticals. Digital wallets are projected to grow at 15% CAGR at POS from 2022-26.18

Beyond digital wallets, FinTech represents a dynamic and broad ecosystem of digital solutions designed to revolutionize accessibility, efficiency, and affordability within financial services, challenging established norms in banking and lending. Beyond digital payments, FinTech’s evolution is marked by trends such as buy now, pay later (BNPL) services, the integration of digital wallets with cryptocurrencies, and the emergence of cloud-based enterprise solutions.

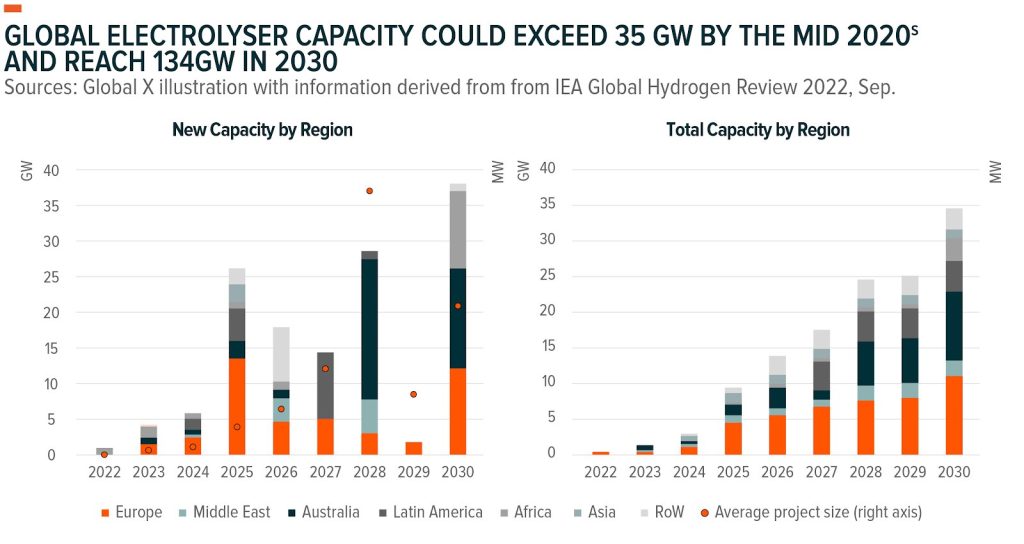

Hydrogen Hubs – The Biden Administration Unleashes $7 Billion From the Infrastructure Investment and Jobs Act to Establish Seven Regional Clean Hydrogen Hubs

Clean hydrogen is going to play a critical role in the global energy transition, and more governments are recognizing this green technology’s disruptive potential. On October 13th, for example, the Biden-Harris Administration took a significant step by allocating $7 billion from the Infrastructure Investment and Jobs Act to establish seven regional clean hydrogen hubs.19 These seven hubs share the common aim of producing three million metric tons of clean hydrogen annually. All seven will employ electrolysis to create green hydrogen, and four will also produce blue hydrogen combined with carbon capture.20 By 2030, the nation is targeting 10 million metric tons in annual clean hydrogen production.21 Characterized by their integrated local production and transport infrastructure, these hydrogen hubs offer several advantages, including streamlined infrastructure requirements and a skilled hydrogen workforce. They have the potential to lay the foundation for both national and global low-carbon hydrogen networks. These hubs are anticipated to serve as a catalyst, and the White House expects that this funding will ignite over $40 billion in private investments.22

As of August 2023, there are an impressive 515 large-scale hydrogen production projects in development worldwide.23 This marks substantial growth from 415 projects in February 2023 and 320 projects in August 2022.24 These projects predominantly focus on green hydrogen, with blue hydrogen initiatives also gaining prominence. The availability of tax credits for clean energy generation further incentivizes the development of hydrogen technologies. The United States is unquestionably positioning hydrogen as a cornerstone for decarbonizing challenging sectors. Notably, six of the seven winning hubs are oriented towards industrial hydrogen use, while all seven intend to apply it in transportation. There is potential for additional regional hubs to emerge independently, supported by Inflation Reduction Act tax credits, further expanding the hydrogen hub initiative. Additionally, an extra $1 billion from the Infrastructure Investment and Jobs Act will likely bolster clean hydrogen demand, addressing the gap between proposed capacity and current demand.25

Hydrogen demand is growing as support for both green and blue hydrogen has gained momentum, due to their potential to decarbonize carbon-intensive industries. There is a strong emphasis on expanding low-carbon hydrogen production and diversifying its applications, including heating, transport, and shipping. Under a net-zero emissions scenario by 2050, the International Energy Agency envisions hydrogen demand exceeding 150 million tons by 2030, with approximately one-third directed towards new applications.26

As hydrogen is still an early-stage innovation theme, it is in our view difficult to actively select the winners of small high-growth companies over the long term. Therefore, a more viable approach for such a theme, in our view, is to participate via a diversified basket, with the intention of keeping the eventual winners embedded in the basket.

Footnotes

- Singh, M. & Reimertz, D. Bloomberg Intelligence. BI Global Cybersecurity Theme Topic Primer. 29 June 2023

- Check Point. Average Weekly Cyberattacks peak with highest number in 2 years, marking an 8% growth year over year, according to Check Point Research. 13 July, 2023.

- Singh, M. & Reimertz, D. Bloomberg Intelligence. BI Global Cybersecurity Theme Topic Primer. 29 June 2023.

- Ibid.

- Ibid.

- Ibid.

- Global X ETFs, with information derived and downloaded from Bloomberg Terminal on 15 November 2023.

- Business Insider. The US economy’s safety net is bigger than anyone thought. 11 October 2023.

- Ibid.

- Worldpay. FIS. The Global Payments Report 2023. May 2023.

- Globalpayments. 2023 Commerce and Payment Trends Report

- Danzinger, P., Fobes, Social Commerce is a $1.2 trillion opportunity and the next global shopping revolution. 27 January 2022.

- Worldpay. FIS. The Global Payments Report 2023. May 2023.

- Mastercard Borderless Payments Report 2023

- Worldpay. FIS. The Global Payments Report 2023. May 2023.

- Ibid.

- Ibid.

- Ibid.

- Bloomberg NEF. Biden Boosts Green Hydrogen in $7 Billion Hubs Program. 17 October 2023.

- Ibid.

- Department of Energy. U.S. National Clean Hydrogen Strategy and Roadmap.5 June, 2023.

- Bloomberg NEF. Biden Boosts Green Hydrogen in $7 Billion Hubs Program. 17 October 2023.

- Fitch Solutions. (n.d.). Key Projects Database. Data Accessed. 20 August 2023

- Ibid.

- Bloomberg NEF. Biden Boosts Green Hydrogen in $7 Billion Hubs Program. 17 October 2023.

- International Energy Association. Hydrogen. 10 July 2023.

This post first appeared on December 4th, 2023 on the GlobalX blog

PHOTO CREDIT: https://www.shutterstock.com/g/whyframe

Via SHUTTERSTOCK

Disclosure:

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.